This is Part 3 of a three-part series titled: “Michael Barnard: Exposing Anti-Hydrogen Media Bias – Part 3 of 3- Critical Minerals, China’s Coal Economy, & Fair Trade” In Part 1, the topic and thesis statement for the series were presented, along with Barnard’s curriculum vitae and journalistic modus operandi. We also explored how Barnard fits into the genesis of the anti-hydrogen media narratives that began in October 2013. In “Part 2 of 3 – Heavy Ground Transportation: Rail, Bus, and Truck”, we examined how Barnard misleads readers into viewing batteries and hydrogen as mutually exclusive technologies rather than complementary ones. In this section, we explore the foundation of the new energy economy and China’s near-total monopoly on raw mineral production and metal refining, which underpins the battery, magnet, solar PV, silicon microchip, and electric motor industries. Each part of this series stands alone, but the report was originally written as one long chronological piece and was later divided into three parts to make reading easier.

Critical Minerals, Environmental Threats from the Battery Supply Chain, and Intellectual Property

As the clean energy transition accelerates, the conversation can no longer be confined to vehicles, fuels, or even infrastructure. Beneath all of these technologies lies a deeper strategic question: who controls the critical minerals and intellectual property needed to build them at scale? Materials such as lithium, nickel, iron, phosphorus, manganese, cobalt, copper, polysilicon, cathode precursors, graphite for anodes, and rare earth elements are the lifeblood of batteries, motors, and clean energy systems. Control over their production and processing will shape not only industrial competitiveness but also national security.

At RMP, we’ve spent years digging into both traditional and emerging energy systems because understanding infrastructure is just as important as advocating for technology. A significant portion of our work has focused on hydrogen infrastructure—mapping its production pathways, distribution infrastructure, and real-world applications. Over the years, RMP has built and maintained multiple interactive energy infrastructure maps: a North American GIS hydrogen map that has been live for more than a decade, a global LNG terminal map covering every liquefaction & regasification terminal in the world which has been live for just over 10 years, and a NAATBatt-based map of all North American lithium-ion battery infrastructure that also layers in copper mines and lithium mining prospects; it’s RMP’s newest GIS map which was just released earlier this year.

Our new lithium-ion battery infrastructure map is perhaps our coolest map yet for diving deep into America’s and Canada’s pursuit of making batteries domestically. Each map is paired with supplemental tables to make the data more accessible and useful for powerful SQL queries. This kind of work reflects what authentic curiosity about energy infrastructure looks like: digging in, cataloging, and sharing the evidence so others can understand the foundations of the transition. If we’re going to champion new energy pathways, we need to know how they work beneath the surface. Readers who care about the future of energy should want the same: a clear view of the machinery behind the headlines.

By that same logic, it would make sense to expect someone like Michael Barnard—who has written more than a thousand posts attacking hydrogen and praising batteries, solar, and wind—to show a similar curiosity about how batteries, solar panels, and wind turbines are made, where the raw materials come from, and how those materials are refined into cathode- and anode-active components, polysilicon, and electric motors. Spoiler alert: he doesn’t. Barnard’s work always follows his simple narrative: hydrogen bad, Tesla products good, West bad, China good.

Barnard has not shown interest in the complex economic realities of the battery supply chain until recently because it hasn’t served his storyline until recently. If his energy motivations were more authentic, you would think he’d be rolling up his sleeves to dig into how batteries are sourced, processed, and scaled. Barnard downplays China’s dominance when there are concerns about critical minerals and encourages U.S. dependence on its biggest geopolitical rival out of the other side of his mouth. When this casual dismissiveness of how strategically important critical minerals are to make in the USA and Canada, his articles stop being just sloppy hit pieces—they become dangerous advocacy for poor US and Canadian policy.

Barnard’s Thin Record on Critical Minerals

Barnard has written over 1,140 posts for Cleantechnica from February 2014 through October 2025, but less than 10 (less than 0.9%) have ‘critical minerals’ as a keyword in his titled works. His first post about critical minerals came in 2021 with a short piece on lithium that in essence says Canada has an abundance of lithium but Canada should just leave it in the ground and buy from China.[28] Barnard did not touch the critical minerals subject again until three years later in 2024. His 2024 article was another of his trademark attacks, this time aimed at the Geological Survey of Finland’s Associate Professor Simon Michaux, dismissing serious research from a nationally recognized institution that conflicted with his narrative.[29] It wasn’t until December 2024 that Barnard interviewed (in my opinion) one of his more interesting and educated guests Gavin Mudd, the director of the Critical Minerals Intelligence Center at the British Geological Survey. That conversation with Mudd became podcast episodes 043 and 044 in early 2025.

Mudd did not seem to be a regular in Barnard’s circle of friendly voices. Mudd forced Barnard out of his comfort zone as compared to way he behaves with more friendly guests like Paul Martin, Michael Raynor, or David Cebon who are Barnard’s anti-hydrogen drinking buddies.[30-1] At several points, Mudd’s expertise collided directly with Barnard’s narrative, leaving Barnard to pivot or sidestep. The exchange highlighted both Mudd’s command of the subject and Barnard’s lack of depth on critical minerals.

Early in the discussion, Barnard seemed to demonstrate he hasn’t put much thought into the battery supply chain or rare earths. Around the 12-minute mark, he tentatively asked Mudd: “Probably the two primary battery metals that get discussed… cobalt and lithium, is from my perspective… Is that accurate?, or is there any other critical mineral you’re concerned about at the Critical Minerals Intelligence Center?” Mudd’s answer was a cautious “No”.[31-1] I got the feeling Mudd was realizing, just like I was at that moment, that critical minerals were not a familiar topic to Barnard. Mudd explained that most of metals designated by the US as critical are the same ones the UK has designated critical to give Barnard a primer. The way Barnard posed the question—tentative and narrowly framed—shows that after ten years of promoting battery propulsion he has not put much effort into understanding the raw materials, refined materials, and manufacturing processes required to make them.

Barnard seemed to only be superficially aware of minerals with controversial social media hot takes like lithium and cobalt. Later, when Mudd discussed the economics of recycling NMC versus LFP cathodes and why there is motivation to recycle one of those cathodes and zero interest in the other, Barnard didn’t engage because he didn’t know enough to engage. Mudd was referencing what we talk about at RMP in that nickel & cobalt have a value proposition for recycling, but iron and phosphate are cheap and there will be less motivation to recycle LFP batteries. Mudd explains “I think one of the problems we’re seeing with the rise of LFP batteries is that they’re all cheap materials largely. So things like cobalt, it’s an expensive metal, nickel is an expensive metal. That means the price of that battery or the value of that battery was certainly much higher”[32-1] Barnard wouldn’t bite on the topic and would pivot back to a topic where he was comfortable, like something pro-China or anti-hydrogen. He showed no interest in the recycling value proposition concept. Rather than examining how and where various cathode chemistries are manufactured, Barnard’s narrative centers on the role batteries play in lowering CO₂ emissions in Western countries after they arrive from China.

Again and again, Barnard tried to pivot back to familiar talking points when he was out of his depth with Mudd. At one point he again shifted to praising the Tesla Semi, a truck still not in series production today in late 2025 that Tesla took deposits for in 2017.

At another point in the critical mineral’s conversation with Mudd, Barnard downplays projected copper shortages by suggesting aluminum substitution will change global copper projections. It will not. Barnard downplays copper projections because the facts on copper shortfalls complicate his optimistic narrative that electrification is advancing quickly and resource shortages are nothing his followers should worry about. Barnard claims that he thinks aluminum will step up and reduce the amount of copper necessary for electrification. By Barnard suggesting copper demand will not need to roughly double by 2035 is misleading spin that distracts from important conversations about the difficulty related to boosting copper supplies. Copper demand is projected to double by 2035, regardless of Barnard’s opinions.

Barnard’s suggestion that aluminum use in high-voltage transmission will significantly blunt copper demand is a good example of his broader playbook. It is true that aluminum dominates in overhead transmission lines because it is lighter and cheaper than copper, and this fact is worth noting. But that does not translate to copper demand disappearing across the wider electrification system. Distribution networks, underground cabling, motors, transformers, and EV components overwhelmingly rely on copper because conductivity, durability, and efficiency matter more than material cost & weight in those contexts. Institutions such as the IEA and S&P Global continue to project sharp increases in copper demand as electrification accelerates, despite aluminum’s clear role in transmission. By elevating one correct but narrow fact and using it to dismiss larger, well-documented projections, Barnard deflects attention from the full picture and attacks and discredits experts. This copper example is not an outlier but another microcosm of his modus operandi: select a narrow truth, stretch it into a general conclusion, and use it to undermine expert analysis that complicates his narrative.

Where institutions and analysts see structural constraints on copper, Barnard insists they are wrong, leaning on contrarian narrative rather than evidence. Just like Barnard is wrong about the need for more hydrogen to displace diesel, he’s wrong about copper required for his thesis of ‘electrifying everything’. According to S&P Global’s commodity outlook, global copper demand is projected to double—rising from around 25 million metric tons per year today to roughly 50 million tpy by 2035—driven directly by the energy transition and the massive requirements of electrification and renewable energy technologies.[33] Similarly, Willis Towers Watson forecasts copper consumption nearly doubling to about 50 million tpy by 2035, again attributed to the accelerating global shift toward clean energy systems,[34] The point of my article you’re reading now is that you should trust and support our credible institutions that Barnard attacks and not Barnard’s attack pieces on any institution that does not follow his narrative.

Later in the Mudd podcast, Barnard took time to make ad hominem attacks on another research institution named ARENA—the Australian Renewable Energy Agency—Barnard says “ARENA the Australian Renewable Energy and National Something Organic [sic] Association, they’re a big investment fund for mostly clean tech. They’ve got some bad stuff and some stupid stuff they say about hydrogen”.[32-2] As pointed out repeatedly through this article, it is standard practice for Barnard to attack research institutions when their publications conflict with his anti-hydrogen narrative; in this case hydrogen was not even on topic. Mudd, however, stayed on point, grounding the conversation in data. Barnard had the chance to explore meaningful issues with Mudd, such as the economic trade-offs between different cathode chemistries, but the opportunity was lost. His lack of knowledge left him unable to engage on the topic of critical minerals and keep falling back to narrative topics like Tesla and anti-hydrogen smear.

Mudd also raised serious environmental topics related to Barnard’s clean energy thesis that Barnard consistently separates from batteries, such as the Mount Polley tailings disaster in British Columbia and the Brumadinho disaster in Brazil. These events were not caused by battery-metal mining per se, but they serve as stark reminders of what happens when large-scale mining operations fail. The processes used to extract and refine copper, nickel, and other minerals required for batteries are the very same types of mining that produce toxic tailings, massive waste plumes, and long-term water contamination. The risks are not hypothetical—they are inherent to the industry. Mudd even says about the industry he studies every day for his job: “Historically the mining industry is considered a dirty industry and the industry would not disagree with that.”[31-2] Making batteries carries serious threats to freshwater resources and the air we breathe at every step in the supply chain, unlike renewable hydrogen that literally produces pure potable water as a byproduct.

The Thacker Pass project, designed to be an environmentally advanced lithium mine with minimized water and carbon intensity, highlights the central conflict of the green energy transition: the necessity of extracting critical minerals for battery electric vehicles (BEVs) is opposed by environmental and Indigenous groups who prioritize the protection of local ecosystems and cultural sites from mining’s inherent impacts. This video from Lithium Americas explains the design of their state-of-the-art mine, which you can read more about on the Thacker Pass Overview page.

Tailings ponds and heap-leaching operations can leave behind toxic legacies for decades, often long after the mining companies responsible have disappeared. In these situations where the mining company no longer exists, taxpayers generally must fund environmental remediation efforts for problems from many decades ago. Yet Barnard, like many anti-hydrogen commentators, peddles FUD about water use in hydrogen production as an environmental concern while ignoring these severe and recurring risks from mining and refining operations.[35] The conversation about energy must acknowledge that mining metals for batteries is not impact-free. This tension is evident in the Sierra Club, which champions battery-electric vehicles (BEVs) even as its local chapters raise serious environmental concerns about projects such as Thacker Pass, where developer Lithium Americas claims modern features like water recycling and waste heat reuse will reduce environmental impacts.[36] If we cannot support the most responsible mining and refining operations in the world at home, we cannot call it clean. It’s hypocritical to praise something and endorse it as clean when it’s made abroad with no environmental oversight, yet resist proving it by demonstrating it can be made clean at home with the most advanced sustainability procedures in the world. Mining and refining metals for “green” energy remains a classic “everyone wants to go to heaven and no one wants to die” dilemma of the battery supply chain.

Protecting Michigan’s freshwater resources has always been our North Star at RMP, written into our mission statement from the beginning. That commitment is why we emphasize the environmental threat battery production can pose to drinking water and the need to balance prosperity with preservation. Let’s talk about just one of the three massive mining disasters Barnard & Mudd mention on the podcast and contemplate how much water was ruined, the massive Mount Polley disaster, and the devastation of Quesnel Lake. A decade after the catastrophic breach of the Mount Polley mine tailings dam in 2014, Quesnel Lake remains heavily impacted. The breach released approximately 25 million cubic meters of toxic sludge into Polley Lake, Hazeltine Creek, and Quesnel Lake, the deepest lake in British Columbia and a critical salmon habitat. The heavier elements settled over six kilometers of lake bed, forming a waste plume up to two kilometers wide and ten meters deep.[37] Ten years later, scientists continue to detect elevated metal concentrations in the lake, showing that the environmental impacts are still being felt.[38]

This is why RMP continues to follow and normalize the NAATBatt GIS database of the lithium-ion battery supply chain and keeps a watchful eye on metal production in North America. Too much of the public debate reduces “clean” energy to a single CO₂ metric. But mining, smelting, and refining carry enormous environmental costs that can’t be captured by carbon accounting alone. From a human health perspective, CO₂ ranks behind emissions that cause water contamination or release sulfur oxides, nitrogen oxides, mercury, lead, particulate matter, ozone, arsenic, and cadmium. Again, as Mudd himself said to Barnard at the 37-minute mark: “Historically the mining industry is considered a dirty industry and the industry would not disagree with that.”[31-2] Barnard had nothing to add to Mudd’s comment, because acknowledging it would break from his script. Barnard’s motivation is not to protect the environment, it’s to protect his misleading narrative. Something is rotten in the State of Cleantechnica.

In the end, the Mudd interview underscored two things: first, that meaningful discussion of critical minerals requires expertise and evidence; and second, that Barnard’s narrative doesn’t provide either. Mudd spoke intelligently about rare earths, cathode chemistries, and recycling economics—particularly the trade-off between NMC and LFP cells. His points resonated with what we have long written & tweeted about at RMP: if a metal isn’t valuable, it faces economic feasibility challenges in recycling, no matter how often advocates like Barnard suggest otherwise. When the money is not there, things don’t happen.

Now let’s talk a little more about who refines the metals, coordinates the supply chain, and controls the intellectual property on cathode active material, anode active material, and rare earths. LFP cathodes get praised over NMC cathodes because they rely on more abundant materials like iron & phosphorous rather than nickel and cobalt. But even though the USA & Canada have abundant resources of lithium, iron, and phosphorous, the US doesn’t have IP or facilities to make LFP powder (the cathode active material) to make the batteries. Nearly all LFP powder production today—roughly 94%—is dominated by China. This is a critical national security risk for the USA and Canada with regard to depending on a Foreign Entity of Concern (FEOC) for our energy. LFP powder is not the only critical component of the energy transition, China controls a greater than 90% of global market share in the production & distribution of multiple critical minerals:

LFP Cathode Precursor & Powder – China holds approximately 94% of the LFP cathode material supply chain and controls 91% of iron phosphate production, which is crucial to LFP battery production.[39]

Rare Earth Elements (General Processing) – China refines and processes about 85–90% of global rare earth materials, giving it near-total control over this critical value chain.[40][41]

Heavy Rare Earths & Magnets – For heavy rare earth elements and permanent magnets (e.g., NdFeB), China controls up to 99% of processing capacity and about 90% of magnet production globally.[42][43][44][45]

Yttrium – China supplies more than 60% of the world’s yttrium carbonate, vital for electronics and industrial applications.[46]

Neodymium (for magnets) – China accounts for over 80% of global neodymium production, a critical component in EV motors and wind turbine generators.[47]

Graphite (Anode Material) – Over 92% of global battery-grade graphite production is based in China, covering both natural and synthetic sources.[48]

Polysilicon – China controls approximately 90–93% of global polysilicon production capacity, the ultra-pure silicon used in the production of solar panels and microchips—a key ingredient in the semiconductor and photovoltaic industries.[49]

RMP is tracking new efforts in North America on our GIS battery database to address the gap to make LFP powder in St. Louis, Missouri[50][51] and also in Quebec, Canada; but the imbalance remains a serious energy security concern even as North America begins its efforts to strengthen domestic supply chains. Barnard not only overlooks these economic risks—he seems content to celebrate them, and mock the US and Canada when China flexes on these monopolies to hurt the U.S. economically.

Barnard Understands China’s Mineral Dominance—and Cheers It On

Barnard’s small handful of posts on critical minerals reveal a clear understanding and appreciation of China’s strategic positioning. In his three posts on critical minerals earlier this year[52][53][54], he repeatedly underscores Beijing’s dominance in rare earth elements, lithium, cobalt, and other metals essential for clean energy technologies. He highlights China’s ability to control production, refine materials, and influence global markets, portraying these actions as skillful and disciplined. He boasts about China flexing on the U.S. by shutting down access to critical minerals as political punishment through transaction stopping export licensing. Barnard writes “these licenses give Beijing control over not just where these materials go, but how fast they go, in what quantity, and to which politically convenient customers. The U.S.? Let’s just say Washington should get comfortable waiting behind the rope line.”[55] Barnard is no friend of the United States (or Canada) with such inflammatory rhetoric. How can Barnard not see the contradiction in urging U.S. and Canadian consumers to buy products dominated by China, while at the same time mocking the U.S. & Canada for their dependence on Chinese access? This is not behavior aligned with sustainability goals; it serves China’s advantage at the expense of the U.S. and Canada.

Barnard Ignores National Security Risk of Total U.S. Dependence on China

Rather than simply obscuring the truth that reliance on foreign-controlled mineral supply chains carries serious economic and strategic risks, Barnard’s messaging actually promotes it. By brushing past the warnings of industry experts and policymakers, he downplays the very vulnerabilities that threaten the foundation of the clean energy transition. If we want credible analysis of critical minerals, we should be listening to institutions like Benchmark Mineral Intelligence and NAATBatt International, which provide trusted data and expertise to governments and industry leaders—not to Barnard, whose commentary is guided by narrative rather than evidence.

Senator Tom Cotton, a senior member of the Senate Armed Services Committee and chairman of the Senate Intelligence Committee, has been one of the most outspoken voices on the dangers of U.S. dependence on Chinese-controlled supply chains. His background in defense and intelligence gives his perspective particular authority, as he views minerals not just as commodities but as critical assets tied directly to national security. Speaking in a Benchmark Fireside Chat on June 10, 2025, Cotton underscored the stakes: “The resilience of critical mineral supply chains is both an economic issue and national security concern of great consequence, especially given China’s dominance in global production.”[56-1] As Cotton bluntly put it, the threat is underestimated: “As the chairman of the Senate Intelligence Committee I’m often asked, ‘Is the threat from China as real as it seems?’ and my answer is, ‘No, it’s actually much worse.’”[56-2] This statement reflects what policymakers, defense experts, and economists already know: critical mineral dependency is not just an economic vulnerability—it is a national security liability. Barnard, by contrast, brushes past this reality, praising China’s supply chain dominance while mocking the West, especially my country the United States, for its reliance, instead of engaging with the serious implications highlighted by Benchmark, NAATBatt, and U.S. policymakers.

Cotton also reminded listeners why this issue cannot be compared to trade in consumer goods. “If we lost access to Christmas decorations or toys from China, it wouldn’t threaten our health, safety, and well-being. But it’s very different with critical minerals and energy security if there were say a trade dispute. It does hurt our health, safety, and well-being.”[56-3] The point is clear: a supply disruption in decorations is an inconvenience, but a disruption in lithium, cobalt, or rare earths would paralyze sectors from electric vehicles to defense systems. This is why policymakers stress that supply chain resilience must come from North American investment, not reliance on an adversary.

Instead of following Barnard’s advice to “submit” to China’s leadership and “wait behind the ropes”, the United States and Canada should be investing aggressively in domestic resources. That means permitting responsible development of lithium from Arkansas’ Smackover formation, graphite from Quebec, nickel and cobalt from Ontario, and phosphates for LFP precursors in Florida and multiple Canadian provinces. Being serious about “clean energy” means accepting the domestic costs we currently reject: tolerating the serious risks of mining and high-carbon smelting with coal at home, rather than silently relying on supply chain dominators like China to burn our global share of coal to make “clean energy”. It means supporting innovation and processing capacity domestically, removing “blue tape” (as Senator Cotton calls it) and red tape that slow projects down, and ensuring that North America builds the refining, cathode, and anode facilities that China currently monopolizes. RMP fully supports making these products in North America with equal or better environmental safeguards than used in China.

As Cotton concluded, “China still has the United States and the rest of the world over a barrel on this issue, but many more people and normal Americans certainly appreciate that this is not a tenable situation for us to be in.”[56-4] That is the message policymakers and industry leaders must take to heart. Barnard may want to downplay the risks, but the data and the voices of institutions like Benchmark, NAATBatt, and U.S. intelligence leadership make the stakes unmistakably clear. When I hear that last quote about “many more people and normal Americans,” I think he is speaking directly to me and countless others who are frustrated by media outlets like Cleantechnica that publish what we have repeatedly demonstrated as misleading information. We want journalistic integrity from outlets we know and trust, with citations to respected organizations, not shallow spin, and we are ready to push back against voices like Barnard’s that mock America’s vulnerabilities instead of working to solve them.

Today, energy and technology commentary moves freely across borders. Many high-profile analysts and influencers who shape American discussions about renewables and industrial policy like Zachary Shahan, Michael Barnard, Michael Liebriech, Auke Hoekstra, David Cebon, Paul Martin, and Gniewomir Flis are based overseas and operate under the media and privacy laws of their home countries. This creates what might be called an accountability gap: content that strongly affects U.S. audiences is often produced beyond the reach of American transparency or journalistic-standards frameworks. The result is a gray zone where opinion pieces and promotional narratives can circulate widely without the fact-checking expectations that apply to domestic outlets. The issue is not nationality but regulation—how to ensure that information aimed at U.S. readers meets consistent standards of accuracy and disclosure, regardless of where it originates.

Barnard’s coverage of China’s mineral dominance sets the stage for a deeper discussion of China’s broader energy and industrial strategy. In one podcast with David Fisher, Barnard explores China’s electricity generation and its reliance on coal to power mining, refining, and manufacturing operations for batteries, solar panels, and other renewable energy technologies. While Barnard lauds China’s industrial output and strategic positioning, the underlying energy system is still heavily coal-dependent, highlighting environmental and operational trade-offs that rarely appear in his commentary or the BEV community at large.

Understanding China’s energy mix is crucial for evaluating the true sustainability of global supply chains and for assessing the risks of dependence. The upcoming section will examine China’s trade practices through the lens of fair trade and national security, emphasizing why onshoring critical mineral production and clean energy manufacturing is not only an economic opportunity, but also a strategic imperative for North America.

China’s Dependency on Coal, Dominance in Hydrogen, and Fair-Trade Practices

Commentary on China’s energy system often highlights rapid clean energy growth while overlooking what remains stubbornly central: coal. At the same time, hydrogen is gaining a strategic role in China’s decarbonization plans, even as analysts like Barnard downplay its significance. These realities are critical for understanding not only China’s trajectory but also the broader dynamics of global competition and U.S. energy security.

Michael Barnard frequently frames China as ahead of schedule on climate targets, minimizing the scale of its coal dependence while dismissing hydrogen as a distraction. That framing distorts the comparative picture of the massive dependency on coal in China. China’s coal capacity is still rising, and claims that coal-powered battery electric vehicles are environmentally superior hold up only when CO₂ is treated as the sole metric. In practice, coal carries additional burdens: particulates, sulfur dioxide, and other pollutants that natural gas, nuclear, or hydrogen pathways largely avoid. Meanwhile, hydrogen development in China is central rather than peripheral to China’s strategic energy planning. China’s industrial policies also raise questions about fair competition in global markets.

The sections that follow take each of these issues in turn: Barnard’s selective treatment of China’s coal reliance, the paradox of electrification in a coal-heavy system, the importance of hydrogen in China’s long-term strategy, and the implications of industrial concentration for energy security and fair competition.

Framing Coal, Gas, and Hydrogen Through Selective Narratives

Michael Barnard’s reporting at Cleantechnica often claims to be driven by data and objectivity, but a close look reveals a pattern: an effort to diminish the scale of China’s coal reliance, to exaggerate the flaws of U.S. energy systems, and to steer readers away from any solutions, such as hydrogen, that do not fit his established worldview. His podcast 045 & 046 titled China’s Balancing Act: Coal, Renewables and Nuclear[57][58] from February 2025 provides a good example of him downplaying China’s reliance on coal and its impacts. Barnard’s guest, David Fishman, is a senior manager at the Lantou Group, where he advises on the energy sector across Asia Pacific, India, and China. Unlike podcast guests Martin or Cebon, who often echo Barnard’s anti-hydrogen framing, Fishman came across as more independent, knowledgeable, and grounded.

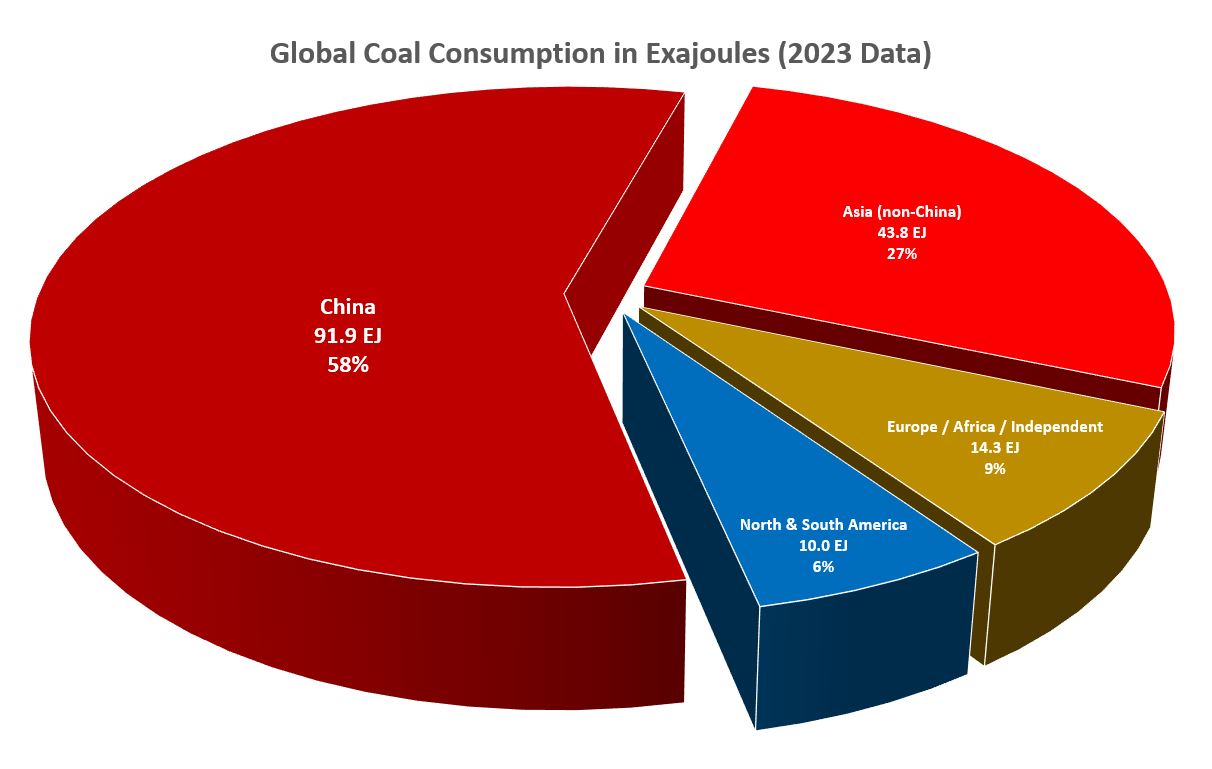

Fishman described in plain terms the enormity of coal in China’s energy mix. As he put it, “The Chinese coal fleet is utterly mind-boggling when we talk about the scale, right? We’re talking about 1,200 heading for 1,300 gigawatts of installed capacity and still permitting and licensing more.”[57-1] Fishman goes on and says China is “still allowing more coal to enter the system. And still between 55 & 60% of the final generation mix is coal-fired generation.” and Fishman continues about what percentage of Chinese thermal energy comes from coal “Sometimes you would see it was thermal generation, and if that’s reported, you can assume 90, 98, to 99% coal” [Podcast 045 – DF – 5:29]. Fishman emphasized that coal is domestic, cheap, and fully controlled by state-owned enterprises supplying state-owned generators.[57-3] These are not marginal figures; they reflect structural reliance on coal for the foreseeable future.

Rather than sit with the gravity of this observation, Barnard (similar to Liebreich) repeatedly attempted to soften or redirect. Barnard asks Fishman for validation on something he’s been repeating for some time: “but China is only shutting down old plants and replacing them with highly efficient super critical ones, it’s one to one right?” Fishman responded “No, when you’re saying they’re shutting down one old inefficient plant plant for one new super-efficient, ultra-super-critical? I don’t think so. As you can see, net-net coal capacity is still rising. Net-net coal capacity is still growing in China.”,[57-4] contradicting Barnard’s frequent narrative that China is on a path of declining coal use, Barnard shifted to asking whether new plants might simply replace older ones. Barnard’s framing of this coal expansion as an “upgrade” was directly undercut by Fishman’s clarification. Barnard’s Cleantechnica narrative was again running into pesky facts. In fact, Barnard has written several articles since his podcast with Mudd and he still publishes articles contrary to what Mudd specifically told him as inaccurate.

The way Barnard treats coal in China versus natural gas in the United States is particularly telling. For Chinese coal, he routinely cites figures at the very lowest end of the emissions spectrum, such as 0.8 tons of CO₂ per MWh, rather than acknowledging the broader range of 0.8 on the low end to 1.4 tons per MWh on the high end.[59][60][61] He also attempts to greenwash China’s coal fleet by emphasizing terms clean coal terms like “supercritical” facilities and by repeatedly claiming that China “washes” its coal.[62] When it comes to U.S. natural gas, however, Barnard takes the opposite approach. The widely accepted figure is just under 0.4 tons of CO₂ per MWh—without the mercury, and with far lower SOx, NOx, and particulate emissions than coal.[63] Yet Barnard conflates methane leakage across the entire oil and gas system with natural gas generation alone, and through this maneuver inflates emissions to his own estimated figure of 0.7 tons CO2e per MWh. With that quick sleight of tongue, he then suggests as a reasonable fact that gas and coal are “about the same.”[57-5] To claim is natural gas and coal are “about the same” in terms of environmental sustainability is rotten.

In reality, natural gas produces roughly half the CO₂ emissions of coal per unit of electricity and avoids the most dangerous externalities of coal, including particulates, sulfur dioxide, and coal ash.[64] Barnard’s own acknowledgment that a single U.S. coal plant “kills 80 people per year”[57-6] is difficult to reconcile with his kid gloves treatment of China’s coal system. Fishman warned of coal emissions “plateauing” after 2030 without a major nuclear build-out[57-7], but Barnard again misses the gravity of plateauing at 92,000 peta joules of coal burning per year, preferring his narrative that China is comfortably ahead of its targets. Coal remains the foundation of China’s power sector, hydrogen and nuclear are advancing, and U.S. natural gas remains cleaner than coal – although Barnard would dispute these facts, they’re indisputable to rational thinkers. Barnard downplays coal in China, dismisses hydrogen, and minimizes nuclear while exaggerating the flaws of the U.S. system. This is not clarifying analysis but selective framing that obscures the realities of global decarbonization.

The Coal Paradox and the BEV Narrative

Much of the discussion around battery electric vehicles (BEVs) centers on lifecycle CO₂ emissions as a sole metric versus gasoline burning engines. A University of Michigan study, published recently in Environmental Science & Technology on August 25, 2025, is an example how lifecycle CO₂ comparisons between electric vehicles and conventional powertrains[65] becomes too narrowly focused to declare BEVs cleaner “even when you consider coal burning”. The study states “cradle-to-grave greenhouse gas (GHG) emissions of current (2025) light-duty vehicles” implying a full lifecycle basis for comparing electric vehicles to conventional models without considering other externalities from mining and non-electrical coal-based energy. As soon as the University of Michigan study was published, it became a source that spawned sensational headlines at news outlets across the country and around the world that greenwash these externalities by ignoring them. My own Detroit News on September 7, 2025 is just one example, which reported that EVs can produce lower CO₂ per mile even on coal-heavy grids.[66] While technically accurate under certain metrics, this CO₂-focused framing can obscure the broader industrial realities behind battery production.

The scale of coal consumption in China provides essential context for discussions about clean energy. By global standards, China’s coal burn is enormous, supporting not only power generation but also energy-intensive industries such as mining, refining, smelting, coal-to-chemicals, and battery assembly. Every stage of the battery electric vehicle (BEV) supply chain—turning raw ore into usable cathode or anode materials, operating large-scale refineries, and driving electric arc furnaces—depends heavily on coal-fired electricity and coal for heat. Yet in popular reporting, this coal backbone is rarely talked about, even as it underpins the narrative that BEVs represent a clean energy future “even when burning coal”.

To make the comparison in a more relatable context, let’s imagine building clean energy infrastructure in the USA with US coal, using the same super-ultra-critical coal plants China uses. Let’s consider the coal-fired DTE Monroe Power Plant in Michigan an example plant for our math. With a nameplate capacity of about 3,280 megawatts, DTE Monroe is not just the largest coal plant in Michigan but also one of the largest coal plants in the United States. By American standards, it is enormous. In fact, the idea of permitting even one new Monroe-size plant today would trigger widespread protests and regulatory challenges lasting years. The notion of approving dozens, let alone hundreds, would be inconceivable in the current political and environmental climate.

Now let’s extend the thought experiment further. If the United States were to target building only enough new coal plants to match even 30 percent of China’s annual coal consumption, it would require about 5.5 new Monroe-size plants to be built in every single state! Across all 50 states, that would amount to roughly 275 new coal plants—each one as large as the biggest in Michigan—dedicated to powering metal smelters, refineries, electric arc furnaces, and other industrial processes tied to battery manufacturing. That is, this coal would be used to make clean energy, just like the UofM study suggested and BEV supporters support now. We could use Barnard type descriptions and call these “supercritical” coal plants and we could state that the coal would be washed, just like in China. And even if we added ~275 massive coal plants in America, we would not even come close to China’s coal burning. We would burn much less than half the coal burned in China, we would stop at just less than one third. Let me say that again, we would need to add 5.5 Monroe-sized plants in all 50 states just to get to 30% of China’s coal’s consumption![67] And it would all be for green energy that reduces CO2 emissions according to the University of Michigan study published in August 2025. If it sounds ludicrous to build hundreds of new coal plants for clean energy in America, it shouldn’t, that’s how affordable batteries are made now. I have always said, if you want to know how good batteries are for the environment, make them in North America and find out.

Imagine pitching this plan to the American public: 275 large coal plants, justified on the grounds that the energy would be used for “green” industries only like turbines for windmills, polysilicon for solar panels, and metal refining for lithium-based batteries. The political impossibility of such a proposal underscores how detached much of the clean energy discourse has become from the realities of global industrial supply chains. If it were framed in U.S. terms, no one would seriously believe that building hundreds of new coal plants could ever be considered a sustainable environmental strategy.

And yet, when the same model of coal burning is implemented in China at three times the size it is largely accepted as the hidden cost of decarbonization only because it’s half a world away. We’re told that “in the end” there is breakeven even on CO2 emissions versus gasoline. This is according to recent studies just like the one done in Ann Arbor just a few miles from RMP headquarters. If that’s true, let’s move the coal burning from half a world away to our backyards to make this clean energy domestically.

Chinese coal is effectively outsourced coal—burned far away from Western media attention, beyond the reach of daily scrutiny from groups like Michigan’s department of environmental quality, the University of Michigan, or the Sierra Club, and reframed as part of a green solution once the batteries arrive on American shores. The illusion of “clean energy” batteries is created not by cleaner production, but by distance and opacity. Carbon dioxide is not the only metric we need to be concerned about. Make them at home and let’s find out. RMP will support coal burning in America if that’s what environmental groups support abroad. How can a battery only supporter not support coal if it’s for batteries or solar panels if that’s how they’re made now in China?

This thought experiment underscores a central paradox. Building hundreds of coal plants in the U.S. to support battery production would be politically impossible—pollution in the name of reducing pollution. Yet when the same coal is burned overseas, with limited oversight and little media attention, it becomes an invisible foundation of the global BEV supply chain. Lifecycle analyses that emphasize only CO₂ per mile can obscure this reality, ignoring the coal-heavy electricity grids that power lithium mining, nickel refining, and cobalt smelting.

In Indonesia, for example, coal use has surged in recent years as new power plants have been built almost exclusively to support Chinese-owned nickel smelting operations for battery materials.[68] This highlights that the coal burn tied to battery production is not confined to China’s borders, but is embedded in supply chains across multiple countries. Coal burning in Indonesia is definitely not “supercritical” or “washed coal” either, it’s old school thick black smoke coal without the same regulations for clean air that China has for new coal burning plants. BEVs may appear cleaner on a CO2 per-kilometer basis, but replicating China’s model domestically would expose the selective framing that allows coal dependence abroad to be tolerated while remaining unacceptable at home.

This framing also reveals the limits of CO₂-only metrics. Focusing narrowly on tailpipe or per-mile emissions misses the broader environmental costs—water use, particulate pollution, land disruption, and the resource pressures tied to large-scale mineral extraction. Studies like the University of Michigan analysis, widely cited in outlets such as my hometown Detroit News, often present coal-powered BEV supply chains as environmentally unproblematic because they meet a long-term lifecycle CO₂ test. Recognizing these omissions is not a rejection of BEVs but a call for fairness and clarity in how global decarbonization strategies are evaluated.

With 92,000 petajoules of annual coal consumption, it’s no wonder China is pushing hydrogen so aggressively—not just for deep decarbonization decades down the line because of their massive coal use, but as a practical step toward balancing renewables and sustaining its industrial growth. What is surprising is how rarely Barnard acknowledges this, preferring instead to minimize hydrogen’s role rather than confront how central it has become to China’s strategy.

Barnard Ignores Hydrogen’s Strategic Role in China

Hydrogen is emerging as a central pillar of China’s long-term energy and transportation strategy, yet Michael Barnard at Cleantechnica consistently minimizes its significance. His reporting often frames hydrogen as marginal, impractical, or inherently inferior to battery-electric solutions. This framing neglects both the scale of China’s hydrogen infrastructure and the government policies actively supporting its development, presenting a skewed view to readers that understates hydrogen’s strategic importance.

China leads the world in hydrogen production and utilization across multiple sectors. Fuel cell production, hydrogen-powered buses, trucks, and even passenger vehicles are expanding rapidly. Barnard frames development to look insignificant with statements like “Hydrogen fuel-cell heavy trucks … saw only modest sales of around 4,421 units, capturing a mere fraction of the market at around 0.5%.”[69] On the surface, that 0.5% figure purposely makes hydrogen look negligible. Yet focusing on percentages obscures the absolute scale: globally, there were approximately 6,460 hydrogen fuel-cell buses in operation by the end of 2022, with over 5,000 of them in China and the remainder in the rest of the world.[70] . As published in Part 2 of this series, it is already estimated there are over 11,000 FCEBs in operation globally just three years later in 2025. In other words, China already has roughly three to four times more hydrogen buses than the rest of the world combined by the end of 2022 and growing faster than any country and maintains this ratio in 2025. Toyota warns that China’s dominance in hydrogen mobility is accelerating, with large-scale production, low costs, and growing infrastructure — and urges rapid action to close the gap.[71] The contrast again illustrates a key pattern: Barnard emphasizes relative percentages without acknowledging absolute scale or leadership, which misleads readers about China’s dominant position in hydrogen technology and infrastructure.

Barnard’s analyses frequently pit hydrogen against battery-electric technology as if the two are mutually exclusive, when in reality they’re complementary. Battery systems are well-suited for light-duty vehicles and short-range urban transport, whereas hydrogen’s high energy density and rapid refueling make it ideal for heavy-duty trucks, buses, and industrial applications. China’s energy planners explicitly embrace both technologies, designing an integrated approach to decarbonization. Hydrogen’s role is strategic, not ancillary, particularly for long-haul transport and grid balancing.

Policy support reflects this strategy. China’s National Energy Administration (NEA) has backed hydrogen across multiple provinces, integrating it into provincial policies and pilot programs. Hydrogen features prominently in the 14th Five-Year Plan and is expected to receive expanded focus in the 15th Five-Year Plan, due in March 2026. These plans include targets for hydrogen production capacity, infrastructure deployment, and adoption in public transportation, logistics, and industrial sectors. In effect, China is signaling hydrogen as a national priority, positioning the country to maintain global leadership as the technology matures.

Barnard’s body of work never reconciles with these realities. While China’s NEA describes its global dominance of the hydrogen market as in its embryonic stage as compared to battery-electric systems, its rapid growth trajectory is undeniable. Production of fuel cells, adoption of hydrogen buses and trucks, and supportive policy frameworks collectively establish China as the global leader in this sector. Barnard often downplays these achievements, framing hydrogen as experimental or unproven, thereby reinforcing a narrative aligned with his pre-existing skepticism.

The broader implication is a consistent misrepresentation of energy strategy. By selectively emphasizing small percentages, comparing immature hydrogen technologies to mature battery systems, and framing the two as competing rather than complementary, Barnard obscures China’s strategic intent. In doing so, his reporting fails to inform readers about the true scale of hydrogen adoption, the structural policy support driving it, and its role as a cornerstone of China’s energy transition.

In sum, hydrogen in China is not peripheral; it is strategically prioritized across multiple industries and regions. Barnard’s narrative, focused on minimizing hydrogen and elevating battery-electric technology alone, cannot reconcile these facts. A clear-eyed assessment shows China leading the world in hydrogen deployment, supported by national and provincial policy, and integrating hydrogen alongside batteries to achieve broader decarbonization objectives — a reality that Barnard’s reporting systematically downplays.

Trade Practices and Energy Security

We have already examined Barnard’s tendency to downplay the seriousness of China’s role in critical minerals and industrial supply chains. That conversation matters because China’s dominance is not only an issue of scale, but also of control. Whether in lithium, nickel, or rare earths, the world’s clean energy future is tied closely to China’s ability to process, refine, and export key materials. This is where the concept of “foreign entity of concern” (FEOC) becomes central: it is not about vilifying a country, but about acknowledging risks when too much strategic leverage is concentrated in one place.

Canada offers a useful case study. Its national security agencies have consistently ranked Chinese espionage and influence operations as the most active state-sponsored threats. The Canadian Security Intelligence Service (CSIS), for example, warns that Chinese cyber actors target high-tech industries including AI and aerospace.[72] Election interference was documented in both 2019 and 2021, with disinformation campaigns aimed at Canadian politicians.[73]

On the trade and regulatory front, Canada has imposed a 100% tariff on Chinese EVs, and Prime Minister Mark Carney is now reviewing whether to relax that measure as part of a broader reset of EV policy.[74] At the same time, his government has announced that Canada will waive the 2026 requirement that 20% of all new vehicles sold be zero-emission, citing financial strain on automakers.[75] These moves illustrate the kind of policy tension Barnard often glosses over: he would likely welcome the prospect of lower tariffs that would help Chinese OEMs even though such a step could threaten jobs for the thousands of Canadians employed at GM, Ford, Stellantis, and across their Tier 1–3 suppliers. Simultaneously, Barnard would likely criticize the rollback of Canada’s EV mandate because it would help Western automotive OEMs and Canadian workers and not benefit China.

The United States faces challenges similar to those in Canada. High-profile cases range from the OPM breach, which exposed the records of more than 22 million federal employees[76], to Volt Typhoon and Salt Typhoon, cyber campaigns that penetrated critical telecom infrastructure. Efforts to recruit U.S. Navy personnel to provide military intelligence [77] highlight that espionage is not theoretical, but persistent. Economic espionage also remains a front-line concern: the FBI regularly warns about Chinese attempts to steal U.S. R&D across sectors from semiconductors to biotech.[78] These activities feed directly into China’s industrial advantage, reinforcing the FEOC rationale.

At the same time, technology markets underscore why this concentration of power is risky. China’s solar sector recently experienced a $60 billion overbuild crisis, leaving global supply chains vulnerable to both sudden collapses and predatory pricing strategies.[79] Similarly, restructuring in China’s oil refining sector shows how quickly state-directed industrial decisions can reshape global markets.[80] For partners dependent on these supply chains, the risks are amplified: shocks in China ripple outward with little transparency or accountability.

This is not about denying China’s achievements or vilifying China. On the contrary, the scale and speed of industrial buildout in areas like batteries, solar, and hydrogen in China are extraordinary. RMP applauds and follows China’s moves on hydrogen development closely, their progress in scaling hydrogen is an order of magnitude ahead of the rest of the world combined. But it does mean that relying on a single country for the bulk of supply chain capacity creates systemic vulnerabilities. Whether through cyber intrusions, trade distortions, or strategic overcapacity, the risks extend far beyond technical efficiency or cost.

Barnard doesn’t control these global dynamics, but his reporting shows how narratives shape perception—even when using Latour’s actor-network theory, he ends up highlighting his own biases. By minimizing China’s coal dependence, dismissing hydrogen’s importance, and deflecting from critical mineral realities, he contributes to a narrative that obscures the risks of overreliance on a single supplier. His work fits neatly into a broader pattern where uncomfortable realities—espionage, industrial concentration, or foreign interference—are downplayed or ignored, while China’s progress is highlighted and Western shortcomings are magnified.

Recognizing China as a foreign entity of concern is not about closing doors but about opening eyes. Canada and the U.S. are already taking steps to secure supply chains, protect democratic institutions, and foster fair competition. Doing so requires clear, evidence-based discussions, not selective storytelling. And if the debate is going to be honest, it must acknowledge the structural risks of overdependence, not dismiss them when they conflict with Barnard’s preferred narrative.

Final Conclusion – Batteries Are Important, But Not Mutually Exclusive of Hydrogen

Something is rotten in the state of Denmark. In his play Hamlet, it was Shakespeare’s way of saying that corruption and deception can fester beneath the surface even when the crown jewels look polished. In this story, Barnard plays the role of King Claudius — wrapping himself in authority, titles, and confident narratives while quietly poisoning the well of public understanding. His narrative isn’t an innocent mistake. It’s a selective framing exercise that narrows the reader’s vision into false binaries and misleading percentages.

RMP has demonstrated how Barnard diminishes the narrative importance of hydrogen by emphasizing small market share percentages while consistently ignoring absolute numbers, scale, and context. This strategy allows him to wave away rapid global deployment by focusing only on narrow metrics he extrapolates into unrealistic forecasts. He conveniently downplays the growth achieved and planned by players outside the Western focus. Context matters, and Barnard consistently strips it away to present a distorted picture of hydrogen’s true progress; especially in countries like China that dominate but never wind up Barnard’s cross-hairs.

Look at hydrogen production itself. According to the International Energy Agency, China accounts for about 65% of global installed electrolyser capacity and 60% of global electrolyser manufacturing capacity.[81] The National Energy Administration confirmed that by the end of 2024, China had already established 125,000 tons per year of green hydrogen electrolysis capacity.[82] Those aren’t pilot projects. That’s industrial scale.

Hydrogen policy is everywhere inside China. By the end of 2024, over 560 hydrogen-specific policies had been published at the national and provincial levels.[83] Hydrogen refueling stations? China already operates over 550 stations covering 31 provinces and municipalities.[84] This isn’t hype. It’s infrastructure. It’s long-term planning.

Meanwhile, batteries are not being neglected. China absolutely dominates global battery production, controlling over 80% of global lithium-ion battery manufacturing capacity[85], refining the lion’s share of lithium, cobalt, nickel, and rare earths. It dominates solar panel production, wind turbines, and permanent magnets. In other words, China already controls everything Barnard insists is “all the world needs to ditch fossil fuels.” Yet China still identifies hydrogen as a strategic pillar of its decarbonization plan and burns 11x more coal than the USA. That single fact undermines Barnard’s entire thesis.

Why would a country that already controls the supply chain for batteries, magnets, turbines, and solar panels — all the tools Barnard says are sufficient for the West to become sustainable — still build out the world’s largest hydrogen strategy? Why would the Chinese Communist Party include hydrogen in its five-year plans? Why would the National Energy Administration issue hydrogen policies month after month, and why would almost every province follow suit? The answer is simple: because hydrogen is not optional. It is an essential part of a sustainable energy economy working along side multiple other technologies.

This is where Barnard’s narrative breaks down. His percentages and soundbites obscure the reality that both batteries and hydrogen will be needed. By pretending hydrogen is irrelevant, he is doing exactly what China is not doing. He creates false dichotomies — batteries versus hydrogen — when the evidence shows they are complementary technologies serving different sectors.

So why does Barnard do this? With the evidence laid bare, we are left with only two possibilities. Either he is deliberately dishonest, shaping narratives to book speaking engagements and sell ads to his followers on Cleantechnica. Or he is so blind to the scale of China’s hydrogen dominance that he can’t see what’s right in front of him. And, I don’t think he’s dumb.

The problem, then, is integrity. Barnard spins numbers to tell a story that misleads Western audiences, downplaying the industrial reality in China to conceal important context when it suits his narrative, and then amplifying that same reality when it allows him to boast on China’s behalf. It’s a story that keeps readers in narrow thinking lanes, dismissing hydrogen as a sideshow. But the data prove otherwise: China has bet on both batteries and hydrogen and is already winning on both fronts.

Something is rotten here, and it’s not in Denmark this time. It’s in the way Barnard cloaks himself as an expert while peddling a narrative at odds with facts. Readers deserve better than a King Claudius act from Shakespeare’s Hamlet. They deserve the truth: batteries are important, but they are not mutually exclusive of hydrogen. To claim otherwise is to mislead — and that’s exactly what Barnard does week in and week out writing for Cleantechnica for over 11 and half years and counting.

“The serpent that did sting thy father’s life

Now wears his crown.” – Hamlet Act 1 Scene V

Footnotes:

Footnote [28] – Michael Barnard. “Canada Used To Provide A Lot Of World’s Lithium, But Can It Revive That?” CleanTechnica, 24 February 2021, https://cleantechnica.com/2021/02/24/canada-used-to-provide-a-lot-of-worlds-lithium-but-can-it-revive-that/. Accessed 7 October 2025.

Footnote [29] – Michael Barnard. “Finnish GTK Risks Credibility By Publishing Bad Minerals Study In Peer-Reviewed House Journal” CleanTechnica, 3 December 2024, https://cleantechnica.com/2024/12/03/finnish-gtk-risks-credibility-by-publishing-bad-minerals-study-in-peer-reviewed-house-journal/. Accessed 7 October 2025.

Footnote [30] – Michael Barnard (Host), Paul Martin(Guest). “2. Hydrogen won’t be green if it ignores when, where and how (with Paul Martin)” Redefining Energy – TECH, no. 2, 26 April 2023, https://podcasts.apple.com/us/podcast/2-hydrogen-wont-be-green-if-it-ignores-when-where-and/id1675126007?i=1000610741523. Accessed 7 October 2025.

Footnote [30-1] – 00:35 – Michael Barnard says “So, Paul and I have spoken many many times on podcasts, not on podcasts, over beers in Toronto, one amazing day last fall.”

Footnote [31] – Michael Barnard (Host), Gavin Mudd(Guest). “43. Critical Minerals: the new Gold Rush (1/2)” Redefining Energy – TECH, no. 43, 8 January 2025, https://podcasts.apple.com/us/podcast/43-critical-minerals-the-new-gold-rush-1-2/id1675126007?i=1000683180615. Accessed 7 October 2025.

Footnote [31-1] – 11:43 – Michael Barnard says “Probably the two primary battery metals that get discussed..cobalt and lithiuum, is from my perspective…Is that accurate, or is there any other critical mineral you’re concerned about at the Critical Minerals Intelligance Center?”

Footnote [31-2] – 37:11 – Gavin Mudd says “Historically the mining industry is considered a dirty industry and the industry would not disagree with that.”

Footnote [32] – Michael Barnard (Host), Gavin Mudd(Guest). “44. Critical Minerals: the new Gold Rush (2/2)” Redefining Energy – TECH, no. 44, 22 January 2025, https://podcasts.apple.com/us/podcast/44-critical-minerals-the-new-gold-rush-2-2/id1675126007?i=1000685015807. Accessed 7 October 2025.

Footnote [32-1] – 13:34 – Gavin Mudd says “I think one of the problems we’re seeing with the rise of LFP batteries is that they’re all cheap materials largely. So things like cobalt, it’s an expensive metal, nickel is an expensive metal. That means the price of that battery or the value of that battery was certainly much higher”

Footnote [32-2] – 03:43 – Michael Barnard says “ARENA the Australian Renewable Energy and National Something Organic Association, they’re a big investment fund for mostly clean tech. They’ve got some bad stuff and some stupid stuff they say about hydrogen”

Footnote [33] – S&P Global Commodity Insights. “World Copper Deficit Could Hit Record; Demand Seen Doubling by 2035” S&P Global Commodity Insights, 14 July 2022, https://www.spglobal.com/commodity-insights/en/news-research/latest-news/energy-transition/071422-world-copper-deficit-could-hit-record-demand-seen-doubling-by-2035-s-p-global. Accessed 27 September 2025.

Footnote [34] – WTW. “Copper: The Core of the Green Revolution” WTW Insights, 1 May 2023, https://www.wtwco.com/en-us/insights/2023/05/copper-the-core-of-the-green-revolution. Accessed 27 September 2025.

Footnote [35] – Michael Barnard. “Fortescue & Nikola Insane Green Hydrogen For Trucking Play In Waterless Arizona Desert” CleanTechnica, 31 January 2024, https://cleantechnica.com/2024/01/31/fortescue-nikola-insane-green-hydrogen-for-trucking-play-in-waterless-arizona-desert/. Accessed 27 September 2025.

Footnote [36] – David von Seggern. “Lithium Mining on the Radar” Sierra Club Toiyabe Chapter, 17 June 2021, https://www.sierraclub.org/toiyabe/blog/2021/06/lithium-mining-radar. Accessed 27 September 2025.

Footnote [37] – Shannon Waters. “A decade after disastrous breach, Mount Polley mine tailings dam could get even bigger” The Narwhal, 31 July 2024, https://thenarwhal.ca/mount-polley-mining-disaster-tenth-anniversary/. Accessed 27 September 2025.

Footnote [38] – BIV. “How toxic impact of Mount Polley disaster filters through BC waters 10 years later” BIV, 1 May 2024, https://www.biv.com/news/resources-agriculture/how-toxic-impact-of-mount-polley-disaster-filters-through-bc-waters-10-years-later-9960174. Accessed 27 September 2025.

Footnote [42] – CNBC. “China-controlled rare earths account for 3 pounds of an electric car” CNBC, 28 May 2025, https://www.cnbc.com/2025/05/28/china-controlled-rare-earths-account-for-3-pounds-of-an-electric-car-ev.html. Accessed 7 October 2025.

Footnote [43] – Wikipedia. “Neodymium magnet” Wikipedia, https://en.wikipedia.org/wiki/Neodymium_magnet. Accessed 7 October 2025.

Footnote [44] – Kalea Hall. “Auto companies ‘in full panic’ over rare-earths bottleneck” Reuters, 9 June 2025, https://www.reuters.com/business/autos-transportation/auto-companies-in-full-panic-over-rare-earths-bottleneck-2025-06-09/. Accessed 7 October 2025.

Footnote [45] – Area Development. “‘The Battle to Break China’s Rare Earth Supply Chain Dominance’” Area Development, Q4 2024, https://www.areadevelopment.com/logisticsInfrastructure/q4-2024/the-battle-to-break-chinas-rare-earth-supply-chain-dominance.shtml. Accessed 7 October 2025.

Footnote [46] – . “Global Yttrium Carbonate Production: Analysis, Import & Export Price Update 2025” Business Newswire Online, 2 May 2025, https://businessnewswire.online/news-release-global-yttrium-carbonate-production-analysis-import-export-price-update-2025/. Accessed 7 October 2025.

Footnote [47] – Adam Isaak. “Neodymium: China Controls Rare Earth Used in Phones & Electric Cars” CNBC, 18 October 2018, https://www.cnbc.com/2018/10/18/neodymium-china-controls-rare-earth-used-in-phones-electric-cars.html. Accessed 7 October 2025.

Footnote [48] – Karan Bhuwalka, Hari Ramachandran, Swati Narasimhan, Adrian Yao, Julia Frohmann, Leopold Peiseler, William Chueh, Adam Boies, Steven J. Davis, Sally Benson. “Securing the supply of graphite for batteries” arXiv, 1 March 2025, https://arxiv.org/abs/2503.21521. Accessed 7 October 2025.

Footnote [49] – Bernreuter Research. “Polysilicon Market Outlook 2029” Bernreuter Research, 24 June 2025, https://www.bernreuter.com/polysilicon/industry-reports/polysilicon-market-outlook-2029/. Accessed 7 October 2025.

Footnote [50] – respectmyplanet.org. “ICL-IP America Inc. location – St. Louis Missouri – This location is the one of the very few LFP cathode active material production locations in North America. RMP is watching this location on our map closely. This link is to RMP’s GIS Map of all locations centerd on this specific location.” RMP, 31 March 2025, https://www.respectmyplanet.org/public_html/lithium_ion_battery_supply_chain?id=2055. Accessed 7 October 2025.

Footnote [51] – respectmyplanet.org. “ICL-IP America Inc. location – St. Louis Missouri – LOCATION HOMEPAGE – This location is the one of the very few LFP cathode active material production locations in North America. RMP is watching this location on our map closely. This link is to this location’s homepage at RMP.” RMP, 31 March 2025, https://www.respectmyplanet.org/Lithium_ion_battery_supply_chain/location?id=2055. Accessed 7 October 2025.

Footnote [52] – Michael Barnard. “Critical Minerals Are a Gold Rush, the West Lost Sight Of” CleanTechnica, 9 January 2025, https://cleantechnica.com/2025/01/09/critical-minerals-are-a-gold-rush-the-west-lost-sight-of/. Accessed 7 October 2025.

Footnote [53] – Michael Barnard. “Critical Minerals: Global Expert Optimistic About Supply” CleanTechnica, 22 January 2025, https://cleantechnica.com/2025/01/22/critical-minerals-global-expert-optimistic-about-supply/. Accessed 27 September 2025.

Footnote [54] – Michael Barnard. “Trump’s Tariffs Are Wrecking America’s Supply Chain for Critical Minerals” CleanTechnica, 10 March 2025, https://cleantechnica.com/2025/03/10/trumps-tariffs-are-wrecking-americas-supply-chain-for-critical-minerals/. Accessed 27 September 2025.

Footnote [56] – Benchmark Minerals. “Fireside Chat: America First in the Battery Race: Leadership, Security, and Strategy” Benchmark Minerals, 10 June 2025, https://source.benchmarkminerals.com/video/watch/america-first-in-the-battery-race-leadership-security-and-strategy.

Footnote [56-1] – 00:23 – U.S. Senator Tom Cotton (Arkansas) says “The resilience of critical mineral supply chains is both an economic issue and national security concern of great consequence epecially given China’s dominance in global production.” Tom goes on to say he often makes the point that China doesn’t enjoy this advantage because they sit on geologic deposits that make this dominance easier and in fact in some ways they’re disadvantaged but still pull this off.”

Footnote [56-2] – 01:08 – U.S. Senator Tom Cotton (Arkansas) says “As the chairman of the senate intelligence committee I’m often asked “Is the threat from China as real as it seems, and his answer is ‘No, it’s actually much worse”

Footnote [56-3] – 10:45 – U.S. Senator Tom Cotton (Arkansas) says “If we lost access to Christmas decorations or toys from China, it wouldn’t threaten our health, safety, and well-being. But it’s very different with critical minerals and energy security if there were say a trade dispute. It does hurt our health, safety, and well-being”

Footnote [56-4] – 09:12 – U.S. Senator Tom Cotton (Arkansas) says “China still has the United States and the rest of the world over a barrel on this issue, but I think many more people and a lot of normal Americans certainly appreciate that this is not a tenable situation for us to be in.”

Footnote [57] – Michael Barnard (Host), David Fishman(Guest). “45. China’s Balancing Act: Coal, Renewables and Nuclear (1/2)” Redefining Energy – TECH, no. 45, 5 February 2025, https://podcasts.apple.com/us/podcast/45-chinas-balancing-act-coal-renewables-and-nuclear-1-2/id1675126007?i=1000689326879. Accessed 27 September 2025.

Footnote [57-1] – 05:00 – David Fishman says “The Chinese coal fleet is utterly mind-boggling when we talk about the scale, right? We’re talking about 1,200 heading for 1,300 gigawatts of installed capacity and still permitting and licensing more”

Footnote [57-2] – 05:29 – David Fishman says China is “still allowing more coal to enter the system. And still between 55 & 60% of the final generation mix is coal-fired generation.” and Fishman continues about what percentage of Chinese thermal energy comes from coal “Sometimes you would see it was thermal generation, and if that’s reported, you can assume 90, 98, to 99% of thermal generation is from coal””

Footnote [57-3] – 05:49 – David Fishman says “So coal has this obvious, amazingly powerful and influential role in the Chinese energy landscape. It’s domestic, right? It’s cheap, it’s affordable. You have almost full control over the supply coal. The major miners are SOE’s (State Owned Enterprises), that are supplying the coal to state-owned generators at fixed prices so that they can supply power at regulated rates or partially regulated rates.”

Footnote [57-4] – 22:48 – Barnard asks “but China is only shutting down old plants and replacing them with highly efficient super critical ones, it’s one to one right?” Fishman responded “No when you’re saying they’re shutting down one old inefficient plant for one new super-efficient, ultra-super-critical? I don’t think so. As you can see, net-net coal capacity is still rising. Net-net coal capacity is still growing in China.”

Footnote [57-5] – 23:59 – Michael Barnard says “If you just assign the emissions from natural processing, distribution, LNG plants to electricity, well the United States electrical, it’s actuall 0.7 tons. So super critical coal is about 0.8 tons. Natural gas in the United States then is about 0.7 tons, if you count it that way, which is not a great way to count it, but for this purpose, it is because it’s natural gas which is coal.”

Footnote [57-6] – 24:20 – Michael Barnard says “And of course, coal comes with a lot more negative externalities on top of natural gas. I did the math a few years ago and worked out that the United States… every coal plant kills about 80 people per year.”

Footnote [57-7] – 51:00 – David Fishman explains that coal’s massive use in China could plateau and (he thinks) their long term strategy is to build multiple nuclear reactors called Hualong One Reactors to displace coal plants one for one: “So I do think they’re going to build a whole bunch of Hualong 1’s for the next 5 to 10 years. And you know what, the ones that were approved in 2021, if things move along the way they have been able to build in the past, then 2026, 2027, 2028, that’s when we start seeing the fruits of the labor, so to speak. And hey, if it helps the 2030 carbon peak stay a reality, right? So we say 2030, we peak carbon and then what? How do we stop it from becoming a plateau after 2030 and actually start drawing down? Well, if you could bring on a few nuclear plants that one-to-one allow you to shut down a coal plant, that’s how you actually draw down after 2030 instead of plateauing after your carbon peak.”

Footnote [59] – International Energy Agency (IEA). “CO2 Emissions in 2022” International Energy Agency, 1 March 2023, https://iea.blob.core.windows.net/assets/3c8fa115-35c4-4474-b237-1b00424c8844/CO2Emissionsin2022.pdf. Accessed 12 October 2025.

Footnote [60] – International Energy Agency (IEA). “Greenhouse Gas Emissions from Energy Highlights” International Energy Agency, 1 August 2024, https://www.iea.org/data-and-statistics/data-product/greenhouse-gas-emissions-from-energy-highlights. Accessed 12 October 2025.

Footnote [61] – International Energy Agency (IEA). “CO2 Emissions from Fuel Combustion 2019 – Highlights” International Energy Agency, 1 November 2019, https://iea.blob.core.windows.net/assets/eb3b2e8d-28e0-47fd-a8ba-160f7ed42bc3/CO2_Emissions_from_Fuel_Combustion_2019_Highlights.pdf. Accessed 12 October 2025.

Footnote [62] – World Nuclear Association. “Clean Coal Technologies” World Nuclear Association, 13 July 1905, https://www.world-nuclear.org/information-library/energy-and-the-environment/clean-coal-technologies.aspx. Accessed 12 October 2025.

Footnote [63] – U.S. Energy Information Administration. “How much carbon dioxide is produced per kilowatthour of U.S. electricity generation?” U.S. Energy Information Administration, 1 December 2023, https://www.eia.gov/tools/faqs/faq.php?id=74&t=11. Accessed 12 October 2025. EIA FAQ page cited gives a grid-average intensity (0.81 lb/kWh) → ~0.367 metric t/MWh

Footnote [64] – IPCC Working Group III. “Climate Change 2022: Mitigation of Climate Change” IPCC Sixth Assessment Report, 14 July 1905, https://www.ipcc.ch/report/ar6/wg3/. Accessed 12 October 2025.

Footnote [65] – Elizabeth Smith, Maxwell Woody, Timothy J. Wallington, Christian Hitt, Hyung Chul Kim, Alan I. Taub, and Gregory A. Keoleian. “Greenhouse Gas Reductions Driven by Vehicle Electrification across Powertrains, Classes, Locations, and Use Patterns” ACS Environmental Science & Technology, 25 August 2025, https://pubs.acs.org/doi/10.1021/acs.est.5c05406. Accessed 12 October 2025.

Footnote [66] – Summer Ballentine. “Are EVs really better for the environment? Study checks role of coal, battery and range” Detroit News, 7 September 2025, https://www.detroitnews.com/story/business/autos/2025/09/07/are-evs-better-for-the-environment-study-looks-at-range-coal-plants/85947184007/?gnt-cfr=1&gca-cat=pp&gca-ds=override. Accessed 12 October 2025.

Footnote 67 — Basis for “~5.5 Monroe-size plants per state” (Primary-Energy Framing)

Assumptions and data sources:

- China coal — primary energy consumption (high estimate): ≈ 92 – 99 EJ / 92,000 – 99,400 PJ per year (IEA World Energy Balances 2024; Energy Institute Statistical Review 2024).

- DTE Monroe Power Plant — nameplate capacity ≈ 3,280 MW; annual generation ≈ 28 TWh / year (= 100.8 PJ / year at 97% capacity factor) (DTE Energy Monroe Plant Overview).

- Energy conversion factor: 1 TWh = 3.6 PJ.

Calculation (primary-energy basis):

- 30 % of China’s coal primary energy = 0.30 × (92,000 – 99,400 PJ) = 27,600 – 29,820 PJ / year.

- Annual energy per Monroe plant = 28 TWh × 3.6 = 100.8 PJ / year.

- Number of Monroe-size plants required = 27,600 – 29,820 PJ ÷ 100.8 PJ ≈ 274 – 296 plants total.

- Spread across 50 states: 274 – 296 ÷ 50 ≈ 5.5 – 6 plants per U.S. state.

Summary: Using a primary-energy estimate for China’s coal use (≈ 92–99 EJ per year), the U.S. would need to build roughly 274 to 296 Monroe-size coal plants — about 5½ to 6 per state — to equal just 30% of China’s coal primary energy consumption to make sustainable energy here instead of farming it out to China. The point of this example is if you support something “even if we use coal” like the U of M study suggests, you should also support making it with US coal the same way as it is currently made with Chinese coal.

Sources: IEA World Energy Balances (2024); Energy Institute Statistical Review (2024); Ember Global Electricity Review (2024); DTE Energy Monroe Plant Overview. Minor variations in capacity factor or dataset year shift the total slightly but do not change the scale.

Footnote [68] – Edwin Shri Bimo. “Indonesia: Captive coal power plants supporting nickel operations pose challenge to govt’s green energy goals” *Business & Human Rights Resource Centre*, 15 December 2024, https://www.business-humanrights.org/en/latest-news/indonesia-china-backed-captive-coal-power-industry-pose-challenge-to-govts-green-energy-goals/?utm_source=chatgpt.com. Accessed 12 October 2025.

Footnote [69] – Michael Barnard. “China’s Electrification Of Trucks, Buses, & Construction Vehicles Accelerates Rapidly” *CleanTechnica*, 22 April 2025, https://cleantechnica.com/2025/04/22/chinas-electrification-of-trucks-buses-construction-vehicles-accelerates-rapidly/. Accessed 12 October 2025.

Footnote [70] – International Council on Clean Transportation. “Zero-emission bus and truck market in China: A 2022 update” *International Council on Clean Transportation*, 1 December 2023, https://theicct.org/wp-content/uploads/2023/12/ID-57-%E2%80%93-ZETs-China_Final.pdf. Accessed 12 October 2025.

Footnote [71] – Hydrogen Today. “China Leads in Hydrogen Mobility — and Toyota Must Catch Up” *Hydrogen Today*, 5 May 2025, https://hydrogentoday.info/en/china-leads-hydrogen-mobility/. Accessed 12 October 2025.

Footnote [72] – Canadian Security Intelligence Service. “CSIS Public Report 2024: Intelligence Operations” Canadian Security Intelligence Service, 14 July 2025, https://www.canada.ca/en/security-intelligence-service/corporate/publications/csis-public-report-2024/intelligence-operations.html. Accessed 12 October 2025.