The big story this month is the location of the Ensign #161 drilling rig. The lat/lon of Ensign #161 on the date of this post’s publication is 40.4293, -104.604 which is not a Michigan lat/lon. You can see a map of Ensign #161 along with 10 other active Ensign rigs in the same area of Colorado by clicking on this link (depending on when you read this, the location may have changed). With Ensign #161’s location in Greeley, Colorado, which is just north of Denver and just SE of Fort Collins, you might wonder: why is Ensign #161’s Colorado location the big story in Michigan in January of 2016?

The answer is that Marathon just commissioned Ensign #161 to drill the Beaver Creek 1-14 HD1 well in Beaver Creek Twp MI & the Schlabach 1-7 HD1 well in Clare MI. The reason this is significant is because every single HVHF attempt in Michigan since 2008 (100% of them!) has been a failure for the operator. That means of the more than 50 HVHF wells permitted in Michigan, with the very first permit issued in 2008, there have been zero successful HVHF wells in Michigan’s history. RMP has been watching Marathon’s two recently permitted wells in Beaver Creek Twp and Clare Michigan very closely because permits for HVHF attempts in the Michigan Basin have basically stopped since 2013. With the utter failure of a single operator to turn a profit in the Michigan Basin using the HVHF completion technique, HVHF activity had all but ceased since Marathon drilled the Beaver Creek 1-14 HD1. Initial production numbers and a well completion report have not been filed yet because of a 90 day grace period for filing. Even without completion report numbers, the rig’s move to Colorado indicates a big clue that Marathon’s two new wells will be added to Michigan’s long list of failures using HVHF to produce fossil fuels in the Michigan Basin.

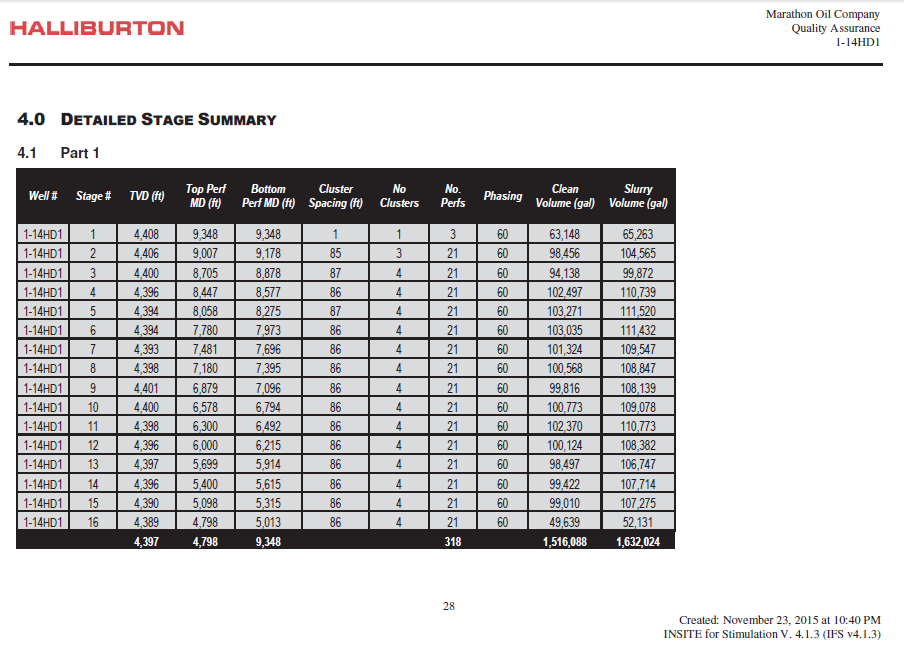

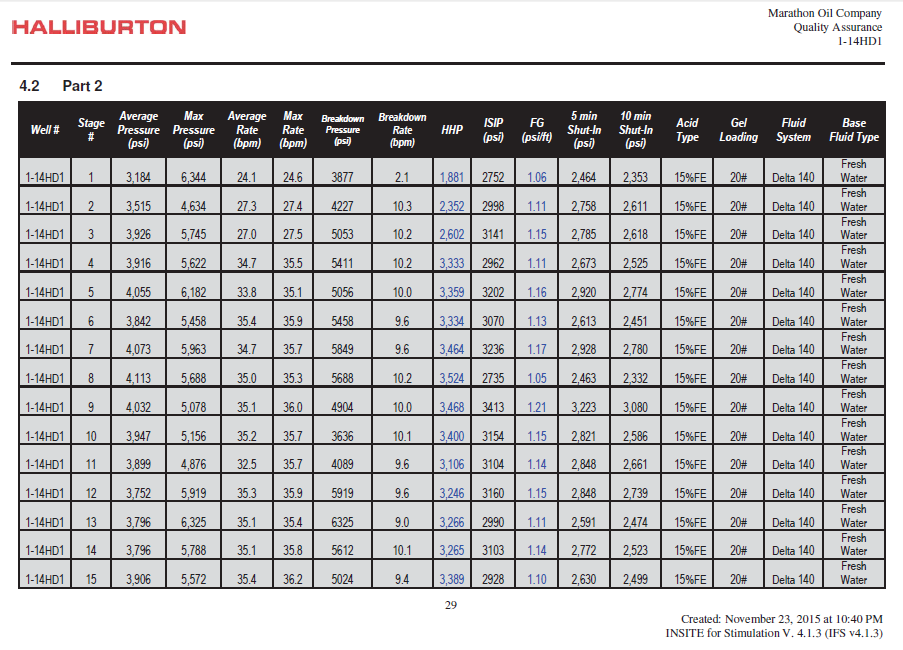

While RMP does not have a well completion report or initial production report for the Beaver Creek 1-14 HD1, the hydraulic fracturing completion information falls exactly within the range of water consumption that RMP predicted in 2015. The Beaver Creek 1-14 HD1 was completed by Halliburton with the first fracturing stage beginning on 11/17/2015 and the final stage wrapping up on 11/23/2015. Marathon filed the MDEQ’s brand new EQP 7200-25 form for water consumption related to HVHF for the Beaver Creek 1-14 HD1 which was signed by Marathon’s Compliance Coordinator Dennis Mendenhall on January 23, 2016. The Beaver Creek 1-14 HD1 consumed a total Pure Michigan fresh water volume of 1,639,588 gallons according to the new form. This puts the Beaver Creek 1-14 HD1 well right in line with RMP estimates of a HVHF well that did not use a LVWW like a Collingwood well would have. Remember RMP’s size analogy from December 2015 for relative fresh water consumption where an Antrim well is about the size of a mouse, an A1 well is about the size of a horse, and a Collingwood well is about the size of a blue whale. This puts the Beaver Creek 1-14 HD1 well into the Detroit River formation as similar to an A1 well which is exactly what RMP predicted in the autumn of 2015. Like all HVHF wells, LVWW wells, A1 wells, and Collingwood wells drilled in Michigan’s history since 2008, this well looks like another failure and tax write off as the rig Marathon was using has already boogied on down the road to Colorado.

The Beaver Creek 1-14 HD1 well was fractured in 16 stages using approximately 100,000 gallons of water per stage. One thing RMP did not predict/anticipate was the volume of proppant used at 25.5 million pounds of silica sand. That equates to about 250,000 lbs. of sand per stage which is very large and unprecedented in the Michigan Basin. If you recall, the Beaver Creek 1-23 HD1 well into the Collingwood, which ironically is the next door neighbor to the Beaver Creek 1-14 HD1, had held the previous sand consumption record in Michigan at near 19 million pounds of sand over 33 stages. Now, this well which is right next door, breaks the sand consumption record at 25.5 million pounds in the Michigan Basin using half the fracturing stages. It sounds like Marathon wanted to try a very sandy slurry for their fracturing fluid.

Encana used the Ensign #119 rig to drill every single Collingwood well in Michigan’s history between 2010 and 2013. When Encana realized that the Collingwood was a bust, they moved Ensign #119 to Colorado and it has never come back. Michigan has not seen a Collingwood well completed since June of 2013 and RMP predicts we never will again. You first heard the news about Ensign #119 moving to Colorado in February 2013 if you follow RMP on facebook or twitter. Now that we see Ensign rig #161 leave Michigan for Colorado just as we saw rig #119 do the same, we have a strong indication that Marathon does not like what they’re seeing from Michigan’s Detroit River formation and they’ve most likely pulled the plug; again, you heard it here first.

What does this mean for fracing in Michigan? It means that the threat to Michigan’s fresh water resources and wildlife habitat from the industrialization of our forests because of a hydraulic fracturing boom has never been lower than it is right now. Reasonable people that care about the environment are celebrating what the data is telling us: the poor use of Michigan fresh water, our most valuable natural resource, for HVHF completions and more specifically LVWW’s in our most sensitive cold transitional aquifers is near an end. Many organizations like RMP who are focused on fresh water conservation are now turning our focus away from HVHF and focusing on other issues that threaten Michigan’s fresh water resources. Issues like the Enbridge Line 5 oil pipeline under the Straits of Mackinac, 1000’s of leaking petroleum storage tanks across Michigan, secondary oil recovery using water injection, landfills, fecal waste, fertilizers, prescription drugs, invasive species, historical sedimentary contamination, and factories that use toxic chemicals are all displacing hydraulic fracturing as a priority environmental concern in the Michigan Basin.

Now let’s take look at other Michigan oil & gas activity that occurred in January 2016:

It has been a slow start to the year thus far. We only have 1 application for a new oil well in Ionia county targeting the Detroit River formation. The operator applying for the well, Circle D Operating, is also new to Michigan and their address of record, which seems a little odd, is the Glenn Eagle Retirement Home in Traverse City, MI. We also only have 1 new permit so far for 2016 in Montcalm County. Amplify Development is targeting the Traverse Limestone with a new oil well named the Paulen 2-25. Since we only have 1 application and 1 permit to start 2016, there is no point to pasting single row infographics for Michigan’s January 2016 activity. Suffice it to say we are off to a slow start after 2015 which was the slowest permitting year in Michigan history breaking the record set in 1931.

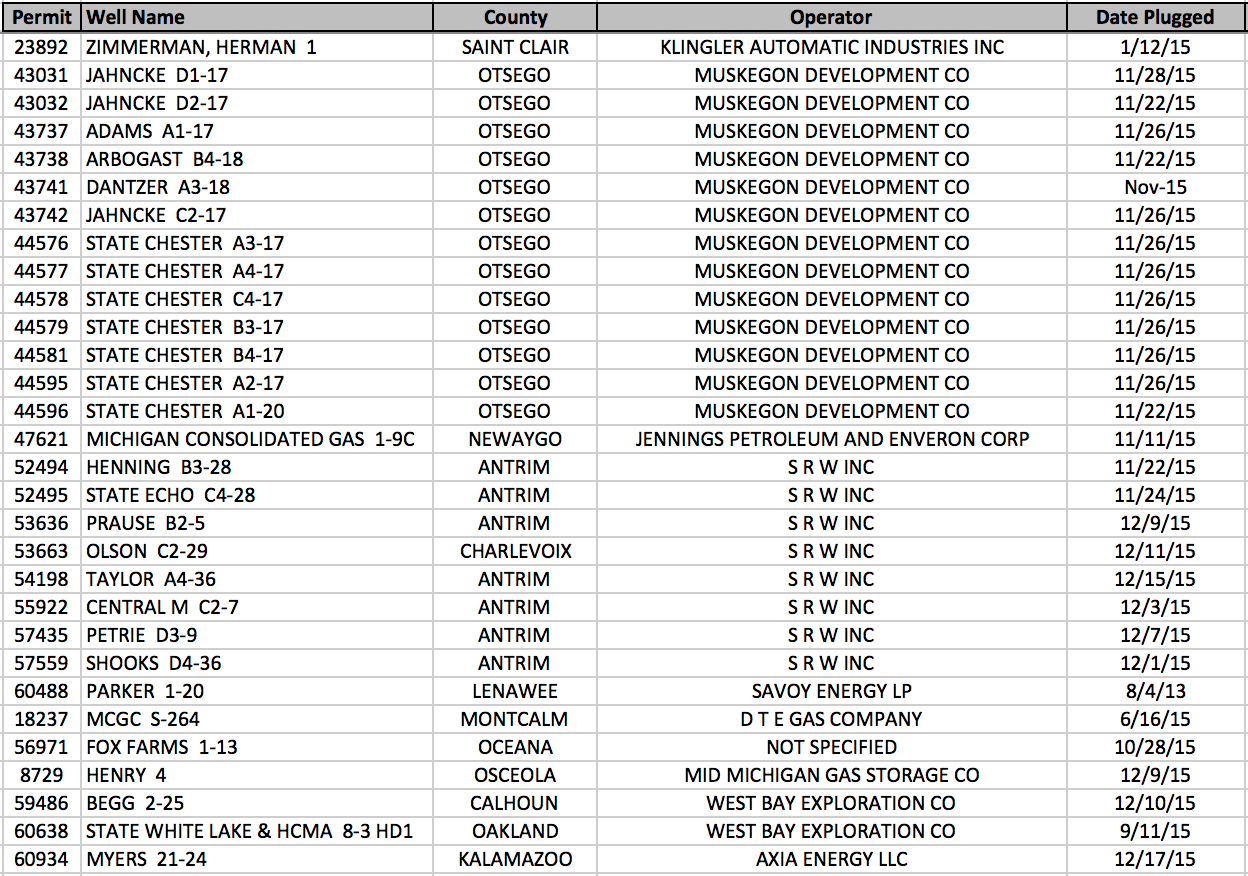

January 2016 – Oil & Gas Wells Published as Plugged

The well pluggings published in January show 30 wells reported plugged this month. One well of note is West Bay’s State White Lake & HCMA 8-3 HD1 well which is located in the Indian Springs Metropark in Oakland County. A listing of the 30 wells reported plugged in January is shown below.

January 2016 – Petroleum As % Of U.S. Trade Deficit KPI:

New in 2016! RMP will be tracking Petroleum as a percentage of the US trade deficit. RMP mentioned in our December 2015 MOGM that President Obama signed a bill that lifted an export ban on crude oil that had been in place since 1970. RMP will be monitoring the effect of that legislation by monitoring an important economic statistic published by the United States Census Bureau. The data and graph (shown below) come from this website: https://www.census.gov/foreign-trade/statistics/graphs/PetroleumImports.html

Each month what RMP hopes to see, and what RMP predicts we will see, is the blue section of the graph become smaller and smaller until it goes to zero. It may take a few years but we will track it month by month from the moment President Obama signed the bill. You can see the trade deficit’s highest point, in March of 2011, at 66.2%. You can also see the drop since hydraulic fracturing has boomed in other states outside of Michigan. The most current reading, November of 2015, shows our trade deficit related to petroleum at 12.7%. RMP hopes to see that number approach zero. RMP is hopeful that as the number approaches zero we will help cut off funding for terrorism, allow US oil workers to keep working as we migrate away from oil, and abate any motivation the oil lobby might have from trying to stall the adoption fuel cell electric vehicles and hydrogen fuel cell infrastructure in Michigan. Look for a separate post published by RMP to explain the economics of US oil exporting in the coming months and how it might help spur adoption of FCEVs in Detroit. Keep in mind that the data lags three months behind the current month. So, January 2016’s graph shows November 2015 ending data. RMP expects to see a spike in the graph as a result of Saudi actions, Iran sanctions being lifted, and a slump in Chinese oil demand but then we expect & hope, ceteris paribus, the natural effect of this new US legislation will cause the graph to inch toward zero.

The January 2016 Apps to Plugs Ratio KPI:

The apps to plugs ratio is self explanatory. By looking at the number of applications to wells plugged KPI we can see wells coming vs wells going.

2016 Apps to Plugs Ratio KPI:

1 Application : 30 Wells Plugged

The January Permits to Plugs Ratio KPI:

The permits to plugs ratio is nearly the same as the apps:plugs ratio but with permits instead of applications.

2016 Permits to Plugs Ratio KPI:

1 Permit Issued : 30 Wells Plugged

Five more permitted Collingwood wells that Marathon acquired when they acquired EnCana expired in January of 2016. We have been reporting that no more wells requiring a LVWW are likely to ever take place in Michigan and these permits expiring is just more affirmation. All of the State Oliver, State Excelsior, and State Pioneer well permits are officially expired.

While HVHF is all but dead in Michigan, we will still keep our eyes peeled should anything change. One HF well (not high volume) that is of interest this month is Cobra’s ACOWS to hydraulically fracture the Prarie Du Chien formation in Arenac County. It will be interesting to see if Cobra can get production out of their Clayton 22-11 unit. Arenac County is one of geographic areas tested early in Michigan oil & gas history and where a lot of the first permits in the state were pulled a long long time ago. In my research into petroleum geology I came across an adage used in the oil business: if you want to find oil, go where it’s already been found.

That’s a wrap on January 2016 for the Michigan Basin. As promised, RMP will be moving our 2016 focus toward CO2 injection, storage tanks, secondary recovery, and abandoned wells. This month, the HVHF story was too big to not cover. Even though we don’t have numbers yet, we have an indicator that a significant milestone in Michigan HVHF has occurred this month. The cupboard is bare. It’s over. All the lies sold by Aubrey McClendon and company at Chesapeake have run their course in the Michigan Basin and they have cost Michigan land owners and oil & gas operators in the Michigan Basin millions of dollars. Michigan has become a tax write off for some of the biggest corporations in America over the past six years since we all fell for the “fracking” bait hook, line, and sinker.

The current sophistry on the street in Michigan is that when oil prices rebound, which they always eventually do, Michigan will become very active with hydraulic fracturing throughout the basin. The reason the Ensign 161 rig went to Colorado and there are 10 active rigs between Denver and Fort Collins at the time of this publishing is because Colorado has product. It’s logical that Colorado sells oil to market at about the same price as everyone else including Michigan. Why is Colorado busy and Michigan is not when we both sell oil at the same prices? It is only partly because Colorado can produce oil for less money than $40/bbl. Operators from Colorado, Texas, and Oklahoma were testing unconventional formations in Michigan and walking away when oil was sold for more than $100/bbl. If a person claims to be rightfully concerned about hydraulic fracturing, they should be concerned about the plight of the folks in Colorado that face a legitimate threat to their fresh water. RMP stands with people in Colorado who work to protect ground water like the folks of the DWR. Michigan doesn’t have a similar situation to Colorado. Michigan does, however, have issues that currently demonstrate a high priority for fresh water conservation. Michigan has 6 quadrillion gallons of fresh water to watch over. It’s important that we as Michiganders remain vigilant and not become myopic about a hydraulic fracturing boogy-man that simply does not exist. All Large Volume Water Withdrawals (LVWW) related to the oil & gas industry in Michigan have moved down the road.

The people of Southfield Michigan do not want residential drilling and RMP stands with them also. The people of Southfield live in population dense area and do not want their aquifer pierced, extra truck traffic, noise, smell, and a risk of ground water contamination and absolutely zero say in the decision. Technically speaking, any bill, ordinance, or moratorium Southfield passes is symbolic only. The decision to permit the well rests with Michigan’s OOGM alone. The only official way to intervene is through a court order / lawsuit.

The people & wildlife on the prairie of North Dakota have a potential threat to their fresh water and habitat because of oil & gas industrial operations just like Colorado, Southfield MI, and Texas do too. North Dakota also sells oil to market at about the same price as Michigan. Why is North Dakota so busy with oil production and Michigan is not? The answer is easy and the same: North Dakota has product and Michigan does not. It’s really that simple and I could keep painting more examples ad nauseum. EOG’s Riverview #102-32H well north of Billings produced over 200,000 barrels of oil in less than 3 months! Let me say that again: 1 well’s initial 90 day production was over 2,200 BOPD while horizontal bore lengths are getting shorter! North Dakota is actively being hydraulically fractured and Michigan is not, and that’s not going to change regardless of the price of a barrel of oil. It’s time to move on from HVHF in Michigan and put focus where focus should be: on fresh water.