On October 22, 2024, RMP launched our new Lithium-ion Battery Supply Chain Map showing 531 locations across North America. The map is based on NREL’s NAATBatt database and you can read more about it in our post introducing the map here. The map splits the supply chain into upstream, midstream, and downstream assets. China absolutely dominates the global upstream and midstream segments of the li-ion battery supply chain and therefore RMP’s focus is on the nascent upstream and midstream segments in the USA and Canada.

Less than a month after the new map hit the internet, RMP already has our first update to the map adding 110 new lithium mine locations and 23 copper mines. This upgrade adds significantly to the already impressive NAATBatt database. Let’s look at data sources.

New Lithium Locations

The new 110 new lithium mine locations come from this map from the Center for Biological Diversity we’ll call the Western Lithium Projects Map (WLP map). The map has 135 locations but 25 of the locations overlapped with the NAATBatt database RMP uses as our base data. Of the 110 locations added to RMP’s combined database, 102 of them are ‘prospects’ or locations that could potentially become a mine some day. 8 of the locations are either actively producing lithium products or in development and will be producing lithium products in the near future.

The WLP map locations are predominantly located in Nevada. Because they are mostly prospect locations, RMP added a new checkbox to filter Raw Material locations called prospects. If you want to see only these prospective lithium mine locations simply turn off all other marker types and only check the ‘prospects’ market type (or vice versa).

All new lithium locations added to the database are in the ‘upstream’ supply chain category that RMP is trying to focus on. Raw materials are the most important part of the supply chain. Until the USA and/or North America can start to make its own raw materials, the entire globe (272 countries) will depend on just one country (China) for all raw materials. China is expected to control over 50% of lithium processing through 2040 according to a recently published Financial Times article.

Addin information to our li-ion battery supply chain database is how RMP intends to track western progress as the USA enters the upstream and midstream supply chain segments.

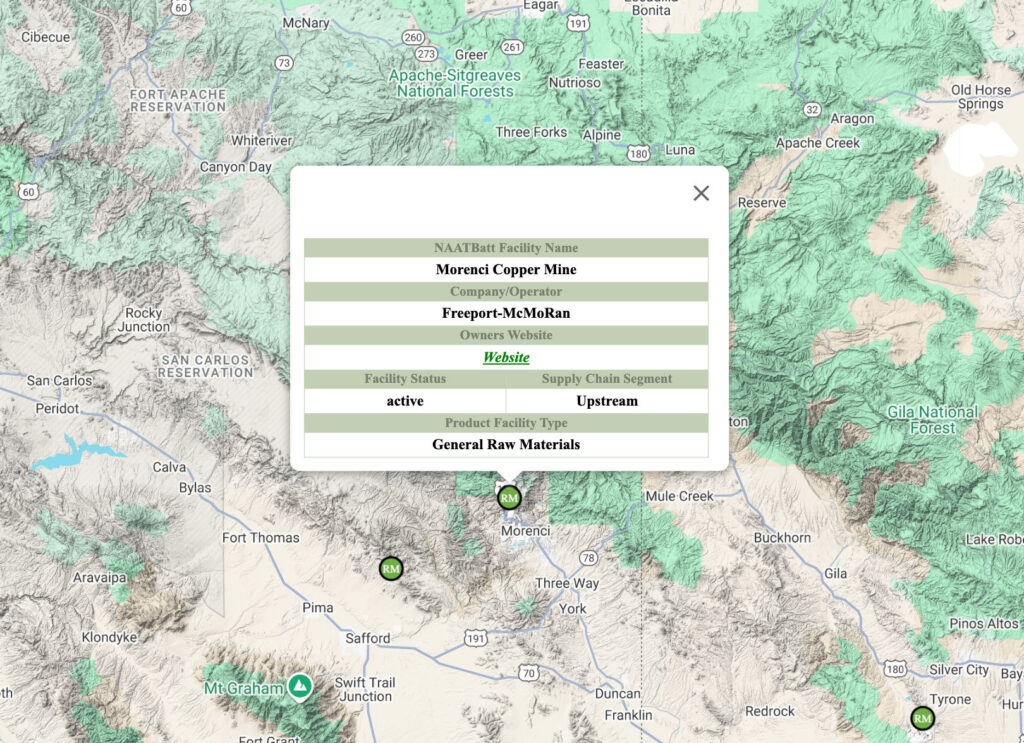

Copper Mines

Again focusing on the upstream locations, RMP considers copper a key raw material for the li-ion supply chain map and database tracking. Copper is not included in the NAATBatt database and there is no easy resource out there showing all copper mines in a nice table to add to RMP’s database.

In order to add the 23 copper mines that RMP added in this update, they had to be added the old fashioned way: by hand. That’s when you have to look up the latitude & longitude one by one and add it to the table. Look the website of the company one by one and add it to the table. Look up the ore type one by one and add it to the table. It’s some work, but it’s worth it to get these locations. Copper is such an important part of the “electrify everything” concept that is sweeping energy discussions around the globe.

As RMP outlined in our first article about our new map, lithium is considered a “bottleneck” raw material globally. Even though production of nickel, cobalt, and manganese is less likely to truly be a bottleneck for batteries, lithium most certainly is and it is a key mineral no matter what type of cathode chemistry you’re trying to make. Copper is the same way. Everyone following new energy resources recognizes copper as a bottleneck element.

Copper supply is increasingly constrained due to aging mines, declining grades and exploration success. Water issues and heightened political risk in key producing regions is also tightening global copper markets. Geological challenges are limiting new Tier 1 discoveries. Existing mines produce lower-grade ore, requiring more material to be processed for the same copper output. As surface deposits are depleted, mining operations must go deeper, increasing costs and technical complexity.

Most of the USA’s copper comes from mine in Arizona, but RMP also added copper mines located in Montana, Alaska, Minnesota, Nevada, Utah, and New Mexico. Of the 23 mines added in this update, 5 are in developmental stages and 18 are active. There are few dozen abandoned copper mines in the USA that RMP did not add, but these mines might get added if operators pursue them re-open.

RMP did not add any South American locations but may consider doing so as copper is such a key raw material. Also, RMP did not add any copper locations from Canada and there are 7 key Canadian copper mines that RMP will be adding soon to enrich our database.

What’s Next For RMP’s Lithium-Ion Battery Supply Chain Map

With 133 new locations added in this update, it brings RMP’s li-ion GIS database to a total of 664 locations of upstream, midstream, and downstream facilities. This is the largest and most comprehensive interactive map of li-ion supply chain locations I am aware of. That’s pretty cool.

With RMP’s standard/agnostic/proprietary mapping software, you can do some pretty cool filtering to hide & unhide locations based on their supply chain segment and status. This is a very powerful feature that allows you to filter by, for example, all active lithium, cobalt, nickel, and copper mines. Or, you can see all electrode manufacturing locations that are under construction, or so many other combinations. Using RMP’s map (which is always free to you or your students) is a powerful GIS database that allows you to study & learn more about the nascent li-ion supply chain in North America.

But, one of the perks of writing your own software is being able to write your own customized and “curated” SQL queries to make even cooler maps. The next map I have in mind is specialized to give a new look at mines across North America. What I’m envisioning is a map allows the user to filter by raw material type like lithium, nickel, copper, etc. It would be really cool to see these mines by mineral type and be able to filter accordingly. That’s the coolest thing about writing your own software, if you want to see something that doesn’t exist anywhere, you just create it yourself.

RMP will be creating this new raw materials by mineral type map and many other cool ‘specific’ queries that all use the same data as the source. There are so many cool data points to dive into and so many cool ways to organize them to drill down. What if you want to know where synthetic graphite is being made or where natural graphite is being mined or both. The sky is the limit to what you want to look for this large dataset.

One analogy that is easily relatable to trying to find what you’re look for is “looking for a needle in a haystack”. For this map, it’s more like a stack full of needles and you’re looking for a very specific needle in a needlestack. Or all a needles of this type in the needlestack. RMP’s maps are powerful. If you’re interested in learning more about North America’s role in the new energy era, please consider following RMP on our socials or enter your email below to subscribe to this blog. RMP is also active on Threads, Reddit, Facebook, Instagram, and Mastodon. Please give us follow if you’re interested in the lithium-ion battery supply chain or any other environmental science RMP tracks.

How can you help?

RMP is small 501(c ) 3 non-profit organization operating in Michigan for just over 10 years. We are an unfunded organization operating on part time volunteer work and no money. If you can recognize the value in the research, data, and software we provide free to the public , we hope that you’ll consider making a tax-deductible donation to our organization. With funding, we could do more and reach more people. The information we curate is dedicated toward understanding how sustainable energy works and how to protect our freshwater resources. If this is something you care about, we are an organization that could use you as an ally. Thank you for reading and please share this post with others you think might be interested. Please consider making a secure and tax-deductible donation to help RMP by clicking here.

Leave a Reply