Michael Liebreich is an outspoken critic of hydrogen for transportation & energy solutions. Michael purports to be an objective resource on energy information but he is a ground floor investor in ChargePoint which presents a conflict of interest to his objectivity. ChargePoint bills itself as the world’s leading EV charging network and says they focus on their “commitment to EV charging—and only EV charging”.[1] Michael says we must choose only one solution for entire market segments like energy & transportation; and he says hydrogen cannot compete economically in those segments. Michael has fabricated a narrative he calls the Hydrogen Ladder to support his investments and sow doubt about hydrogen. Michael specifically and aggressively tries to discourage sovereign investments directed toward hydrogen through Twitter, YouTube, and other platforms. Michael uses his bully pulpit to try to kill off hydrogen ambitions he perceives as threats to his personal investments with information that misleads the public.

RMP has largely ignored Michael Liebreich over the past few years as one more blustery voice among many that would use their platform to smear hydrogen’s economic potential. I decided to post this article on RMP to debunk Michael’s Hydrogen Ladder after he was invited to give the keynote speech at the October 2022 World Hydrogen Congress in Rotterdam. It is important to speak up and speak out against information that misleads the public and does not serve the best interest of our economy and our environment. Just like RMP has debunked false narratives spun to smear hydrogen from Dr. Ulf Bossel & Mark Jacobson, RMP will now debunk Michael Liebreich’s Hydrogen Ladder.

Introduction

RMP follows the energy sector of our economy closely and has a history as an environmental watchdog organization. The org was formed when HVHF oil companies came to Michigan in 2008 to produce small amounts of natural gas & oil using record amounts of our fresh water resources. RMP seeks to expose human avarice that threatens our fresh water public natural resources for private profits when headlines don’t jive with the underlying data. RMP’s core mission is to protect our fresh water natural resources. RMP has been successful exposing threats to our environment because of our focus on how energy operations work in the real world and how those operations generate profits & losses using our natural resources. RMP uses a simple formula at the heart of our research: follow the money.

RMP has gathered a wealth of energy infrastructure data in a relational database over the past 14 years that allows insight into how legislators and decision makers use our natural resources. RMP uses this relational database of energy infrastructure to debunk or corroborate claims made in the news or on social media by people like Michael Liebreich. Because RMP has one of the most (if not the most) comprehensive public & free to use databases of hydrogen infrastructure in North America, RMP is particularly well suited to debunk false claims about hydrogen fuel cells & hydrogen infrastructure. In this post, RMP will apply our research model & data resources to examine and debunk false and misleading claims made by Michael Liebriech to slander hydrogen.

Thesis Statement

RMP will demonstrate in this post that Michael Liebreich has a financial conflict of interest that belies the objective analysis he purports to publish regarding hydrogen. RMP will spotlight Michael Liebreich’s early round investment in ChargePoint led by Linse Capital in May of 2016.[2] RMP will demonstrate Michael’s claim to fame as an anti-hydrogen entertainer is directly related to the existential problem he believes hydrogen plays in threatening his personal investments. RMP will demonstrate Michael uses unsupported claims (or tissues as he calls them) to slander hydrogen and by contrast demonstrates no critical analysis when talking about the ESG credentials of the “BEV only” utopia he envisions for massive market segments like energy & transportation.

RMP will show that Michael’s arguments are dishonest, disingenuous, and specifically made to manipulate and influence the future success of BEVs & therefore the success of ChargePoint. RMP will focus on Michael Liebreich’s interview with Pasquale Ramano (CEO of ChargePoint) on his Episode 71 videocast he calls “Cleaning Up” published January 12, 2022 to support this thesis.[18] Before we dive in and for those not familiar with the name, let’s take a quick look at Michael Leibreich’s background and history for context.

A Brief History Of Michael Liebreich For Context:

Michael was born in London and considers himself “West London through & through.”[3-1] His father was a mechanic and his mother was a nurse.[3-7] He attended University of Cambridge and studied engineering, or as he describes it: energy engineering; and graduated in 1984. Michael also graduated from the Harvard Business School in 1990. Michael is an avid skier & wound up in the Olympics in Albertville in 1992 skiing for Great Britain. Michael founded New Energy Finance (which is now Bloomberg NEF) in 2003. His resume lends him credibility. It wasn’t all easy street for Michael to get to where he is today, however; there were bumps along the way. Michael considered himself “washed high & dry”[3-3] in the years before he founded NEF just after the dot com boom & bust cycle and considered those years of his life “deeply traumatic.”[3-4]

Michael considered the TMT & dot com boom bust such a dark time because he managed to turn his paper worth of $30M dollars into about $300k.[3-5] He lost 99% of his equity on high risk bubble investments. Michael considers those years of 2001-2003, just before forming NEF, as the lowest point of his life & career. He says of the time period “I was deeply in trouble in terms of my career but also psychologically, I had lost a lot of self-confidence.”[3-4] Michael had pushed all his wealth into risky investments during the dot com bubble and lost it all.

Regardless of the rocky road to his success, Michael says that we shouldn’t play violins for him as he boasts about his current wealth. He has a nice big house in London now, a ski chalet in the Alps, and he recently purchased a flower meadow. Michael met his wife through NEF, and has three children.[3-6] Michael also has a background in finance from his days in business school & as a junior analyst. Michael considers himself a “numerical and finance type person”.[3-8] These days, when it comes to a work day, Michael says “I can spend all day on Twitter reading amazing things and getting into fights and call it work.”[3-2]

Michael founded NEF in late 2003 when he saw a need to keep track of the financial performance of companies participating in the clean energy arena. Michael was frustrated trying to keep track of clean energy investments so he hired a programmer to build a relational database of information to keep track of the companies in the clean energy space that investors & venture capitalists wanted access to. Michael sold NEF to Bloomberg in 2009.

Michael says that after the TMT and dot-com boom & bust his lesson learned regarding his style of making risky investments was not to diversify or de-risk his portfolio, but to have an exit strategy. Michael says this of the sale of NEF “I knew I would have to create an exit strategy after being totally brutalized by the TMT boom & bust and I had no money. This was very bad. I was in my 40s and I had no money. All my friends who had been incredibly risk-averse and boring coming out of business school were wealthy and successful. So, I always knew I was going to create an exit. I knew I was going to sell.”[3-9] Michael goes on to talk about how he nailed the exit in 2009 and this time around, he got his money out.

Creating A Misleading Narrative to Smear Hydrogen – The Hydrogen Ladder

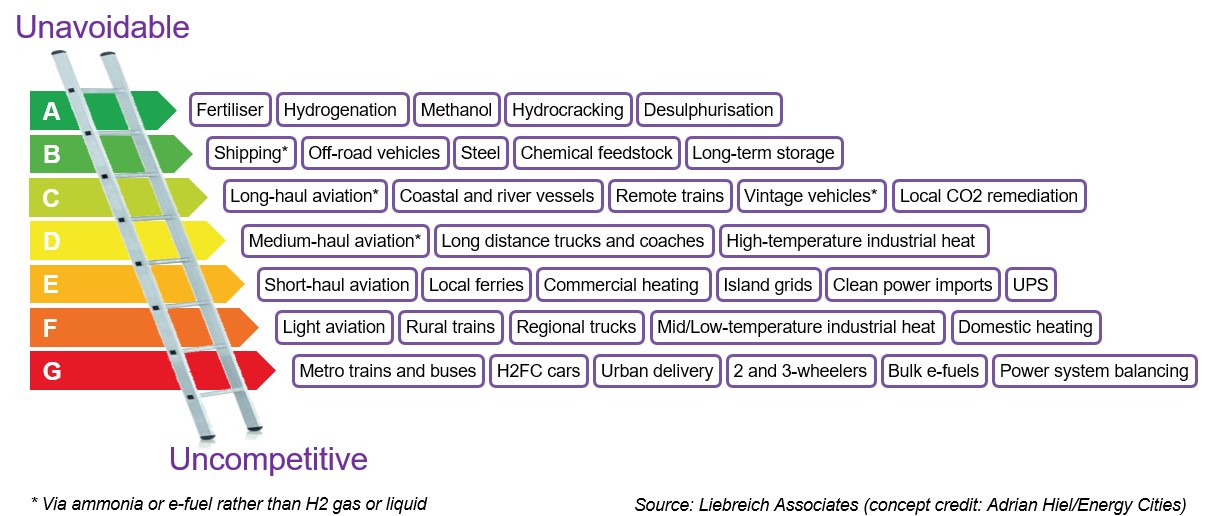

Michael Liebreich’s Hydrogen Ladder is an evolving document, it’s currently on version 4.1 as of this post’s publish date. Michael uses this tag line to describe the ladder: “The Clean Hydrogen Ladder is my attempt to put use cases for clean hydrogen into some sort of merit order.”[4] Michael’s ladder starts from the top left listing market segments in green that will be mandatory for hydrogen & make good use of hydrogen. Then the ladder steps down turning toward deeper shades of yellow to red for market segments where Michael says hydrogen cannot be competitive. This is a common smear technique used for many years by anti-hydrogen folks & publications to slander hydrogen RMP calls the False Dichotomy; it is the same technique that Dr. Bossel used which RMP debunked here almost exactly 5 years ago at the time of this post’s publication date.

The False Dichotomy as RMP calls it, proposes a red herring argument that you can choose either a battery cell or hydrogen fuel cell exclusively for multi trillion-dollar energy & transportation economic sectors. RMP proposes a simple argument against the False Dichotomy: battery cells & fuel cells work best together when it comes to helping our environment & our economy. To think a battery cell alone or a fuel cell alone is our only choice is nonsense. Fuel cells & battery cells are very close to the same thing: a cathode, an anode, and an electrolyte with no moving parts. Fuel cells and battery cells are truly cousins and do their best when they work together as a team. We do not have to choose only one or the other. We will use both fuel cells and battery cells (and many other technologies) to eliminate fossil fuels. Let’s take a look at Michael’s most current & polished version of his Hydrogen Ladder monologue which he articulated in his 20-minute keynote address [5] from last month’s World Hydrogen Congress 2022.

Michael’s starts his freshest anti-hydrogen monologue with three major pillars he says energy must deliver: “Sustainability, affordability, and security.”[5-1] Then Michael tries to imply a dangerous fallacy that because of advances in solar, wind, and batteries, “emissions have largely been capped though they haven’t started to fall”.[5-2] It is common amongst anti-hydrogen propagandists to make this false claim that a simple myopic focus on solar, wind, and batteries is the recipe for a sustainable & carbon free future in order to discourage other technologies. Advances in solar, wind, and batteries have had no provable impact in reducing the global use of fossil fuels over the past 10 years as Michael claims. In fact, emissions from fossil fuel use continue to rise dramatically because of increased mining, shipping, and industrial processing to feed an energy hungry world. The rebound of global CO2 emissions above pre-pandemic levels has largely been driven by China, where they increased by 750 million tons between 2019 and 2021. The emissions increases in those two years in China alone more than offset the aggregate decline in the rest of the world over the same period. In 2021, China’s CO2 emissions rose above 11.9 billion tons, accounting for 33% of the global total.[6]

It is important to point out the opening sentences of Michael’s monologue are false because they try to lay the foundation of his thesis. Michael next goes on to say “Now, with the situation in Ukraine, we see without doubt what we should have known all along. We don’t get security through fossil fuels, we get insecurity.”[5-3] After laying a false foundation, Michael tries to imply that because of Russia’s invasion of Ukraine and a resulting increase in fossil fuel prices coming from Russia, we need to focus on clean energy solutions for our own energy security. The problem with Michael’s statement is that almost all lithium-ion battery processing is done in China. China is consuming more coal because they are primarily making all the battery cell raw materials the world consumes. In Michael’s home country, Director General Ken McCallum of the MI5 Security Service issued the UK’s annual threat update on November 16, 2022 and listed China as one of the top threats to the United Kingdom.

While resources like lithium & cobalt come from countries like Chile, the Congo, and Australia, they are extracted using energy made from fossil fuels. Those same raw materials are then shipped to China using energy made from fossil fuels. In turn, China is increasing its use in coal to produce the world’s battery cell and photo voltaic cell raw materials more than offsetting GHG declines in the rest of the world according to the IEA which bodes poorly for Michael’s sustainability pillar. In terms of the energy security pillar, the USA & the UK’s contributions to the battery raw materials global supply chain are de minimus.

Michael goes on to use much of the same monologue at the World Hydrogen Congress 2022 that he has been using for years now. For some new material, Michael mocks German Chancellor Olaf Sholz and UK Secretary of State for Business, Energy, and Industrial Strategy Jacob Reese Mogg for their support of hydrogen as an energy vector. Michael drops into a sarcastic tone to say “you could hardly get more hyperbolic” when Jacob Reese Mogg calls hydrogen a silver bullet solution.[5-4] Michael goes on in a derisive tone to mock hydrogen as a Swiss army knife. Michael has used these same mocking tones and stale tropes again and again over the years in multiple videos & blog posts. Like a comedian on tour, Michael has been honing his jokes, tone of voice & delivery through performance after performance of the same material over the past couple years. If you watch a sampling of Michael’s videos, you will notice he uses the same lines again and again to slander hydrogen.

About half way through his keynote address, Michael has set the stage to bring out the Hydrogen Ladder. When trying to research the earliest version of the Hydrogen Ladder I came across the same graphic at energy-cities.eu. I reached out to Adrian Hiel at energy-cities.eu to ask if he borrowed the graphic from Michael and Adrian responded the opposite. Adrian emailed back to me “the two ladders are pretty much identical for the simple reason that Michael Liebreich used our creative concept to develop his ladder.” Adrian also pointed out that Michael does give Adrian & energy-cities.eu credit for the graphic but the article published in the Economist that I had found did not show the credit.

While Michael says the purpose of the ladder is his attempt to put hydrogen into some sort of merit order, RMP submits that his main purpose is to say that hydrogen cannot compete in the transportation sector where his ChargePoint investment could be threatened. Michael loads both barrels of slander when talking about fuel cell electric vehicles versus battery electric vehicles shown on his ladder. His first argument is to show a graphic of a BEV and a graphic of an FCEV. He pauses, then asks to the audience to take a good look at the two graphics. Then from that one look at his graphic he argues it’s obvious that BEVs are better and “fuel cell vehicles are worse vehicles.”[5-5] It’s not a much of technical argument as much as Michael’s biased opinion as a ChargePoint investor from a couple images he Googled.

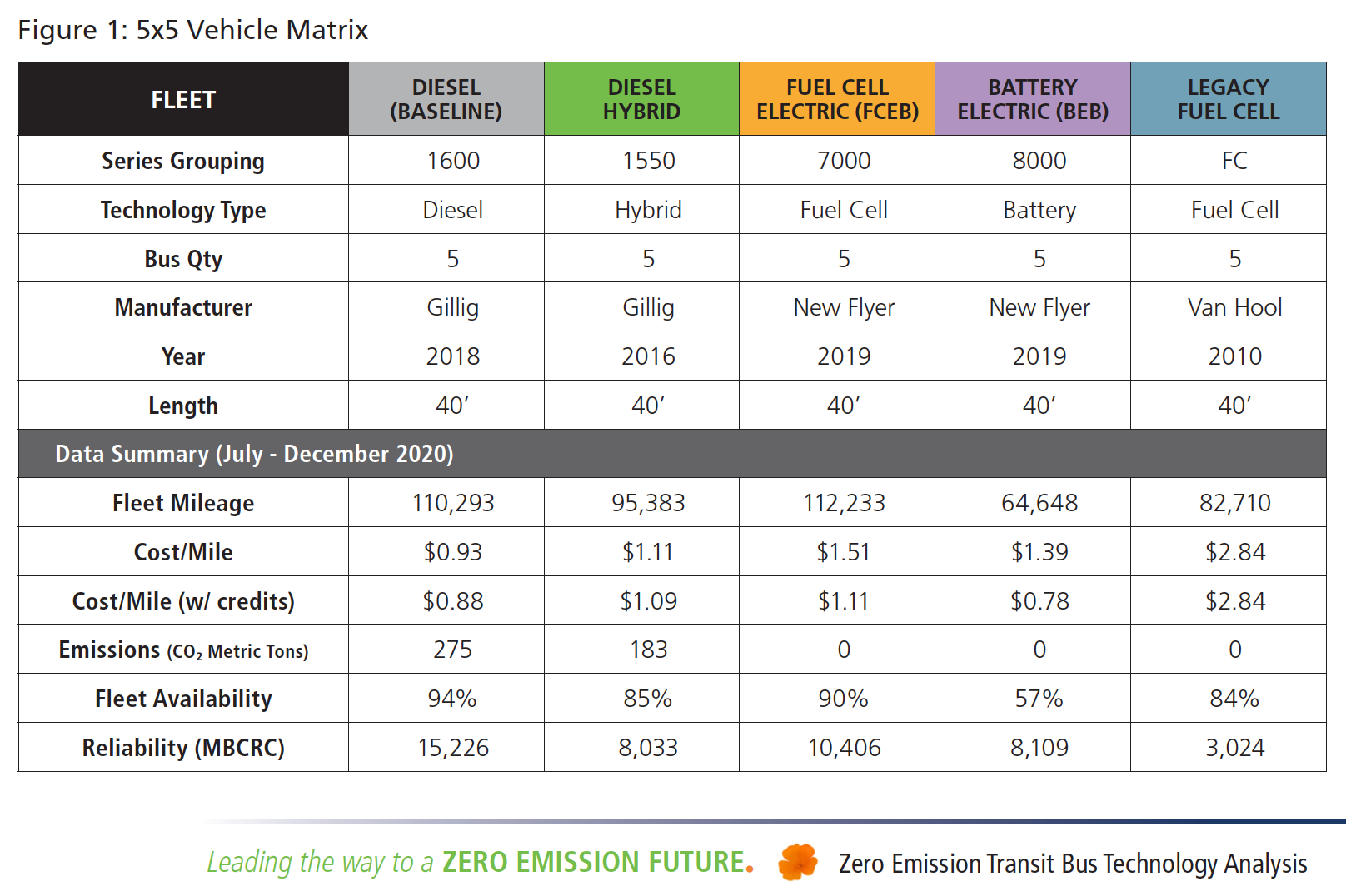

He next applies the same logic to buses and says buses will also be battery only in the future. He says “I know that there are people very happy with their hydrogen buses. I was on the board of transport for London. I couldn’t get the management team to tell me how much they cost to maintain.”[5-6] Despite Michael making it sound like no one knows how much it costs to maintain a fuel cell bus, buses are a place where we have excellent side-by-side data from the Zero Emission Transit Bus Technology Analysis (ZETBTA) report published June 23, 2021 by AC Transit in Oakland California.[7] AC Transit is one of the foremost authorities on long term evaluation of buses with low and zero emission powertrain systems in the world. The ZETBTA report was initially intended to meaningfully analyze the various transit bus technologies that AC Transit operates. The report summarizes results of the study for the fuel-cell electric bus (FCEB), battery electric bus (BEB), diesel hybrid bus, and conventional diesel bus technologies. There are five different technologies being evaluated side-by-side: two different fuel-cell electric system designs, along with the other technologies. Five of each bus technology types were included in this study; hence the original nickname of the report was the 5X5 Transit Bus Technology Analysis.

One of the most powerful tables from the 2021 study shows that a 2019 New Flyer FCEB had a 90% fleet availability compared to a 2019 New Flyer BEB’s fleet availability of 57%. Even the 11 year old legacy 2010 Van Hool fuel cell bus had an availability of 84%.[7] The cost per mile of both the 2019 New Flyers was also comparable. However, the FCEB bus was on the road earning money and moving people 90% of time. The Battery Electric Bus was on the road only 57% of the time earning money and moving people. In this study, the FCEBs were on the road more than BEBs in a pleasant climate like Oakland California. The uptime delta gets worse for BEBs in very cold climates even if they use petrol heaters.

Remember, on a fuel cell bus, the fuel cell is not working all alone. The fuel cell in the Solaris Urbino 18 depends on a 60kWh battery pack as part of its powertrain system to move passengers with high uptimes, warm cabins, and zero emissions for the long routes. It’s not about choosing battery cell or fuel cell, it’s about choosing both. There is no False Dichotomy in which we can choose only one technology. The two technologies complement each other very well and allow for more efficient allocation of battery cell raw material resources. A fuel cell bus is really a fuel cell and battery cell hybrid bus. Fleet operators and transit authorities might want to choose a combination of technologies depending on a multitude of factors, especially for longer routes in colder climates and hilly environments.

Not only are FCEBs competitive on cost & revenue making abilities with their battery only counterparts, they’re easier to supply with green energy. Champaign-Urbana in Illinois recently unveiled a 100% renewable hydrogen investment with two New Flyer Xcelsior sixty foot articulated buses.[11] The buses are powered by green hydrogen made from 5,500 solar panels that sit across the street on an unused plot of land from the Urbana and Champaign Sanitary District. The sun is used to make green hydrogen that can fill these giant 60-foot articulated buses in 10 to 15 minutes for a 300 mile range. The solar panels can make enough hydrogen for up to 15 buses that provide reliable range and heat for passengers even through the harshly cold winters south of Chicago.[12]

Despite battery powered vehicles being on the road for many years, we still do not have a single demonstration of off-grid solar or wind fast charging for cars, buses, or trucks anywhere in the world. 100% green solar, wind, hydro, & RNG hydrogen making facilities have been popping up across North America for years now just like this new one in Illinois. The green hydrogen made at all these new sites can be used to refuel fuel cell vehicles or fast charge BEVs with off-grid green electricity. All signs point toward battery cells and fuel cells working together.

Class 8 trucks have powertrain systems similar to buses and are another area where people continue to prove Michael wrong about hydrogen despite his anti-hydrogen propaganda. Air Products recently completed a $4.0B renovation to their headquarters in Lehigh Valley Pennsylvania with a brand-new hydrogen refueling station to signal their commitment to hydrogen as a fuel. Air Products also announced less than a month ago their very first refuel of a Toyota Mirai at their new HQ on October 26, 2022.

Air products announced two months ago that the New York Power Authority (NYPA) board approved 94 MW of low-cost St. Lawrence hydroelectric power to Air Products to use for making green hydrogen from a $500M investment that will create 90 permanent jobs in New York State. Air Products says the plant will produce 35 tons of liquid green hydrogen per day and they plan to use it to convert their entire fleet of 2,000 Class 8 trucks to hydrogen fuel cells.[13]

Air Products will work jointly with Cummins to manufacture these 2,000 class 8 zero emission hydrogen fuel cell trucks.[14] Both Air Products and Cummins are Midwest American companies creating jobs right here in the USA for energy security and manufacturing security. Air Products and Cummins joint venture is just one example of so many companies’ commitment to clean hydrogen.

There are literally hundreds of companies and dozens of governments making similar commitments around the globe to the hydrogen supply chain. Michael keeps talking junk, but the world keeps proving him wrong with announcements of new investments in hydrogen infrastructure where his ladder says H2 cannot compete.

Lastly, Michael attacks Airbus and his argument is simple and without substance: “I don’t care what Airbus says”.[5-7] That’s literally the argument against hydrogen aircraft Michael gave to the World Hydrogen Congress last month. Airbus built a hydrogen test bench aircraft out of a multimillion-dollar A380. Watch this amazing video of Glenn Llewellyn showing you how this pioneering R&D venture is gathering data for Airbus to offer zero emission aircraft in commercial service by 2035 using green hydrogen.

The conclusion of Michael’s hydrogen monologue is that he thinks hydrogen is bad and he doesn’t care what Airbus or anyone else says. Someone like Michael tells us hydrogen can’t work, yet it keeps on working. Then we’re told the economics aren’t there, but then the economic data shows otherwise and it keeps working. When we ask for the story on where batteries come from and the full story on their supply chain problems, Michael tells us “This depends on there being enough battery materials. And, that’s a very long presentation. And, we’re seeing lithium prices soaring, but we saw this in the solar space. They come back down. There’s no shortage of lithium in the world. There is no shortage of copper in the world. There is no shortage of the key materials of the electrification route.”[5-8] Where is the this ‘very long presentation’ on battery making raw materials Michael references? Does it really exist as Michael claims? There are many reliable and trusted sources contradicting his statements.

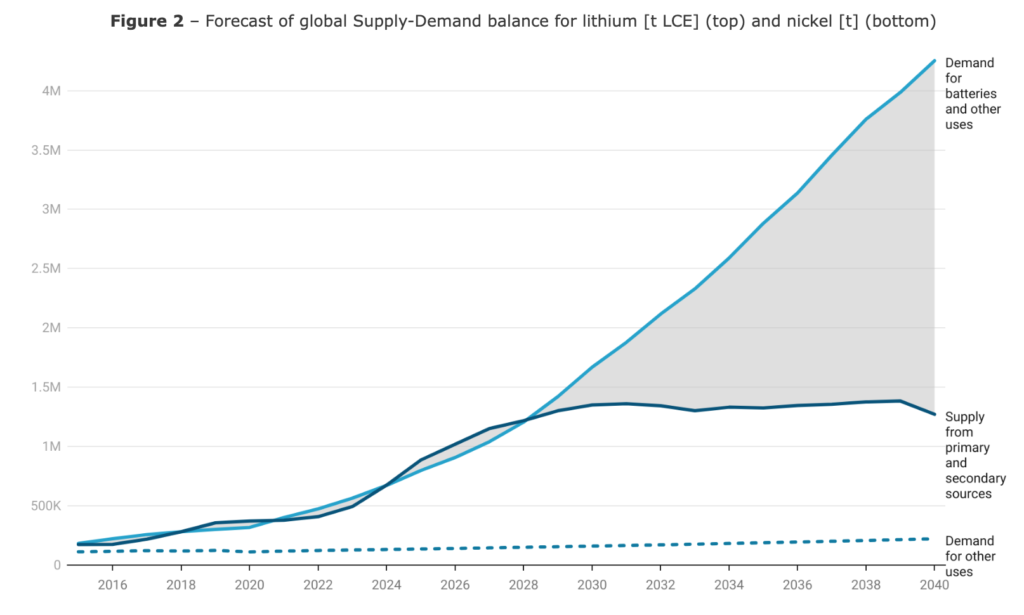

It boils down to this: If the pillar we’re talking about is sustainability, then the answer would be smaller battery packs to maximize efficiency of limited resources which means fuel cells & battery cells working together. If the pillar we are talking about is affordability, then we don’t want to drive up prices of lithium, cobalt, manganese, nickel, & graphite by using those resources inefficiently. Lithium prices, for example, have increased 1,443% since November 27, 2020 which is only two years ago at the time of this publication.[15] It’s predicted lithium carbonate demand will outstrip supply as early as 2028 and diverge dramatically over the decade from 2030 to 2040 which indicates a volatile and unsustainable future.[16] This brings us to Michael’s last energy pillar which is security. With almost all the battery making materials being mined in South America, Australia, Africa, and China, the USA and UK have no control over their energy if “batteries only” is the answer to everything. If Michael has his way, the entire global supply chain for energy will be beholden to China.

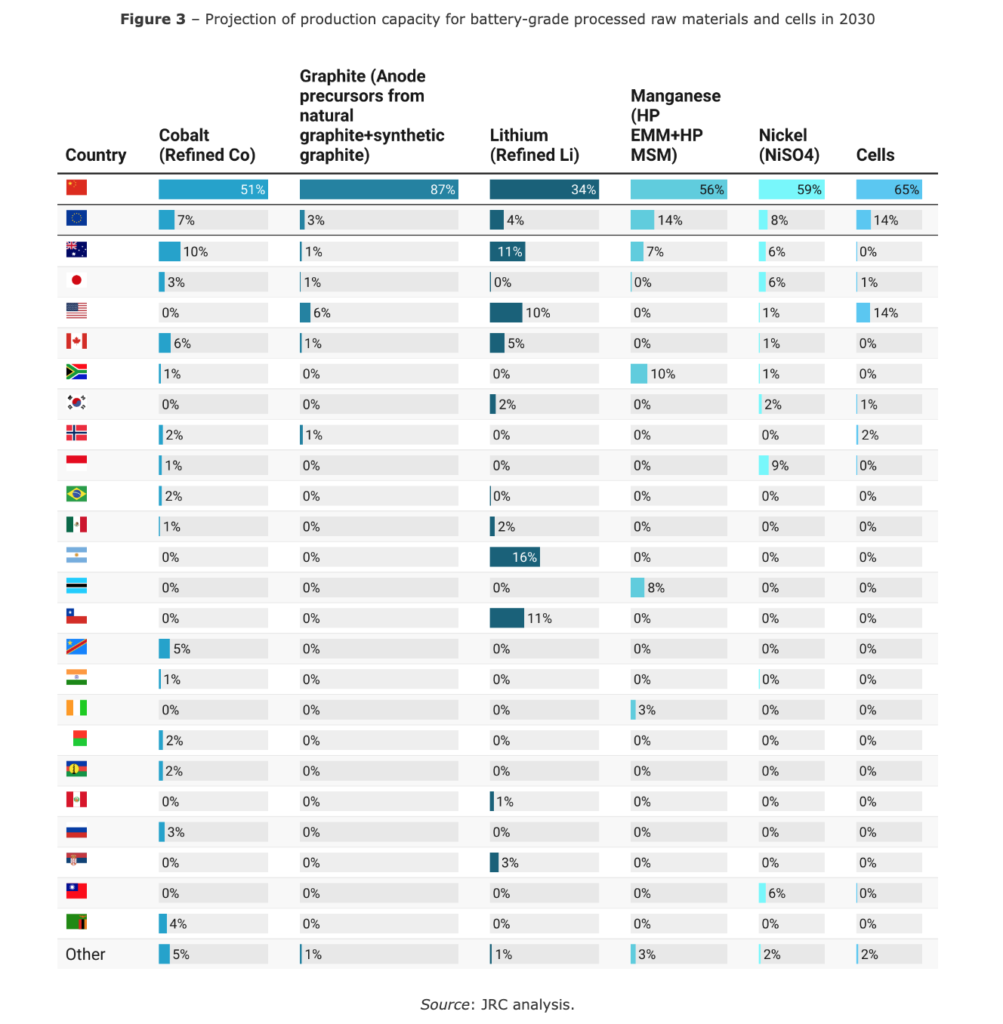

Us boring and risk averse investors believe that a well-diversified portfolio is a better bet than putting all eggs in one basket. The USA literally has only one lithium mine at the time of this post’s publish date.[17] Even with the recent passage of the IRA, lithium carbonate demand will outstrip global production in less than 6 years because of the length of time it takes to permit, construct, and open a new lithium mine. When the battery raw material supply chain crisis really hits in 2030, the USA is predicted to have the #2 ranking with only 14% global market share and be far behind #1 China which will have 65% global market share of battery cell raw materials. By 2030, China will still enjoy 87% global market share of graphite production which is a key component in cathode making. The UK, Michael’s home country, does not even rank in the top 25 countries in any category.[16]

Regardless of every pillar of Michael’s foundational energy thesis being proven bunk, the sad truth is Michael is not too interested into the urgency of environmental issues surrounding sustainability or climate change; he just wants to make money. Michael is interested in climate change insofar as he can profit from it. Just like when he founded NEF, he views clean energy companies as a financial sector in which he fancies himself as a savvy investor. Michael is dismissive of the broader climate change issue when he says this about its urgency: “First of all, I think of climate change as a real thing. Is it as urgent as Greta Thuneberg would like to have us believe? Is it going to threaten societal collapse in a decade or two? No.”3-10 We should take Michael at his word when says he is a finance guy at heart. Michael sees clean energy through a financial lens to leverage rather than environmental protection lens. Michael’s mission is not in alignment with RMP’s mission to protect our fresh water resources; which brings us to the final section of this post: dissecting Michael’s Cleaning Up podcast #71 with Pasquale Ramano, CEO of ChargePoint published on January 12, 2022.

Michael’s True Passion: Growing Financial Investments

There is no better video to watch to see Michael with his guard down and speaking candidly than in his episode #71 of his Cleaning Up video series where he interviews Pasquale Ramano, the CEO of ChargePoint.[18] He gives this disclaimer regarding his conflict of interest to start the video: “Hello I’m Michael Liebreich and this is Cleaning Up. My guest today is Pasquale Romano. He’s the CEO of ChargePoint, the world’s largest EV charging technology provider, and also for full disclosure, a company in which I was an early investor.”[18-1] Later in the video Michael also mentions one of the main reasons he decided to invest in ChargePoint when he says to Pasquale “You do have this ferocious market share in the U.S. which is actually, I’ll be honest, why I initially invested. I think you know that it wasn’t just your good looks”.[18-5] Michael makes it clear he invested in ChargePoint to make money on BEV growth and that he checks the stock charts every day.

Michael and Pasquale talk about their business relationships and conversations with other ChargePoint board members and both seem in their element talking about the subjects that really interest them: investing, acquiring public capital, and growing a business. Most of their conversation revolves around how ChargePoint makes money and intends to make money. You can learn insight on how important it was for ChargePoint’s board of directors to go public with very specific timing to hit the “liquidity window”[18-12] to access public capital. In fact, Michael & Pasquale talk at length toward the end of the 68 minute video about how much discussion took place amongst ChargePoint’s board of directors to time the ChargePoint SPAC in order to access public capital. Pasquale says to Michael “You know, you probably talked to Michael [Linse] who… whose fund you’re invested in, which is invested in us [ChargePoint] at the board level, because he’s on our board and he’s our largest investor. We had a lot of conversations as a board about the timing of going public and getting access to public market capital”.[18-11]

The contrast between “anti-hydrogen entertainer Michael” and “savvy investor Michael” is evidenced well in this video. While Michael is bull dog when he interviews a hydrogen proponent, he is a lap dog when he is talking shop about how to make money by leveraging access to public capital. Michael’s focus is on how he can capitalize on environmental concerns driving public spending. Wanting to be a savvy and respected investor is what Michael seems to covet the most in life; fleecing the greenwashed is just a means to an end. You will only hear the words “climate change” one time throughout the whole 68-minute video and it’s only mentioned in the context of how ChargePoint can leverage it to make a profit.

There is no talk in this video about ChargePoint’s goals for carbon dioxide reduction. There is no talk in this video about ChargePoint’s commitment to smog reduction. There is no talk in this video about how BEVs charged with ChargePoint chargers can help eliminate fossil fuels and protect our air & water. When Pasquale mentions some red flag issues around how to charge BEVs in America, Michael just smiles and asks zero critical questions. Michael’s double standard is remarkably on display in this video. While there are several examples in this video to demonstrate Michael’s double standard, let’s cover two key examples of how Michael’s anti-hydrogen remarks are disingenuous when compared his candid remarks about BEVs.

BEVs Mandated for You – Petrol SUVs For Michael Leibreich

One of the ways Michael and Pasquale imagine ChargePoint can grow is by banning petrol cars. For someone who can afford a second or third car, a ban might be easier to tolerate but could still be very unfair if the consumer cannot get a vehicle that meets their needs. A single mom, for example, earning $20/hour might have a small vehicle budget and need a reliable vehicle at a low price. Her vehicle must get her to work in the cold, get her around to pick up and drop off her kids when temperatures are below freezing in January, and must also allow her to take her family trip when she can eke out a day off work. Furthermore, depending on where the consumer parks overnight, they would need access to an affordable charging station.

Pasquale Ramano acknowledges the gravitas of a vehicle purchase decision for an average vehicle buyer: “a car is the second largest purchase someone makes. So they’re kind of thinking about it like a mortgage. It’s not like it’s a discretionary spend”.[18-6] Earlier in the video Michael Liebreich explains at length what he thinks about the inadequacy of BEVs, the frustration they cause him, and why he refuses to drive one when he takes a 1,000km trip. Michael still drives a petrol SUV[18-2]and says he will not be switching any time soon because of the inconvenience of driving a BEV[18-3 & 18-4].

Next Pasquale talks about why he loves bans of petrol vehicles because they can really put the squeeze on forcing buyers to buy BEVs that Michael earlier said he loathes. Pasquale says this about squeezing buyers into BEVs as he envisions the future benefit to ChargePoint’s profits: “I’m going to have increasing speculation on the shadow casting on the residual value of that [petrol] vehicle so now I have to front load more of the payment. So now the financing mechanisms for vehicles actually make the price go up because of those bans [on petrol vehicles]. So, I actually said this on several public forums: ‘I love bans’ and i don’t care where they can put a ban”.[18-7] Michael beams a smile throughout this segment of the video and seems enchanted by this infomercial for ChargePoint. Michael likes the picture Pasquale is painting as he imagines himself profiting from it. Watch Michael smile from ear to ear when Pasquale says “I love bans”. This is right after Michael said he can’t see himself giving up his beloved petrol SUV because of the “unbelievable” inconvenience it is to drive a BEV.

The part of the video where Michael talks about why he drives a 4.4L petrol SUV is an instant classic. He describes well his reasons, and it’s all about inconvenience. Here are Michael’s own words in his classic bully voice mocking BEV capabilities: “I’m still driving a 4.4L petrol SUV because I drive London to the Alps and at the end, I’ve got a very steep and icy hill..and I do this with 6 people in the car…and there is no electric car that enables that, number one. And two, where would I charge that? Because, I don’t want to stop two, three, four times along the way to exhibit this kind of oh you know ‘now I’m a laptop’, ‘now a I’m a tablet’, ‘now I’m a mobile phone’ type behavior. I want to get to the alps. And then, I want to get back from the alps. It does cast a long shadow, doesn’t it, this problem [with BEVs]?”[18-2]

Michael does not stop there when disparaging the frustrations of BEVs and why he will not drive one when he ventures out further than very short trips. He candidly disclaims his mandatory requirement for himself is very different than the one he wants imposed on others, Michael wants to stop only once and he says he is not unique in this desire. Again, in Michael’s own words: “I just think that, ya know I want to stop once on a long journey, not twice, ya know, I don’t mind taking one meal stop, but I don’t want necessarily to stop twice, and I’m not sure that I’m that unique”.[18-3] Here’s what Michael says about the inconvenience of doing a similar drive in a BEV: “It’s unbelievably inconvenient trying to actually go somewhere new and find out which network the charging station is on and which cable to use and so on”.[18-4]

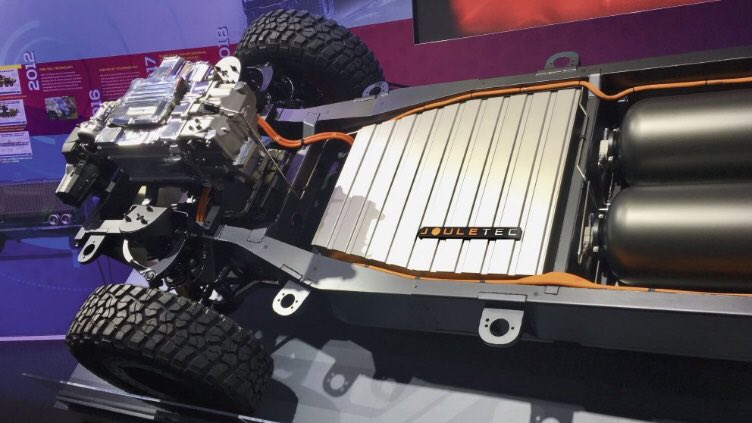

It is ironic that when Michael speaks candidly about BEVs he unwittingly acknowledges the validity of arguments hydrogen fuel cell supporters have used for years as to why fuel cells and battery cells work well together and why we should not just pick one technology. We must support an all-of-the-above strategy to wean billions of people off fossil fuels. General Motors and Honda Motors recently opened a joint venture in Brownstown, Michigan to manufacture generation two fuel cell stacks but their progress & American jobs are delayed by toxic rhetoric like Michael’s that sows doubt. General Motors Defense LLC has a 400 mile range 4×4 Chevrolet ZH2 full size truck platform designed for the US Military that RMP wrote about here. The vehicle uses a Gen2 fuel cell stack and GM’s Ultium brand lithium-ion batteries. It is fuel cells and battery cells again working together to make an awesome on-road and off-road truck.

Having worked in the automotive industry my entire career and my dad working in the automotive industry since 1965 and growing up in the Motor City, I happen to know from personal experience full size GMC trucks are remarkable on-road and off-road vehicles. The GMC and Chevy full-size pickup platform is made right here in Flint Michigan and also in Fort Wayne Indiana. The full-size SUV platform is made in Arlington Texas. GM’s hydrogen powered monster of an SUV can be ready to build in Arlington Texas right now but people like Michael delay America’s zero emission progress.

A Chevy ZH2 could make the drive from London to the Alps in one stop, with six people, and could climb up an icy mountain at the end. Furthermore, a Gen2 Chevy ZH2 can double as a power generator with up to 100kW of continuous power and produce two gallons of drinking water per hour as an emergency vehicle. If everyone had a Chevy ZH2 after a hurricane in Florida, everyone could back up their home power & produce clean drinking water when the fossil fuel grid is down. Chevy ZH2’s could charge BEVs with green hydrogen in a time of emergency.

Michael & Pasquale Discuss: How Do You Charge a Big Class 8 Truck?

An interesting conversation between Michael & Pasquale takes place late in the 53-minute mark of the video when they talk about Class 8 trucks which have powertrain systems very similar to buses. Michael asks Pasquale to imagine what the market for Class 8 vehicles might look like if we were cryogenically frozen and brought back to observe the earth in the year 2050. Pasquale spends much of this segment talking about how long-haul freight with BEVs is a problem.

Pasquale conjectures in the near future that “before you blink” we will have trucks with massive 800kWh battery packs capable of making one stop every four to five hours.[18-8] He can’t hang his hat on anything specific, but speculates a company like Tesla will soon show us an amazing truck like the one he describes. Tesla is less than three weeks away from the 5-year anniversary of the December 14, 2017 Tesla semi reveal date when Tesla started taking customer deposits for a promised delivery date of 2019. Musk promised the emphasis on the Tesla semi was to have the fastest accelerating truck which is something freight companies care little about. Musk asked for cash deposits in 2017 and promised a truck with a 500-mile range at 60mph with a gross vehicle weight of 80,000lbs in 2019.[19] We keep waiting for economically feasible long-haul battery only trucks with 500-mile range @ 60mph and a GVW of 80,000lbs but we have not seen them. The Tesla semi remains vaporware 5 years after its reveal date and 3 years after its promised delivery date. The latest is that Tesla will have a delivery ceremony of their Semi seven days from now on December 1st. RMP is very much looking forward to seeing if the vehicle can match the promises with objective data published by an independent 3rd party like Pepsi.

Pasquale goes on to say that long haul truckers don’t like to stop unless “they’re absolutely required to take breaks because time is money”.[18-9] Pasquale then calls this a problem. Pasquale describes in his own words why it is so difficult to charge long-haul Class 8 trucks: “The one problem, I will be fair…to the challenge there. There is [sic] usually transmission lines coincident with highways, that’s the good news. Here’s the bad news: there’s no distribution coincident with highways. So, if you’re at a truck stop and you look out your truck’s window. You can see megawatts. But you can’t get at them unless you build a substation to basically tap into that transmission infrastructure purpose built for charging. There isn’t [sic] megawatts available at most truck stops.”[18-10]

Well said Pasquale, hydrogen advocates appreciate your candor in agreeing with one of our long-standing arguments about Class 8 trucks and all charging on the USA’s interstate highway system. Pasquale is basically saying what Michael said earlier about not wanting to stop and not being that unique. No one wants to stop unless they are absolutely required to, as preached by Michael and Pasquale. And often, when someone absolutely must stop, they want to get back on the road quickly. For someone who is hyper critical of hydrogen challenges, Michael Liebreich has a perfect opportunity to ask some tough questions here but he does not say a thing. Not a single critical question at this point from Michael Liebreich who says hydrogen cannot compete in Class 8 powertrain systems. By contrast, Michael scours the internet to tweet multiple times per day anything that can be perceived negatively about hydrogen and adds it to his fabricated ladder.

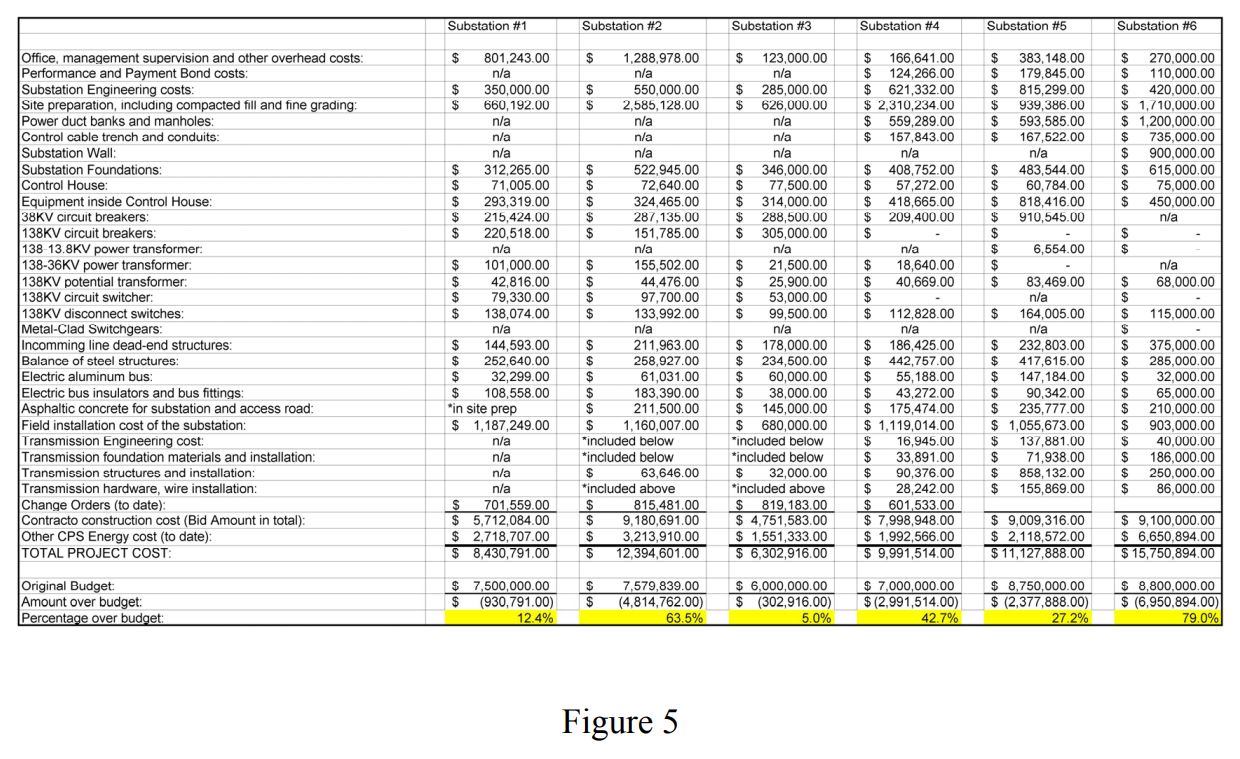

Now let’s talk about why its so difficult to tap into those megawatts in high voltage transmission lines as Pasquale describes. The first problem with building a substation to tap into high voltage transmission lines is the multi-million-dollar cost requiring a long-term payback. The second problem ties to the first problem in that any long-term investment in transmission lines that lead back to a coal plant or natural gas plant guarantees the longevity of the fossil fuel plants to which they are connected. Remember, there is not a single fast charging station in the world that is independent from the fossil fuel grid.

On the MISO grid, which covers Michigan to Minnesota and all the way south to Louisiana, you can download MISO’s app to see the real time power mix. Generally, the MISO grid is about 43% coal, 31% natural gas, and 17% nuclear. Solar will sometimes get as high 3% mid-day but on average is lower than 1%. If you use EPA data to calculate the national average of the electricity grid mix, the USA is 61% fossil, 81% non-renewable, and 11% solar & wind combined.[20] Do we really want to spend millions of dollars per substation to extend our dependency on coal & natural gas plants? If the high voltage transmission lines are connected to a fossil fuel source, the public capital traps and extends the long-term use of fossil fuels. Let’s look at the cost of constructing a substation in more detail and the crux of what Pasquale describes as a fair problem.

Using data from a study written by Darden Lee Wall Jr called Parametric Estimating for Early Electric Substation Construction Cost and approved by the supervising subcommittee and presented by the Faculty of the Graduate School of the University of Texas at Austin[21], we have detailed cost data on the construction of a substation. The costs from the study published in 2009 can be adjusted for inflation using the U.S Bureau of Labor Statistics CPI calculator.[22] It is important to note that costs of substations are constantly changing but are primarily driven by the costs of steel, copper, concrete, and asphalt which are all used extensively in the construction of a substation.

Using the costs from Figure 5 of the study showing the cost of six different substations, we see an average cost of $10.6M per substation with an average original budget of $7.6M meaning that on average each substation came in about $3.0M over budget[21-1]. If we adjust these figures from 2009 for inflation using the US Bureau of Labor Statistics CIP calculator, RMP calculates average inflation adjusted costs at $15.0M actual, $10.7M budgeted, and $4.3M overbudget respectively if the same six substations were built in 2022. From the moment a management decision is made to construct a substation, the average duration of time to receive quotes from contractors is about 2 to 3 years. The full budget duration on average is 3 to 4 years.[21-2] Just based on the costs alone, you can see that it is expensive to tap into the fossil fuel grid just as Pasquale mentioned. Do we want to spend $10M to $15M per substation to extend the life of coal & natural gas plants to mega-charge massive 800kWh battery packs derived from limited resources? By contrast, green hydrogen refueling can be added at current truck stops with less planning and lower costs per location.

This Class 8 anecdote is another great example of how battery cells and fuel cells can work great together to break our dependency on the fossil fuel grid and not invest in its longevity. GM is collaborating with EMPOWER to build hydrogen fuel cell systems to charge batteries with zero emissions and the charging is done off the fossil fuel grid. Each hydrogen charging station can be deployed anywhere and provide up to 600kW of continuous power off-grid, zero emissions, and no noise.[23] The configuration possibilities are endless and as green hydrogen becomes ubiquitous, I can think of no other way or better way to charge batteries off the grid. This brings us back again to one of Michael’s energy pillars: sustainability. Why put an 800kWh battery pack in a Class 8 truck that can only be on the road between 50% to 60% of the time in cold climates or mountainous regions when you could put a fuel cell and a 100kWh battery pack into eight different trucks that could be on the road 90% of the time? That’s eight class 8 trucks that could be built with the same amount of lithium-ion battery pack raw materials as one battery only truck.

Sometimes, a battery electric only solution will make sense. Sometimes a battery cell + fuel cell hybrid powertrain will make sense. People will need an array of choices depending on their situation.

Final Conclusion

While Michael might believe climate change is real, his motives in speaking about clean energy are disingenuous. Michael wants to capitalize on climate change for his personal benefit. He started NEF to track investments in clean energy to make money and influence investment decisions. While fascinated by clean energy, Michael lacks the principal understanding of how battery cells, fuel cells, and energy grids work and how their supply chains work. Michael unwittingly promotes large pack vehicles that use semi precious battery making materials inefficiently which is detrimental to his #1 argument ‘Sustainability’. Michael asks no critical questions at all when Pasquale Ramano says you can’t get the megawatts out of the fossil fuel grid’s high voltage transmission lines without building a multi-million dollar substation. Whereas Michael is hyper critical about anything hydrogen, he literally has zero questions related to gaping concerns for decoupling battery charging from the fossil grid. Michael lobbies from West London for allocating US public taxpayer capital to build ChargePoint stations connected to coal & natural gas plants. Each time an investment is made to build a substation to charge a massive Class 8 truck battery at a similar cost to a green hydrogen refueling station, it guarantees the longevity of the coal or natural gas plant it is connected to by high voltage transmission lines.

Michael has an analogy about battery costs dropping as technology improves and makes a comparison to solar panels. He says “In the innovation delivered by engineers it just works. You see it time and time again. And then, so, when people say things like, oh well the cost of solar’s got to stop going down at some point. And you’re like, well why it’s just sand you know it’s sand that becomes silicon and different sand that becomes glass and yeah you’ve got some steel you’ve got some metal bashing on the racks but there’s nothing in there that says that it can’t continue to go down essentially forever but of course slower and slower because these things are long log curves”

Michael makes a great analogy for what we did observe in solar PV cost drops over the decades. One of main reasons, however, for continued solar PV price downs over the years is the abundance of silicon dioxide to make silicon. Silicon is very common on Earth. In the Earth’s crust, silicon is the second most abundant element. The most common compound of silicon is silicon dioxide, or SiO2. The silicon dioxide compound is the most abundant compound in the Earth’s crust that we know commonly as sand.[24] When something is abundant like silicon, its costs can go down over the long logarithmic charts Michael Liebreich talks about. On that, I can agree with Michael. There is only one thing more abundant than silicon & oxygen on the earth’s surface, and that’s hydrogen. Hydrogen is in the compounds of everything around us and therefore accessible to anyone on the planet. It’s in our water. It’s in our bodies. It’s in our foods. It’s in the wood that holds a roof over our heads. It’s literally everywhere you look no matter where you are in the world.

While silicon is prevalent in the earth’s crust, it does not exist naturally. To get the silicon out of silicon dioxide to make solar panels, we have to break a very strong chemical bond between silicon and oxygen called a covalent bond. The extraction of silicon from silicon dioxide is extremely energy intensive; it requires 1,000-1,500 megajoules of primary energy per kilogram to process high-grade silicon for computer chips or solar panels.[25] Furthermore, over 60% of the silicon wafers in the world are produced in coal or coke furnaces in China[26]. By contrast, the bond between hydrogen and oxygen in water is very easy to overcome. You can split H2 & O2 in a glass of water with a 9V battery and a paperclip.

Hydrogen will experience similar cost downs to solar PV cells because of its abundance. It can be made from hydro power, nuclear power, sewage, landfill gas, biomass, geothermal, solar, wind, natural gas, and even coal. It is the common denominator of all energy. U.K. Secretary of State for Business, Energy, and Industrial Strategy Jacob Reese Mogg rightly called hydrogen a silver bullet solution even though Michael Liebreich mocked him for it. If your only argument is to mock, use sarcastic tones, bully, and block on Twitter for entertainment value, it’s not much of a substantive argument. If your argument is “I don’t care what Airbus says” or anyone else says, it’s not much of an argument. Green, pink, or blue hydrogen can also help replace the coke used to turn silicon dioxide into silicon to make solar panels right here in the USA.

Michael says lithium carbonate, cobalt, manganese, graphite, and nickel will have similar price downs to solar, but that is not true. Prices will remain volatile for battery making raw materials because they are not found in the same abundance as silicon dioxide or hydrogen. When demand starts to soar 4x higher than supply between 2030 & 2040, China will have great leverage on battery prices putting the USA in a poor position to negotiate pricing.

Even if we use the most efficient battery cell + fuel cell hybrid model as RMP suggests, we are going to need a lot of battery making materials. The demand for battery cell raw materials is predicted to diverge from supply dramatically in the year 2028. You have seen the examples in this article demonstrating time and time again how battery cells + fuel cells work well together. There is no False Dichotomy like Michael proposes where we must choose only one or the other. We can, we will, and we should choose both to make our battery cell raw materials go further.

Batteries are a great technology and the USA and Canada have natural resources to make them. We know that it takes time to permit and build processing facilities for key raw materials like lithium carbonate, cobalt, manganese, nickel, and graphite.

There will be situations where battery only makes more economic sense than hydrogen fuel cells. There will also be times when a fuel cell + battery cell hybrid makes more sense economically. Some mass transit agencies and trucking companies will require long routes in cold climates and over hilly terrain where battery only buses & trucks have underperformed their promised ranges. In those situations, hydrogen fuel cell + battery cell hybrid buses will compete well. Some trucking companies or mass transit agencies might find they want a mix of battery only, diesel hybrid, and fuel cell + battery cell hybrid. We do not need to only choose one technology. We need to make the best use of the resources we have.

Batteries are a reflection of their energy source. It’s the same with fuel cells. Remember, battery cells and fuel cells are cousins and have significant similarities in that they’re made up of: an anode, a cathode, an electrolyte and both have no moving parts. The only real difference between the two is that one stores its energy internally and one externally. Battery cells and fuel cells are the yin and yang of energy carriers. We should not have to say we can only use one when both will work better together.

It’s not too late for people who make BEV charging equipment to embrace and capitalize on using green hydrogen to charge BEVs instead of connecting to the fossil fuel grid. RMP has nothing against Michael’s ambition to go out and take risks to make money. Every person working hard to make things happen is a how we move forward. But, we must draw the line at slandering good technologies like hydrogen and not showing any critical analysis toward batteries when there is an obvious financial conflict of interest.

This is exactly what Michael Liebreich does and it is unethical. Don’t believe Michael’s Hydrogen Ladder or slanderous rhetoric. Ask questions about what you’ve read here. Demand answers. Sadly, electricity is the easiest energy to turn green even though the USA still gets over 60% of our electricity from fossil fuels. Primary energy is much more difficult to wean off fossil fuels. Even if we use electric heat pumps, we could again get the electricity for those heat pumps from green, pink, or blue hydrogen. Remember there is no False Dichotomy where we can only pick one technology for energy. We don’t have a black and white world like that. We in fact have a rainbow of colors to choose from for our energy mix and each locality might require different colors.

Lastly, it should be pointed out that on most ladders, you start at the bottom and climb your way up. You should always be suspicious of a ladder where you start at the top and climb your way down.

Footnotes:

Footnote [1] – “Press Room & Corporate Information.” ChargePoint, ChargePoint, https://www.chargepoint.com/about/facts.

Footnote [2] – “Press Room & Corporate Information.” ChargePoint, ChargePoint, https://www.chargepoint.com/about/news/chargepoint-raises-50-million-extend-market-leadership-and-drive-electric-vehicles

Footnote [3] – Kugelmass, Bret. “Ep 48: Michael Liebreich – Chairman and CEO, Liebreich Associates.” Energy Impact Center Podcast, no. 48, 1 Nov. 2021, https://www.youtube.com/watch?v=V5lKtFtsDw0. Accessed 16 Nov. 2022.

Footnote [3-1] – 01:54 – Michael gives his backround and specifies he doesn’t want to be confused with East Enders. Michael says he is “West London through and through”.

Footnote [3-2] – 04:17 – Now days Michael spends all day on Twitter getting into fights and he calls this his new line of work.

Footnote [3-3] – 05:30 – Michael explains he was ” washed high & dry”

Footnote [3-4] – 05:47 – Michael talks about how the dot com boom bust was a “deeply traumatic” time in life

Footnote [3-5] – 06:30 – Michael explains he was worth $30M on paper in high risk investments then lost 99% of his paper equity as the reason this was the lowest point of his life.

Footnote [3-6] – 07:35 – Michael talks about his current wealth how he is doing much better this time around versus his wipe out after the dot com boom/bust.

Footnote [3-7] – 10:15 – Michael talks about his childhood and says “My mom was a nurse and my dad was a mechanic” and talks about wrenching on cars with his dad.

Footnote [3-8] – 12:05 – Michael considers himself a “numerical & finance type of person”

Footnote [3-9] – 38:09 – Michael explains that from the very outset he knew must have an exit strategy so wouldn’t get burned like he did on his risky investments in the dot com boom & bust. He says “I knew I would have to create an exit…”

Footnote [3-10] – 43:33 – Michael explains that he’s not too worried about climate change and he’s more of a business man. “First of all, I think of climate change as a real thing. Is it as urgent as Greta Thuneberg would like to have us believe? Is it going to threaten societal collapse in a decade or two? No.”

Footnote [4] – Liebreich, Michael. “The Clean Hydrogen Ladder [Now Updated to v4.1].” LinkedIn, 2 Sept. 2021, https://www.linkedin.com/pulse/clean-hydrogen-ladder-v40-michael-liebreich. Accessed 16 Nov. 2022.

Footnote [5] – “World Hydrogen Congress – Where the Hydrogen World Comes to Do Business.” World Hydrogen Congress – Where the Hydrogen World Comes to Do Business, https://www.worldhydrogencongress.com/. Accessed 16 Nov. 2022.

Conference Dates: October 11-13, 2022 – Citation date 11/15/2022

Direct Video URL: https://player.vimeo.com/video/761934482?h=b358ff0437

The following quotes are from Michael Liebreich’s keynote address at the World Hydrogen Congress 2022 in Rotterdam:

Footnote [5-1] – 02:00 – “Sustainability, affordability, and security. That’s what energy has to deliver”

Footnote [5-2] – 02:32 – “emissions have largely been capped though they haven’t started to fall”

Footnote [5-3] – 02:56 – “Now, with the situation in Ukraine, we see without doubt what we should have known all along. We don’t get security through fossil fuels, we get insecurity.”

Footnote [5-4] – 04:50 – Michael very sarcastically says “you could hardly get more hyperbolic” when UK Secretary of State for Business, Energy, and Industrial Strategy Jacob Reese Moss calls H2 “a silver bullet solution”.

Footnote [5-5] – 12:48 – “This is because the fuel cell vehicles are worse vehicles.”

Footnote [5-6] – 13:13 – “I know that there are people very happy with their hydrogen buses. I was on the board of transport for London. I couldn’t get the management team to tell me how much they cost to maintain.”

Footnote [5-7] – 17:50 – Aviation. Hydrogen not going to happen. “I don’t care what Airbus says”.

Footnote [5-8] – 18:28 – “This depends on there being enough battery materials. And, that’s a very long presentation. And, we’re seeing lithium prices soaring, but we saw this in the solar space. They come back down. There’s no shortage of lithium in the world. There is no shortage of copper in the world. There is no shortage of the key materials of the electrification route.”

Footnote [6] – IEA. “Global CO2 Emissions Rebounded to Their Highest Level in History in 2021 – News.” IEA, 1 Mar. 2022, https://www.iea.org/news/global-co2-emissions-rebounded-to-their-highest-level-in-history-in-2021. Accessed 16 Nov. 2022.

Footnote [7] – AC Transit & Stanford University, Oakland, CA, 23 Jun 2021, Zero Emission Transit Bus Technology. 0604-20 Report-ZEB Perf_FNL_062321

Footnote [8] – Written by Levy, Alon, “Battery-Electric Buses: New Flyer.” Pedestrian Observations, 31 Mar. 2019, https://pedestrianobservations.com/2019/03/30/battery-electric-buses-new-flyer/. Accessed 17 Nov. 2022.

Great additional article from Alon Levy for Bloomberg here that predicated the above article:

Levy, Alon. “Battery-Electric Buses Yield Mixed Results for Cities.” Bloomberg.com, Bloomberg, 17 Jan. 2019, https://www.bloomberg.com/news/articles/2019-01-17/battery-electric-buses-yield-mixed-results-for-cities.

Footnote [9] – “Are Buses with a Diesel-Powered Heater True Zero-Emission Buses?” Are Buses with a Diesel-Powered Heater True Zero-Emission Buses? | CIVITAS ELIPTIC Project, 13 Dec. 2017, https://eliptic-project.eu/news/are-buses-diesel-powered-heater-true-zero-emission-buses. Accessed 17 Nov. 2022.

Footnote [10] – Staff, Editorial. “Solaris Bus & Coach, Heating an Electric Bus Is a LPG Affair.” Sustainable Bus, 11 Nov. 2019, https://www.sustainable-bus.com/components/solaris-bus-coach-heating-electric-bus-with-lpg-co2-fuel-cell-bus/. Accessed 17 Nov. 2022.

Footnote [11] – Champaign-Urbana Unveils America’s First 100% Renewable Hydrogen Fleet with New Flyer Xcelsior Buses, 14 Oct 2021. https://www.newflyer.com/2021/10/champaign-urbana-unveils-americas-first-100-renewable-hydrogen-fleet-with-new-flyer-xcelsior-buses/. Accessed 15 Nov. 2022.

Footnote [12] – Perrero, Megan. “Champaign-Urbana MTD Partners with Public and Private Sector to Implement Hydrogen Fuel-Cell Technology.” Mass Transit Magazine, 21 Dec. 2021, https://www.masstransitmag.com/technology/facilities/article/21249165/partnerships-are-the-backbone-to-implementing-zeroemission-technology. Accessed 15 Nov. 2022.

Footnote [13] – “Air Products to Invest About $500 Million to Build Green Hydrogen Production Facility in New York.” 26 Oct. 2022, https://www.airproducts.com/news-center/2022/10/1006-air-products-to-build-green-hydrogen-production-facility-in-new-york. Accessed 15 Nov. 2022.

Footnote [14] – “Air Products and Cummins to Accelerate Development and Deployment of Hydrogen Fuel Cell Trucks.” 26 July 2021, https://www.airproducts.com/news-center/2021/07/0726-air-products-and-cummins-to-accelerate-development-and-deployment-of-hydrogen-fuel-cell-trucks. Accessed 15 Nov. 2022.

Footnote [15] – https://tradingeconomics.com/commodity/lithium – Lithium carbonate index price November 27, 2022 of 38,424 CNY/ton. Lithium carbonate index price November 8, 2022 of 593,079 CNY/ton. Lithium carbonate is valued in Chinese Yuan. Accessed 15 Nov. 2022.

Footnote [16] – EU Science Hub. “SUPPLY CHAIN CHALLENGES – Batteries: Global Demand, Supply, and Foresight.” Raw Materials Information System, European Commission, https://rmis.jrc.ec.europa.eu/?page=analysis-of-supply-chain-challenges-49b749. Accessed 17 Nov. 2022.

In 2030 China is forecast to account for 51% global cobalt refining, 87% graphite, 34% Lithium, 56% manganese, 59% Nickel(NiSO4), and over 65% of the average overall global battery market.

Fig1 – Global lithium supply outstrips demand in 2028 and diverges dramatically with demand higher than approx. 4x supply from primary & secondary resources. Click image below to enlarge.

Fig3 – China will control 65% of cell making global market share in 2030 and command 87% global graphite market share which is a key raw material in cathode making. Click image below to enlarge.

Footnote [17] – Almerini, Ana. “Lithium Mining in the United States: Where It Stands Today.” Solar Reviews, Solar Reviews, 13 Apr. 2022, https://www.solarreviews.com/blog/lithium-mining-in-the-united-states. Accessed 17 Nov. 2022.

Footnote [18] – Liebreich, Michael. “EP71: Pasquale Romano ‘the Man in Charge of Charging’.” YouTube, Cleaning Up, 12 Jan. 2022, https://www.youtube.com/watch?v=HeUwPPJOg5s. Accessed 17 Nov. 2022.

Footnote [18-1] – 0:24 – The Disclaimer “Hello I’m Michael Liebreich and this is Cleaning Up. My guest today is Pasquale Romano. He’s the CEO of Chargepoint, the world’s largest EV charging technology provider, and also for full disclosure a company in which I was an early investor. Please join me in welcoming Pasquale Romano to Cleaning Up.”

Footnote [18-2] – 00:26:20 – Michael talks about what he loathes about BEVs: “I’m still driving a 4.4L petrol SUV because I drive London to the Alps and at the end, I’ve got a very steep and icy hill..and I do this with 6 people in the car…and there is no electric car that enables that, number one. And two, where would I charge that? Because, I don’t want to stop two, three, four times along the way to exhibit this kind of oh you know ‘now I’m a laptop’, ‘now a I’m a tablet’, ‘now I’m a mobile phone’ type behavior. I want to get to the alps. And then, I want to get back from the alps. It does cast a long shadow, doesn’t it, this problem [with BEVs]?”

Footnote [18-3] – 00:32:05 – Michael on BEV shortcomings: “I just think that, ya know I want to stop once on a long journey, not twice, ya know I don’t mind taking one meal stop, but I don’t want necessarily to stop twice, and I’m not sure that I’m that unique”

Footnote [18-4] – 00:34:13 – Michael on BEV inconvenience: “It’s unbelievably inconvenient trying to actually go somewhere new and find out which network the charging station is on and which cable to use and so on”

Footnote [18-5] – 35:38 Michael Leibreich says to Pasquale Ramano “You do have this ferocious market share in the U.S which is actually, I’ll be honest, why i initially invested. I think you know that it wasn’t just your good looks”

Footnote [18-6] – 43:51 – Pasqaule Ramano says “a car is the second largest purchase someone makes. So they’re kind of thinking about it like a mortgage. It’s not like it’s a discretionary spend”.

Footnote [18-7] – 46:05 – Pasquale Ramono says “I’m going to have increasing speculation on the shadow casting on the residual value of that vehicle so now i have to front load more of the payment so now the financing mechanisms for vehicles actually make the price go up because of those bans [on petrol vehicles]. So I actually said this on several public forums: ‘I love bans’ and i don’t care where they can put a ban [on petrol vehicles].

Footnote [18-8] – 54:52 – Pasquale conjectures we’ll have great BEV trucks in the near future “before you blink”.

Footnote [18-9] – 54:45 – Pasquale says truckers “don’t stop unless they are absolutely required to because time is money. So, electrifying areas where trucks currently refuel [which] are not that many in the U.S. is a problem”.

Footnote [18-10] – 56:03 – Pasquale talks about the problem of tapping into the fossil fuel grid for megawatts “The one problem, I will be fair…to the challenge there. There is [sic] usually transmission lines coincident with highways, that’s the good news. Here’s the bad news: there’s no distribution coincident with highways. So, if you’re at a truck stop and you look out your truck’s window. You can see megawatts. But you can’t get at them unless you build a substation to basically tap into that transmission infrastructure purpose built for charging. There isn’t [sic] megawatts available at most truck stops.”

Footnote [18-11] – 1:00:22 – “You know, you probably talked to Michael [Linse] who whose fund you’re invested in which is invested in us [Chargepoint] at the board level, because he’s on our board and he’s our largest investor. We had a lot of conversations as a board about the timing of going public and getting access to public market capital”

Footnote [18-12] – 1:02:06 – Pasquale talks about hitting the liquidity window to access public capital.

Footnote [19] – TeslaMotors. “Tesla Semi & Roadster Unveil.” YouTube, Tesla Motors, 14 Dec. 2017, https://www.youtube.com/watch?v=5RRmepp7i5g&t=1001s. Accessed 17 Nov. 2022.

[6:56] Tesla Semi Reveal December 14, 2017. Musk promises 500 mile range @ 60mph with gross vehicle weight of 80,000. Tesla then asks for cash deposits for promised delivery in 2019.

Footnote [20] – United States Government. “Power Profiler Data Repository.” EPA, Environmental Protection Agency, https://www.epa.gov/egrid/power-profiler#/. Accessed 17 Nov. 2022.

Data download from https://www.epa.gov/egrid/power-profiler#/ on 11/12/2022

Footnote [21] – Wall Jr., Darden Lee. “Wall Masters Report – University of Texas at Austin.” UT at Austin File Repository, University of Texas Austin, 2009, https://repositories.lib.utexas.edu/bitstream/handle/2152/ETD-UT-2009-12-455/WALL-MASTERS-REPORT.pdf?sequence=1. Accessed 17 Nov. 2022.

Footnote [21-1] – Cost of substation construction – Figure 5, page 16

Footnote [21-2] – Duration of project – Page 2

Footnote [22] – CPI inflation calculator from the United States Bureau of Labor Statistics – https://www.bls.gov/data/inflation_calculator.htm

Footnote [23] – “GM PLANS TO BROADEN ELECTRIFICATION, EXPANDING FUEL CELLS BEYOND VEHICLES.” GM, 19 Jan. 2022, https://www.gmhydrotec.com/product/public/us/en/hydrotec/Home.detail.html/content/Pages/news/us/en/2022/jan/0119-hydrotec.html. Accessed 15 Nov. 2022.

Footnote [24] – Jason, Donev. “Silicon.” Silicon – Energy Education, University of Calgary, https://energyeducation.ca/encyclopedia/Silicon. Accessed 17 Nov. 2022.

Coal/Coke furnace requirements to make Silicon from silicon-dioxide (SIO2). 1,000-1,500 megajoules of primary energy per kilogram of silicon. Silicon dioxide (SiO2) must be heated 2,200°C (3,992 °F) in order to break the very strong covalent chemical bond with oxygen.

Coke is a grey, hard, and porous coal-based fuel with a high carbon content made by heating coal or oil in the absence of air. It is used mainly in iron ore smelting.

The unqualified term “coke” usually refers to the product derived from low-ash and low-sulphur bituminous coal by a process called coking. A similar product called petroleum coke, or pet coke, is obtained from crude oil in oil refineries. Pet coke gets piled high in mounds near the Detroit River right here in RMP’s home city at the Marathon Petroleum Refinery. When it gets windy, the black powdery substance blows high into the air and into nearby neighborhoods severely impacting the health of mostly poor communities. This same pet coke that gets in your lungs is also a nuisance causing more frequent car washes and window washing in the same communities. The Detroit Free Press writes about Detroit’s ongoing pet coke problem here.

Footnote [25] – Citation Used by University of Calgary for 1,000 to 1,500 megajoules of energy per kg of silicon from SiO2: International Resource Panel. United Nations, pp. 82–82, Environmental Risks and Challenges of Anthropogenic Metals, Flows, and Cycles. Accessed 17 Nov. 2022.

Leave a Reply to Tadashi Ogitsu Cancel reply