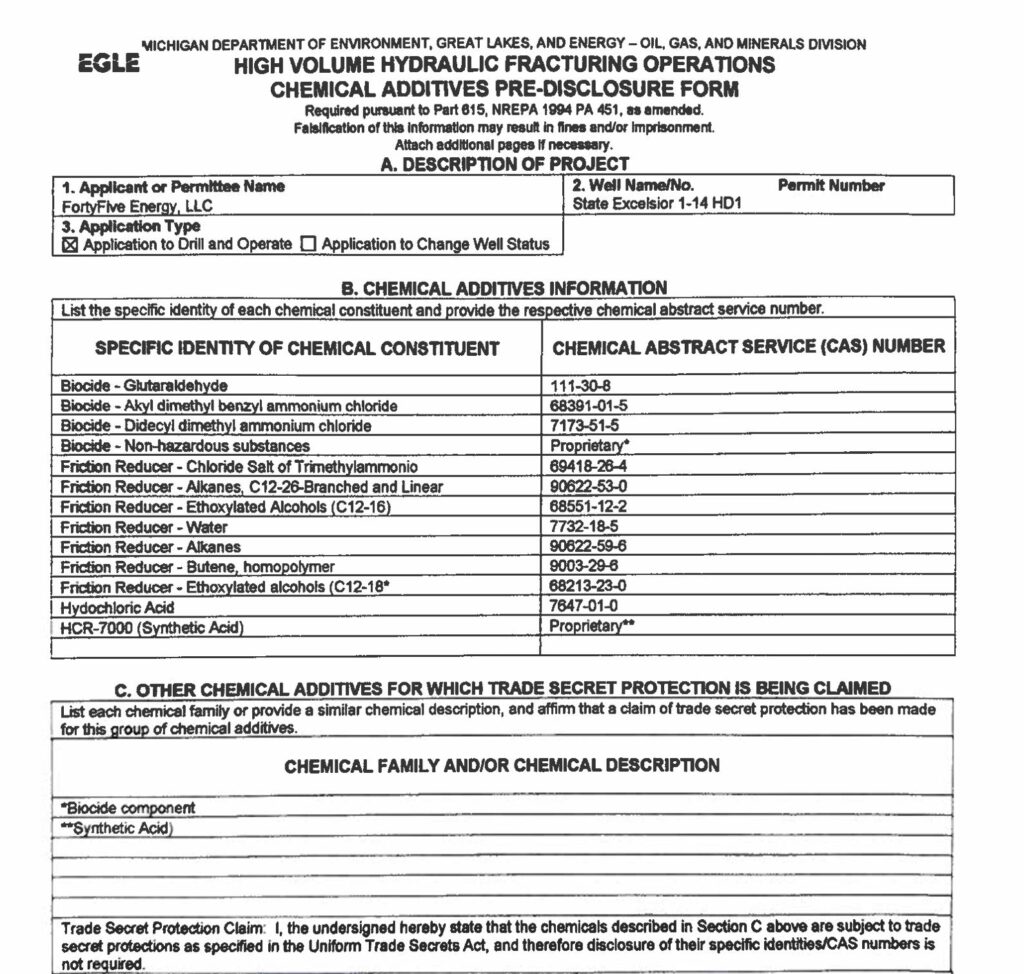

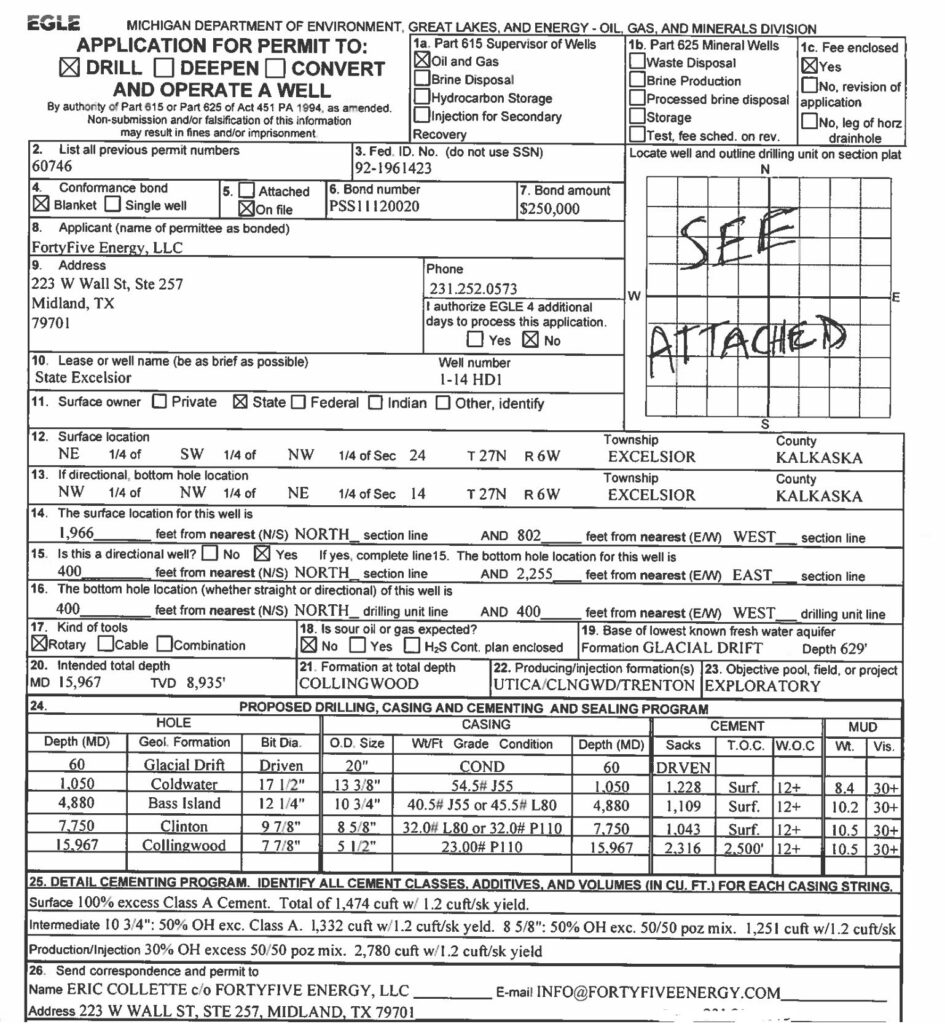

In a move no one expected after a 12-year hiatus, FortyFive Energy LLC of Midland, Texas has filed an application for a permit to drill and complete a new horizontal test of Michigan’s deep Collingwood formation. The proposed State Excelsior 1-14 HD1 represents the first return to large-scale, high-volume hydraulic fracturing (HVHF) in Michigan since June of 2013 — and the company is potentially planning something never before tried in this reservoir: a massive acid-dominated completion that may use zero sand. On Michigan’s EQP-7200-26 form, operators are required to disclose the chemical additives they plan to use in a hydraulic fracture, but they are not required to list expected sand usage, even though most operators typically do when proppant is part of the design. There is a possibility FortyFive Energy will use sand and didn’t list it on EQP-7200-26. There is, however, a chance FortyFive Energy will use a different completion technique using retarded acid as a spearhead for the frack and rely on etching channels for long lived gas and liquids conductivity back to the well bore.

The application has been filed under ‘tight hole’ status, Michigan’s classification that restricts public access to drilling and testing data while work is underway. Tight hole protections do not seal records forever, but they do delay transparency and make it harder for watchdog organizations like Respectmyplanet.org (RMP) to track operations in real time. Even so, RMP will watch the chronology of this well from permit to drilling to completion and initial flow back results.

A Look Back: When Encana Tested the Collingwood (2010–2013)

From 2010 to mid-2013, Encana was the last major operator to attempt commercial development of the Collingwood. Working with Halliburton, Encana drilled deep horizontal wells and conducted the largest HVHF completions in Michigan’s history — operations that dwarfed everything the state had seen before.

Some smaller horizontal-well fracks from that era were already large by Michigan historical standards, with hundreds of thousands to millions of gallons of slickwater, nitrogen, and acid blends. But Encana’s main Collingwood attempts built on an entirely different scale: the truly giant HVHF jobs that set state records.

RMP went back into our 2008 to 2013 Michigan oil & gas archives and looked up some of the water & sand usage numbers from similar ‘giant size’ fracks on the same and nearby well pads targeting the Collingwood. This table shows Michigan’s largest fracks ever with State Excelsior 3-25HD1 holding the record for water used and State Beaver Creek 1-23HD1 holds the record for sand used. Now consider this new well *might* not use sand or proppant. All wells in the table below were drilled & completed with Encana as the operator of record. Halliburton performed all completions for the wells below.

| Well Name (Permit) | Water Used (gallons) | Sand Used (lbs) |

|---|---|---|

| State Excelsior 1-13 HD1 (60360) | ~5,860,000 | ~3,670,000 |

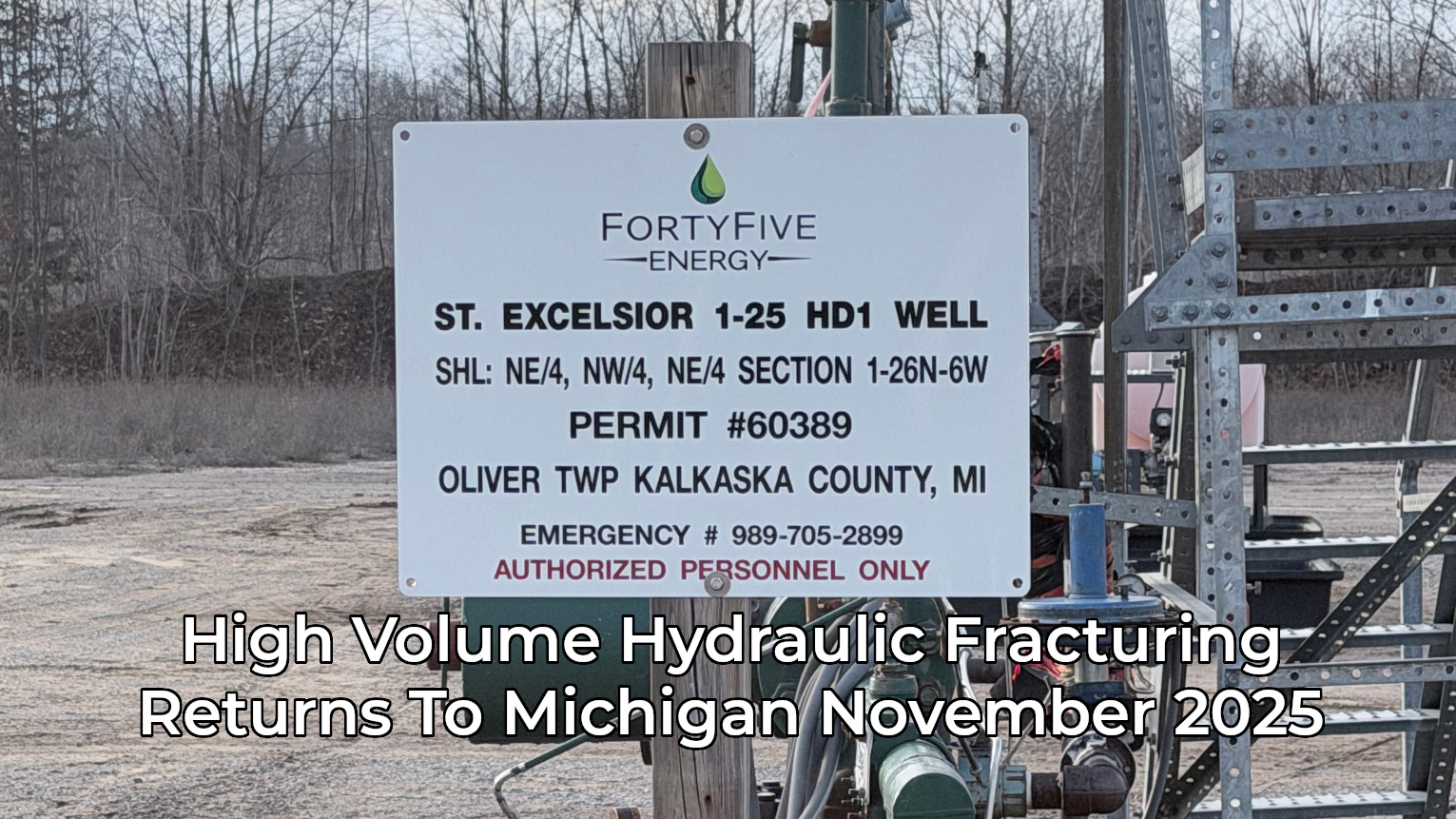

| State Excelsior 1-25 HD1 (60389) | ~8,460,000 | ~5,310,000 |

| State Excelsior 2-25 HD1 (60545) | ~12,700,000 | ~9,890,000 |

| State Excelsior 3-25 HD1 (60546) | ~21,200,000 | ~18,700,000 |

| State Garfield 1-25 HD1 (60580) | ~12,500,000 | ~9,660,000 |

| State Beaver Creek 1-23 HD1 (60621) | ~15,810,735 | ~25,539,000 |

These were genuine mega-fracks. Yet despite the cost and scale, the Collingwood did not produce at economic rates. Declines were steep, revenues were insufficient, and by June 2013 Halliburton rolled off the Westerman 1-29 HD1 pad for good. After all of our research watchdogging these large fracks, RMP predicted the play was finished and we would never see them again. We were right! We coined the phrase “it’s all about the rock” meaning if the rock pays, the operator stays. If the rock does not pay, the operator will not stay. It’s that simple. But here we are 12 years later and FortyFive Energy LLC thinks it can unlock the potential of this 390 million year old organic rich carbonate marl.

November 2025: FortyFive Energy Returns — On the Same Pads Encana Built

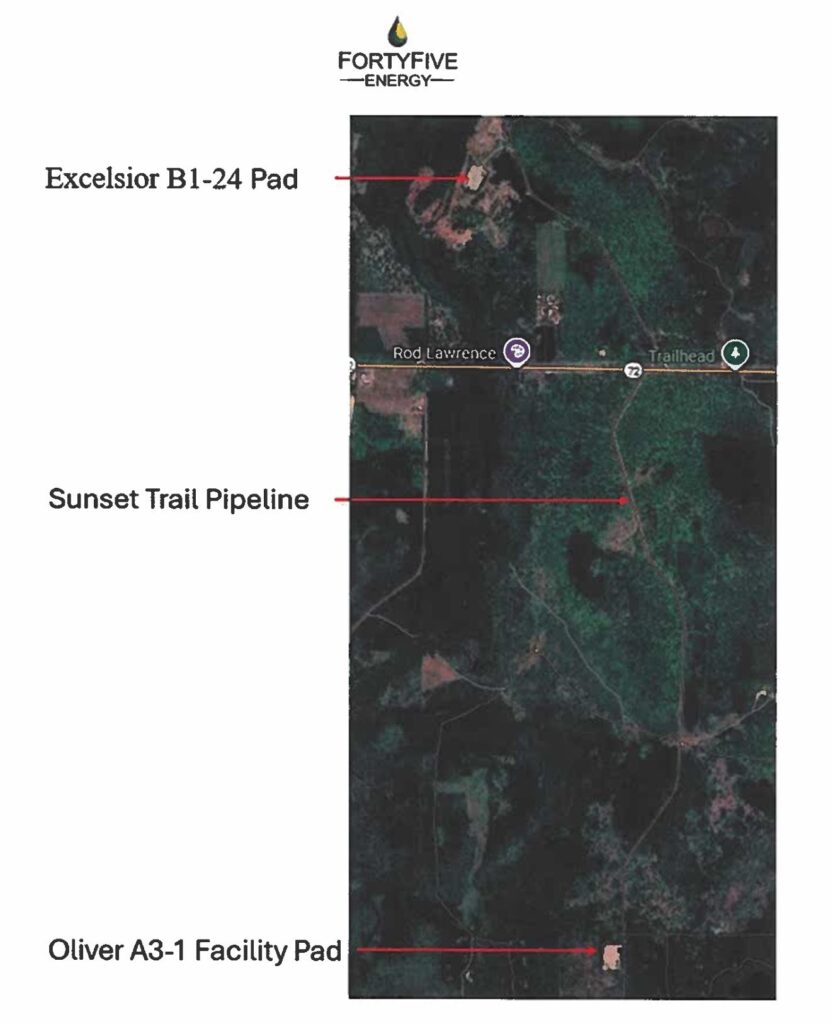

Twelve years later, FortyFive Energy has returned to the exact same pads Encana constructed in the early 2010s. Reusing existing infrastructure will significantly reduce site preparation costs, an important factor considering the size of the operation.

The company’s new WWAT filing proposes water use up to 17,394,300 gallons, placing the State Excelsior 1-14 HD1 firmly in the same mega-scale category as Michigan’s largest historical HVHF jobs. But without sand listed on the pre-disclosure form, we have to guess if FortyFive Energy is trying something new like an acid matrix frack or if they just didn’t list sand and are going to repeat what Encana did and get the same results. Let’s assume for a minute sand wasn’t just omitted from disclosure, let’s assume it’s intentional and FortyFive Energy expects to try something different.

Michigan’s EQP-7200-26 chemical-additive pre-disclosure form lists no sand at all, despite the water volumes suggesting a full-scale stimulation. Instead, the disclosure includes:

- Four biocides

- Nine friction reducers

- Standard HCl

- HCR-7000 synthetic retarded acid

- No proppant of any kind listed

RMP is speculating this may be a retarded-acid matrix or acid-fracture strategy, not a sand-prop fracture. If true, FortyFive Energy may be attempting to stimulate the Collingwood through chemical etching rather than proppant-supported fractures — a radical departure from the Encana era.

Retarded acids such as HCR-7000 react more slowly at reservoir temperatures (approx. 150°F at ~9,000 ft in the Collingwood), allowing deeper penetration into the rock before the acid spends. Instead of pumping sand to hold fractures open, the acid creates etched flow channels that remain conductive after the reaction is complete.

This technique is more common in certain Texas and Louisiana carbonate plays but has never been deployed at scale in Michigan’s Collingwood.

Why Now? The Eric Collette Variable

FortyFive Energy’s CEO, Eric Collette, worked at Marathon Oil Corporation during the period when Marathon purchased Encana’s Michigan acreage according to his Linked-In profile page. That means he may have had access to Collingwood performance data, logs, cores, and completion results long after the public moved on.

His decision to return in 2025 — with a completion design that looks potentially different than Encana’s — suggests he may believe the formation responds better to acid-based stimulation, not proppant-heavy slickwater.

RMP has said this for over ten years after following Michigan oil & gas activity: “It’s all about the rock.” Maybe Eric Collette thinks the rock wants acid, not sand, this may be the first real test of that theory. We will know in early 2026.

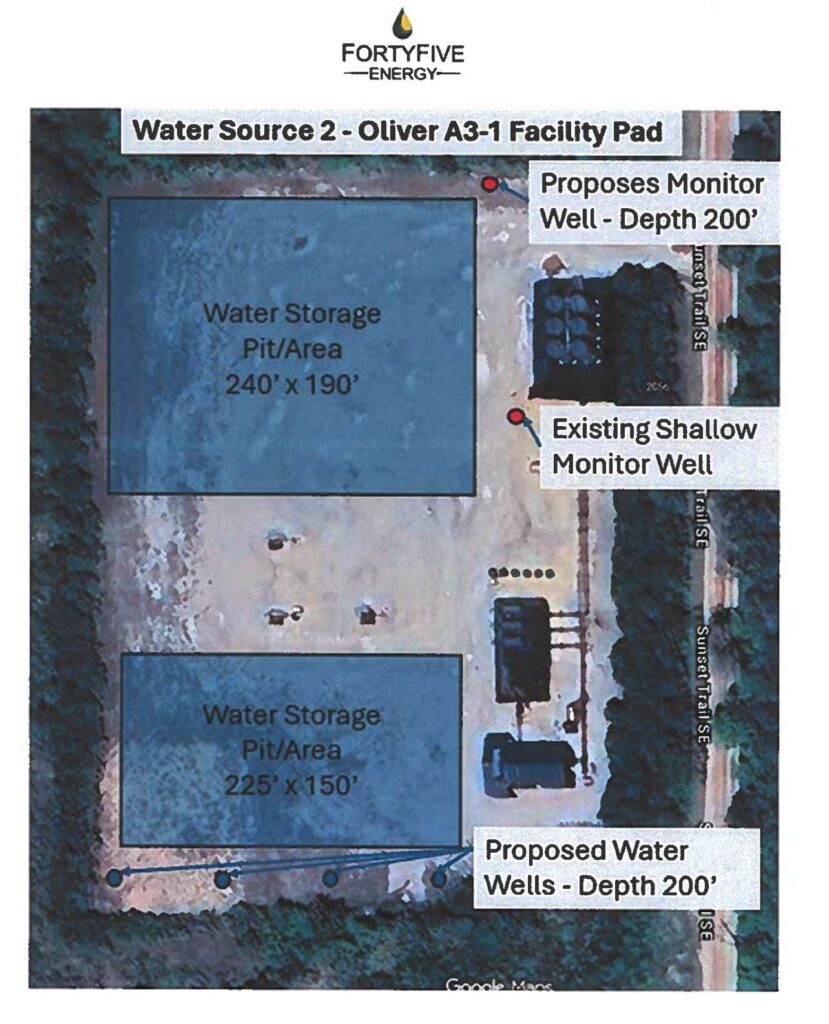

Water Withdrawal: The Largest Operations Since 2013

The company’s Water Withdrawal Assessment Tool (WWAT) submission reveals a large-scale pumping plan in the state’s most sensitive stream classification called a “Cold transitional stream”:

- Two water wells on the Excelsior B1-24 pad (north pad where well head will be located)

• 500 gpm combined

• Depth: 200 ft (glacial drift) - Four water wells on the Oliver A3-1 pad (south pad)

• 1,200 gpm combined

• Depth: 200 ft - Monitoring wells: one on each pad at 200 ft to watch drawdown

- Water containment will be on the Oliver A3-1 pad.

- Water will be moved to the drilling pad using the Sunset Trail pipeline, which will be fully pigged before service.

- Total proposed water withdrawal listed on HVHF form is 17,394,300 gallons

This is the first time Michigan has seen HVHF-scale activity requiring long-distance water movement through existing pipeline infrastructure.

A New Gamble on Old Rock — RMP’s Take

FortyFive Energy’s plan represents the first major return to the Collingwood since Encana exited Michigan in 2013. This may not simply be a repeat of the slickwater-and-sand era, but at the same time, it could ultimately resemble past efforts more than current paperwork suggests. What appears different on paper is the heavy emphasis on chemical additives and synthetic acids rather than clearly disclosed proppant. Whether that translates into a fundamentally new completion technique — or simply a variation on the old one — remains to be seen.

Unlike world-class shale plays such as the Marcellus, where operators work with hundreds of feet of stacked, gas-charged rock, the Collingwood offers only a narrow vertical window measured in a few dozen feet. That thinness magnifies every decision. Landing the lateral must be precise. Staying in zone for thousands of feet is not optional — it is everything. Miss the rock by even a small margin and no amount of water, chemistry, or pressure can fix it. As RMP has said for more than a decade: it’s all about the rock.

Where Encana attempted to brute-force the Collingwood with massive slickwater volumes and tens of millions of pounds of sand, FortyFive Energy may be preparing to test a more chemistry-driven approach, pairing similarly large water volumes with formation-specific acids such as HCR-7000. The goal, if this is truly an acid-dominant completion, would be for the acid to penetrate natural fracture networks, selectively dissolve the carbonate, and leave behind long-lasting etched flow paths — chemical “wormholes” instead of mechanically propped cracks. Still, until full completion data becomes public, the possibility remains that sand could yet be part of the design and disclosed later.

From RMP’s perspective, success for FortyFive will not be judged by stimulation pressure or short-lived test flows. For this well to justify a second well — let alone a full development program — the production profile must meet three hard economic thresholds:

#1 – They must nail the lateral – In a formation only tens of feet thick, the horizontal bore must remain in the most organic-rich interval for the vast majority of its length. A 7,000-foot lateral that is only partly in zone behaves more like a 3,000-foot well than a 7,000-foot well — and the economics follow accordingly.

#2 – Initial production must be high enough to matter – RMP would expect to see at least 5 million cubic feet per day (MMcf/d) of gas, sustained for months, not days, for this well to be taken seriously. At $3.00 per thousand cubic feet, 5 MMcf/d equates to roughly $15,000 per day in gross gas revenue, before expenses and before NGL uplift. Sub-2 MMcf/d initial rates would likely signal another marginal outcome.

#3 – Production decline must flatten into a durable longevity – The historical failure mode of the Collingwood has been steep decline. For this well to approach economic payback, RMP would look for average production of 2–3 MMcf/d over the first full year, followed by a gradual taper rather than a collapse. At 2.5 MMcf/d average over one year, gross gas revenue alone would be roughly $2.7 million. Meaningful NGL production could materially improve those numbers — but only if volumes persist.

When drilling, completion, water handling, and infrastructure costs can easily push into the $10–$15 million range, it becomes clear why both rate and longevity matter. Short bursts of gas do not pay for massive wells. Only sustained flow over multiple years can justify repeated drilling.

If the well shows only a brief surge followed by a rapid falloff — the same pattern that ultimately doomed the Encana program — FortyFive will likely face the same economic wall that stopped every major operator before them. At that point, it will not matter whether the fractures were held open by sand or etched by acid. The result would be the same: pack up and go home empty-handed.

For now, much of the early technical story is shielded by tight-hole status, limiting what drilling information, tests, and early logs become public. That secrecy adds intrigue, but not certainty. RMP will follow this project from rig-up to completion and, ultimately, to initial production as soon as public records allow.

After twelve quiet years, the Collingwood is getting another roll of the dice.

Did Eric Collette see something in the rock that others missed?

Is HCR-7000 the key to pathways that millions of pounds of sand could never keep open — or will sand quietly return as part of a familiar design?

In Michigan’s most stubborn gas formation, the rules have never changed: it’s all about the rock. Whether this new effort proves to be a genuine technical breakthrough — or simply another costly test of an unforgiving formation — is a gamble no one can call in advance.

We will see whether FortyFive Energy rolls a seven — or snake eyes.

Want To Follow This Well’s Chronology & Pay Back?

If you would like to follow the chronology of this well — from rig-up, to completion operations, to initial production results once tight-hole status expires — you can follow RMP by subscribing to this blog or connecting with us on Threads, Bluesky, and facebook.

RMP is projecting that the drilling rig could arrive as soon as the permit is approved and Michigan’s firearm deer season closes on November 30, 2025. If that timeline holds, activity could begin in December 2025.

We will document visible operations as they occur, including drilling, water withdrawal, and completion staging. Photos and video will be shared when possible, primarily through the photographic excellence of the one they call Neo who has visited more well pads in Michigan than a 25-year staff petroleum geologist at EGLE.

As always, RMP will report what can be documented in real time and what becomes public once confidentiality periods expire.

Leave a Reply