The lead story in RMP’s December 2016 Michigan Oil & Gas Monthly is the MDEQ’s Office of Oil, Gas & Minerals (OOGM) funding woes. But first, it should be noted that the MDEQ announced plugging instructions for the Word of Faith 16-27 on December 19, 2016 which means the well does not look like it’s going to become a long term producer. RMP predicted last month the possible potential of the well producing oil for years to come but this latest bit of news dashes that prediction for the well to be an oil producer. RMP will file a Freedom of Information Act request for the initial production report to get the numbers as soon as they’re available. The public must wait 90 days subsequent to the completion of testing before requesting information. Now on to RMP’s lead story for December 2016…

The OOGM’s funding has taken a big hit in the past two years with the decline of oil & gas prices. The OOGM’s funding is a function of oil & gas sold to market in Michigan. We have seen entire countries whose funding is singularly tied to oil & gas production take massive revenue hits over the past couple years; Russia and Venezuela are two of the most remarkable examples that come to mind in 2015 & 2016. The OOGM is no different on a micro scale as its funding is tied singularly to market value of oil & gas. This article will detail the situation of the OOGM’s funding woes and how the OOGM needed $4 million dollars of funding from the Michigan General Fund in Governor Snyder’s 2017 budget for the first time since 2002.

Budget 2017 Funding Woes at the MDEQ’s Office of Oil & Gas Management (OOGM)

RMP is not the only group in Michigan that doesn’t have any money, the OOGM is feeling the pinch right now too. I have a day job to pay for RMP’s web hosting, stamps, and envelopes to run this 501(c)3 non-profit organization. The OOGM, however, does not. Overseeing and providing surveillance of Michigan’s oil & gas infrastructure and protecting Michigan’s freshwater is the OOGM’s day job. And, it takes funding for the OOGM to do their work. Their work is critical to protecting Michigan’s freshwater and RMP has always supported our MDEQ even when we challenge them and consider ourselves auditors of their work. RMP understands & supports the OOGM’s important role in protecting Michigan’s natural resources.

The OOGM is funded as a function of oil & gas sold to market in Michigan. Before going into the specifics of the OOGM let’s consider the MDEQ’s 2017 budget as a whole for the entire State of Michigan. Amy Epkey, Michigan’s Administration Deputy Director, sent an email message to all MDEQ staff explaining the plan for Michigan’s 2017 budget earlier this year. She stated that the 2017 MDEQ budget Governor Snyder would recommend to the legislature would total $513.5 million and would include five key pillars:

Michigan’s 2017 DEQ Budget Pillars

- Flint – $1.5 million for DEQ staff and laboratory costs associated with the response efforts in Flint, and $3.9 million for water connection services for the City to stay on the Detroit water system from October 2016 to December 2016.

- Drinking Water Revolving Fund – $2.95 million additional funding is included in the budget bringing the total general fund amount to $5 million for the Drinking Water Revolving Fund Program to leverage federal funding and support low-interest loans to communities for infrastructure improvements.

- Office of Oil, Gas, and Minerals – $4 million of one time general funds is included to offset reduced revenue within the Office of Oil, Gas, and Minerals due to low oil and gas prices.

- Refined Petroleum Fund – $1.5 million is recommended for the refined petroleum fund as a reallocation from the Michigan Department of Agriculture and Rural Development to direct remediation activities of the DEQ.

- Clean Michigan Initiative Bonds – $16.4 million from the Clean Michigan Initiative bond is included to support response activities at high priority sites and to address contaminated sediments in the Rouge River and Detroit River

In addition, a 2016 supplemental budget bill was introduced for Flint which included $63.3 million for the DEQ for the following areas:

2016 Budget

- City of Flint Water Bill Relief – $30 million of water bill relief is included for the drinking water portion of the bills paid by 21,000 customers.

- Utility Assistance – $25 million for the replacement of lead service lines for high risk, high hazard homes.

- Detroit Water Systems Costs – $3.9 million to support the costs for Flint to stay on the Detroit water system through September 2016.

- Water System Needs – $2.2 to determine and support the appropriate long-term solution for delivering safe drinking water to Flint residents.

Response Team – $2.25 million for staff and laboratory costs associated with the response efforts in Flint.

After reading all those points. There is one that caught my attention more than any other since I write a blog about Michigan oil & gas: The OOGM was allocated $4 million from the General Fund. This is not normal. As I’ve stated, the OOGM is funded as a function of the value of oil & gas produced in Michigan through the oil & gas regulatory fund. The oil & gas regulatory fund is designed to maintain a year-end balance of approximately $7 million. Current expenditures are approximately $8.5 million. Permit fees & gas storage well fees + interest are approximately $100k per year and represent a small portion of the OOGMs revenue. Surveillance fees are the remainder and the lion’s share of OOGM revenue. The surveillance fee is a percentage of the gross value of production of oil & gas. The percentage rate is established in November for the upcoming year and is capped by law at 1%.

You can probably understand with the severe drop off in oil prices how the OOGM’s budget was put into peril in a similar fashion to the entire economies of sovereign nations like Russia & Venezuela as we have seen on TV and I mentioned earlier. Michigan’s OOGM might be a much smaller scale than what we saw in Russia & Venezuela, but the revenue shortfalls are for the exact same reason in concept. These funding woes hit hard and close to home because the MDEQ’s OOGM are the people working to keep our water safe. If they’re not funded, it’s bad news for Michigan. The OOGM personnel are here to make sure our water is protected while we continue to use oil & gas to power our lives.

After Governor Snyder’s Michigan budget was initially reviewed, the House Appropriations Subcommittee presented their recommendations to the MDEQ to reduce funding from the general account from $4 million to $3.5 million. Hal Fitch communicated to his OOGM staff that he expected the funding to be restored from the $3.5 million recommendation to $4 million when the budget was reviewed by the legislature, but people had to be warned to brace for the possible impacts of hiring freezes, frugal living, and finding other cost savings to make ends meet.

The spending recommendations needed to go to the full House Appropriations Committee and then on to the Senate for their recommendations while all this year the OOGM had to feel the weight of uncertainty about their jobs because of the volatility of oil prices. I have to give Hal Fitch credit for keeping his people in the know and communicating to them even if the funding news this year was tenuous. A lot managers at private companies don’t have the guts to communicate hard news like Hal did, so I give him credit. Private companies can often leave their people in the dark and then just yank the rug out. Good for Hal to keep his people informed. I think most people would rather know they’re going into the storm than be blindsided.

If you click here, you can see the governor’s budget that went to the legislature before the legislature took any action. If you check out page 43, you can see the one time general fund recommendation for $4 million. This had to hearten the OOGM but I can only imagine the budget hawks are always coming with their knives to slash anything that can’t be supported with good information. Luckily for the OOGM staff, there is support in the legislature from legislators that construe funding the OOGM as a subsidy to their own financial benefactors. That is to say the oil & gas lobby has hedged their support with our legislators by making financial donations to help fund their reelection campaigns.

By June of this year, Hal Fitch was able to let his OOGM staff know that the $4 million general fund request made the cut for Governor Snyder’s 2017 Michigan Budget. Hal also let his staff know that the OOGM would be receiving $250,000 this fiscal year from nonferrous metallic mineral severance taxes to support the mining program. This funding bodes toward my prediction that BackForty Gold Mine Permit will be approved by the time this article is published or soon afterward.

For those who want to see the details, the budget bill can be accessed on the Legislature’s website at www.legislature.mi.gov. The budget bill is House Bill 5294.

Other Michigan Oil & Gas News

RMP wraps up 2016 Michigan oil & gas news by saying that it was the slowest year in Michigan oil & gas permitting history. Last year in 2015, RMP made a big deal about how 2015 was the slowest permitting year in Michigan history since 1931. This year, just one year later, the 2015 record slowest year has not only fallen to 2016, it was absolutely demolished. In 2016 ,the OOGM issued only 50 permits! Last year, the MDEQ’s OOGM issued 111 permits. Wow. Things are slower than ever in Michigan for oil & gas producers. No wonder funding is falling off. Michigan’s entire oil & gas industry has somewhat fallen off a cliff.

Below is our summary of applications, permits, and pluggings to close out 2016. While it’s possible there could be an application or permit to get reported subsequent to the publishing date of this post, it’s somewhat irrelevant. The story is that things are basically comatose.

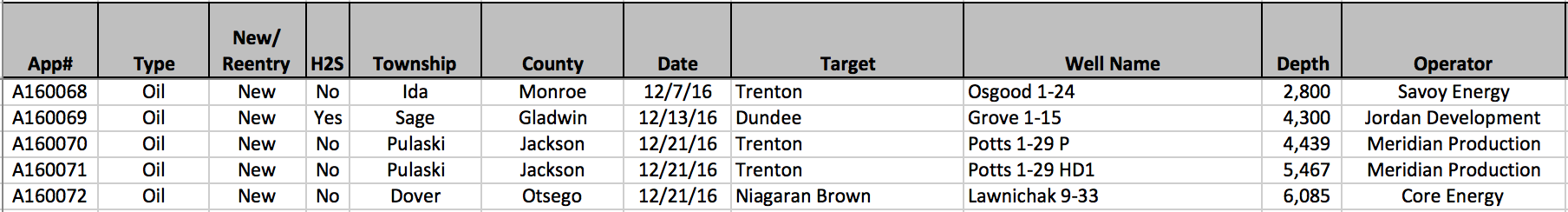

December 2016 – Applications for Oil & Gas Wells

Michigan rounded out the year with five additional applications for wells filed in December bringing the annual total up to 50 with reporting complete through December 23, 2016. There is still one week left to report in 2016 that didn’t make the cutoff for publication. This is an all time low for applications received in Michigan and is about half as many last year which was also an all time low. That means it’s is slow in Michigan; very very slow.

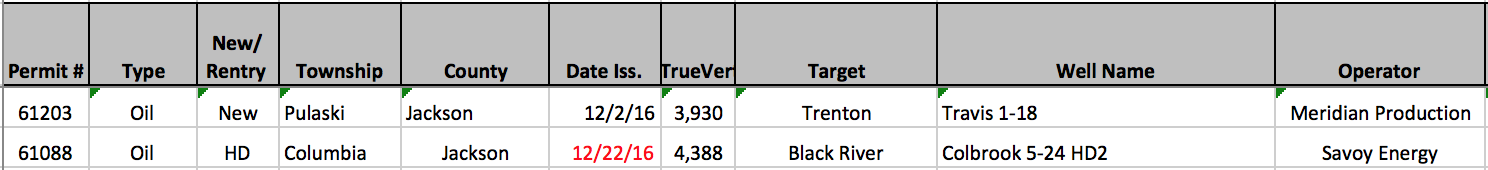

December 2016 – Permits for Oil & Gas Wells

Only 2 permits were issued in December with only one new permit for an oil well in Jackson County. This brings the total number of permits issued in 2016 to 42 which again is an all time low in successive years after 2015’s all time low of 110 permits. Again, this demonstrates just how painfully slow oil & gas activity has become in Michigan: we shattered last year’s all time low with an all time low less than half of what it was last year!

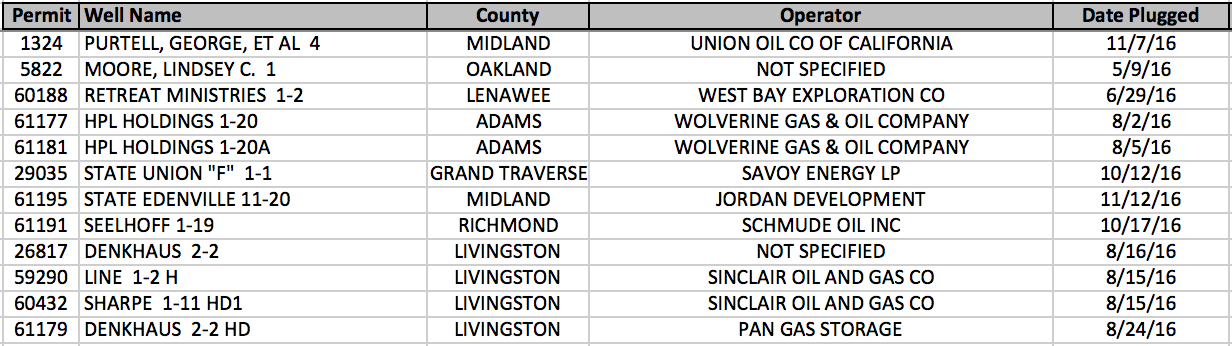

December 2016 – Oil & Gas Wells Reported Plugged

12 wells were reported plugged in December bringing the total number of wells reported plugged this year to 148.

December 2016 Apps to Plugs Ratio KPI:

The apps to plugs ratio is self explanatory. By looking at the number of applications to wells plugged KPI we can see wells coming vs wells going. This KPI along with the previous one supports our original 2014 & 2015 outlook post with more numbers and data.

2016 Apps to Plugs Ratio KPI:

50 Applications : 148 Wells Plugged

December 2016 Permits to Plugs Ratio KPI:

The permits to plugs ratio is nearly the same as the apps:plugs ratio but with permits instead of applications.

2016 Permits to Plugs Ratio KPI:

42 Permits Issued : 148 Wells Plugged

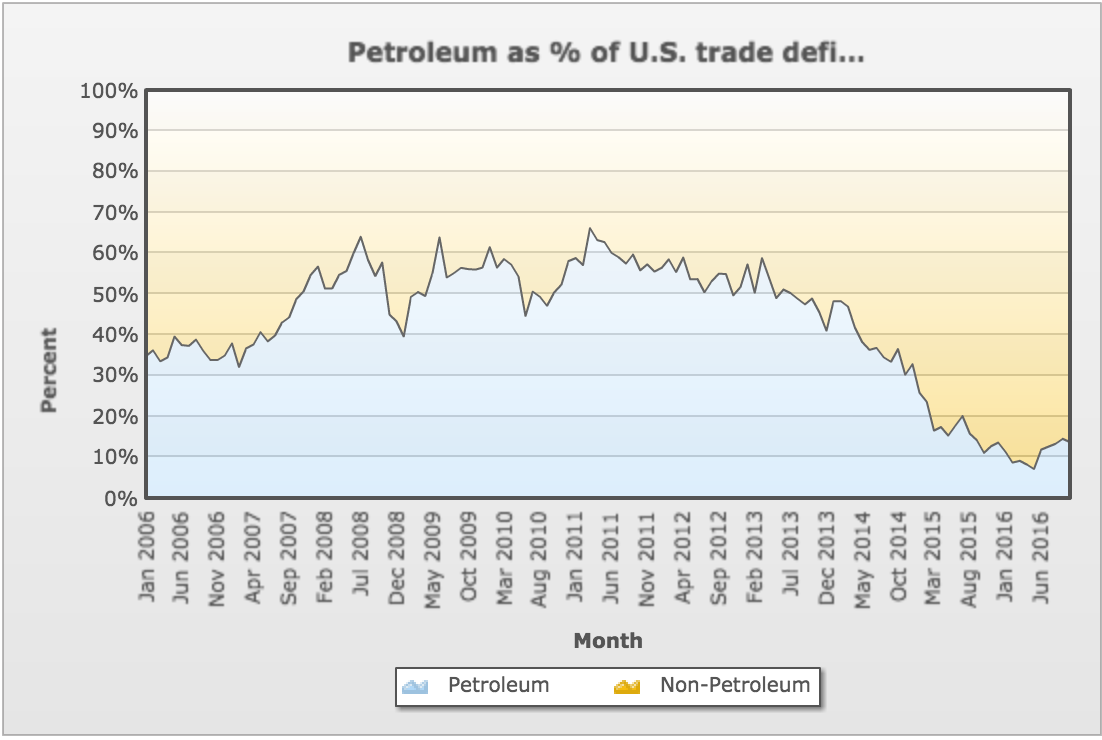

December 2016 – Petroleum As % Of U.S. Trade Deficit KPI:

RMP is tracking this stat since President Obama signed a bill in December of 2015 that lifted an export ban on crude oil that had been in place since 1970. RMP will be monitoring the effect of that federal legislation by monitoring an important economic statistic published by the United States Census Bureau. The data and graph (shown below) come from this website: https://www.census.gov/foreign-trade/statistics/graphs/PetroleumImports.html

This stacked-area line graph shows how much of the monthly US trade deficit can be attributed to the deficit in petroleum products. The vertical axis shows percent of the U.S. Goods and Services Trade Deficit. The horizontal axis shows a monthly time series from January 2006 to present. The bottom area of the graph shows what percent of the deficit comes from petroleum goods. The top area shows the percent of the deficit coming from non-petroleum goods and services. RMP made a prediction the day the bill was signed that this graph would trend toward zero which is a good thing for the US economy.

My thinking on this subject was that, ceteris paribus, the line would trend toward zero because America was producing more oil and by exporting that oil, it would improve our trade deficit with regard to petroleum. As you can see below, there has been a spike upwards over the last couple months which I attribute to Saudi Arabia’s dominance as a global oil producer. Saudi actions to keep production levels high to curb competition are hammering US producers. Even though the trend is as predicted by RMP at the outset of the year, this recent spike reinforces RMP’s underlying economic logic that using crude oil domestically as an energy source is bad for America’s economy and national security over the long haul. American simply cannot compete with producers like Saudi Arabia. We should make the migration to FCEVs to significantly diminish our need for crude oil in the coming years.

By lifting the export ban, RMP believes that it is a good thing for America’s economy because we can continue to let our oil workers work and sell oil internationally while we work to displace oil demand domestically with hydrogen by way of fuel cell electric vehicles. America can be 100% energy independent, eliminate energy volatility in our markets, let our oil workers make the changeover gracefully, and improve our economy & national security along the way. To read RMP’s magnum opus on why we advocate for the responsible migration away from crude oil, you can click here.

FINAL THOUGHTS

Speaking of funding woes, RMP has only received $100 in donations over the past 5 years. Thank you so much to those of you who donated to help our organization persevere. RMP cannot, however, continue to publish a monthly recap of oil & gas activity in the Michigan Basin because we have next to zero cash to fund our operations. RMP is a Michigan based 501(c)3 organization which means donations to us are tax-deductible but donation revenue is low. RMP would sure appreciate if you could help out by clicking here to make a tax-deductible donation if you can afford to. Just because RMP won’t be publishing a monthly Michigan update on oil & gas doesn’t mean we are folding tent. The real value of RMP’s work lies in research analysis done by volunteers which has a lot of value even though RMP doesn’t have a lot of cash. By leveraging the resources RMP has to focus on research instead of publishing monthly oil & gas recaps, RMP will be redoubling our efforts to do investigative research into Michigan energy production and sustainability. With Michigan oil & gas being so dead and slow it doesn’t warrant us pursuing oil & gas reporting in the Michigan Basin on a monthly basis.

RMP will be focused on energy and sustainability topics around Michigan, the country, and the world. RMP will continue to publish information commensurate with our ability to find time outside of our full time day jobs. Thank you to the thousands of readers that have read our Michigan Oil & Gas Monthly magazine for 24 straight months of publishing. Our information and knowledge base will remain intact but we just can’t afford to publish each month. If you have a question about oil & gas in Michigan or know of a hot topic, feel free to email me at respectmyplanet@gmail.com. RMP will still be publishing about Michigan oil & gas as content warrants.

Thanks again to all of RMP’s long time readers, subscribers, Twitter followers, and facebook followers. Upcoming articles published here will start to become more energy diverse and RMP knows you’re going to love what’s coming next in 2017 and beyond. Remember that the most valuable things in the world cannot be bought with money!

Happy New Year!

Cover photo credit goes to Neo who has been an instrumental part of RMP’s oil & gas reporting. The photo is of the Westerman 1-29 HD1 well head with silica dust rising up into the night in front of lights beyond the frac tank. It’s a fitting end photo for RMP’s Michigan Oil & Gas Monthly as the Westerman well was the last HVHF well using over 10 million gallons of water to complete. The Westerman well used 12,636,294 gallons of water to complete and Michigan (thankfully) will never see another well like it again. What a colossal waste of a valuable resource like water to get almost no energy.

Hello Matt,

Thanks for another informative edition of your publication.

That’s certainly surprising news, indeed, about the Word of Faith well. Like you, I figured it would be a long-time producer. Can’t say I’m disappointed that it’s not living up to expectations. I guess the pastor will have to put off his plans for a new limousine until another time (Sorry, couldn’t help myself).

Also, while I’m glad to see drilling is way down in Michigan, I’m concerned that with the new administration coming in in Washington, things may turn around. We’ve all heard how much the president-elect wants to exploit fossil fuels in this country, which includes removing EPA regulations, etc. Of course, he even said he wants to rejuvenate the coal industry–and bring those mining jobs back! Oh, brother.

Let’s hope that as time marches on, renewable fuels will take an even greater foothold around the globe and begin to seriously displace the need for fossil fuels. What’s more, the costs of solar, wind, etc., are continuing to decline and are continuing to become less expensive to produce than traditional energy sources. My only concern is the massive energy lobby in Washington and a certain political party that would continue to feed the fossil fuel beast–in spite of the fact that renewables are becoming the better –and more economical — option.

Matt, thanks again for another eye-opening edition of MOGM. And while I don’t always comment with easy issues, I always enjoying the latest news on what’s happening in our wonderful state.

Happy New Year!