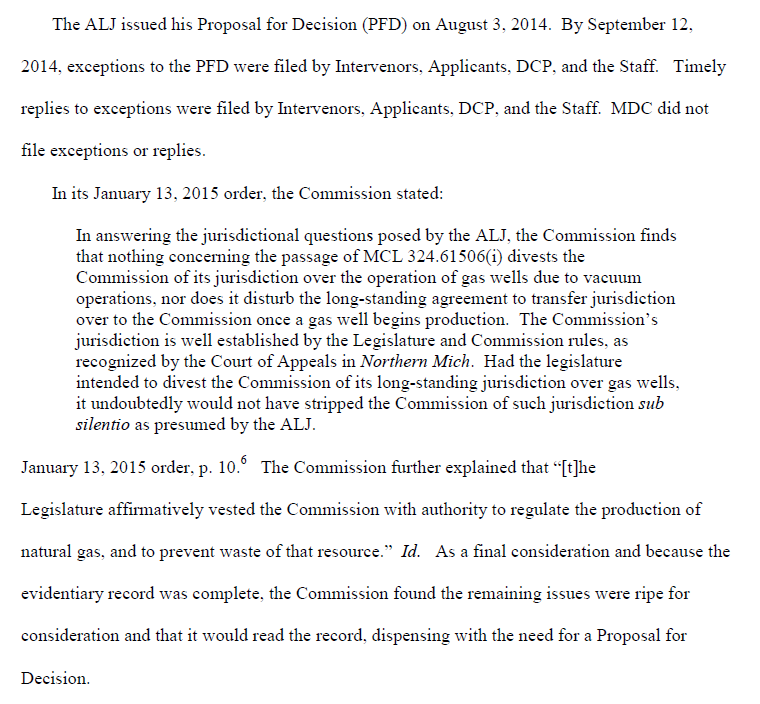

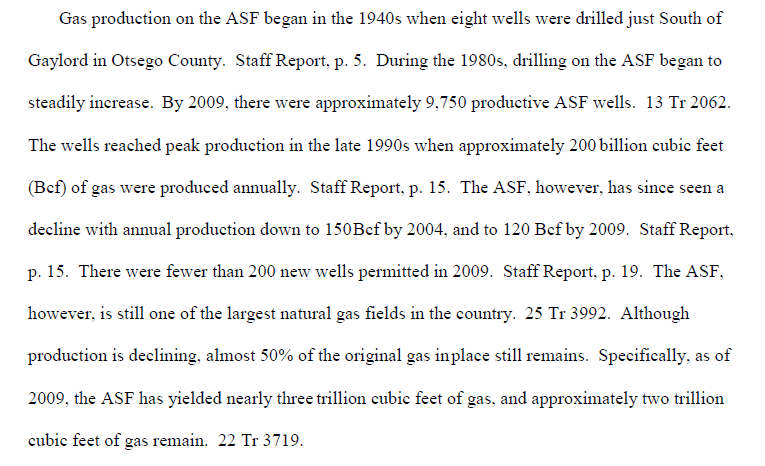

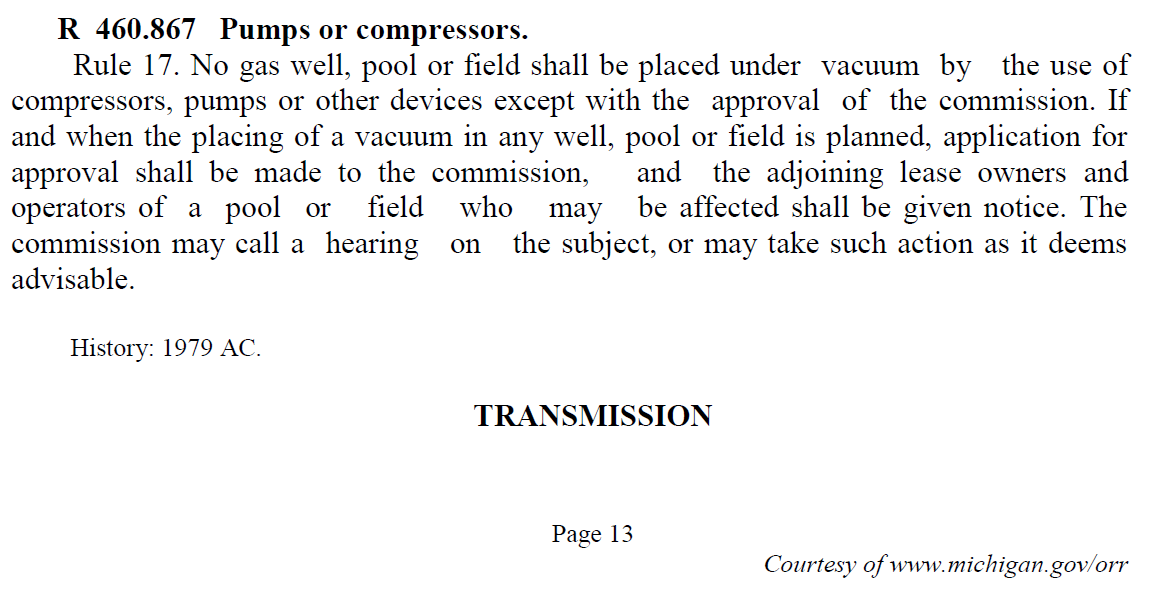

In June of 2015, the MPSC was challenged to determine the appropriate regulatory response to applications filed pursuant to R 460.867 (Rule 17) for operation of Antrim Shale Formation (ASF) wells under vacuum on Michigan Public Service Commission Case# U-16230. RMP wrote about this story in our August 2015 MOGM. Prior to June 2015, battles had been fought over the issue of operating ASF wells on a vacuum for years. Administrative Law Judge Mark D. Eyster held a pre-hearing on June 15, 2010 to officially get the ball rolling on this issue that played itself out over the next six years while everyone else’s eyes were trained on the non-starter issue of hydraulic fracturing in the Michigan Basin .

Over the next six years parties on both sides of the ASF vacuum issue engaged in contested case proceedings resulting in 4,778 pages of transcript and approximately 250 exhibits. Obviously there was a high level of disagreement about how to produce natural gas from the ASF. Applicants in favor of using a vacuum said there is a violation of Act 9 which says there is economic waste if a vacuum is not allowed. RMP called bullshit on that argument back in August of 2015 because no logical argument exists for demonstrating an Act 9 violation. The real reason, and as I wrote about in the August 2015 MOGM, was a desire to get cash faster by harvesting natural gas faster. Nothing was going to waste. Money is the underlying motivator in this issue.

So where am I going with this? Why am I bringing the Antrim Shale Formation on a vacuum issue back to the front burner in October of 2016?

This month we saw dozens and dozens of wells transfer ownership from Terra Energy LLC to Riverside Energy LLC of Traverse City. If you do a little Googling about Riverside, you will find that recently Riverside Energy Holdings LLC, a newly formed company in Traverse City which is owned by White Deer Energy & South Africa’s Umbono Capital, has purchased Chevron Michigan LLC from Chevron Northeast Upstream LLC. Terra Energy was an early application filer for wells on a vacuum and more recently (as recent as 10/6/2016) Riverside is actively filing applications to operate ASF wells on a vacuum. Riverside has filed 51 applications to operate ASF wells on a vacuum since 8/26/2016.

Chevron Michigan LLC, which has been renamed Riverside Energy LLC, owns 312,000 acres and interests in approximately 2,800 wells, and operates 1,900 wells across Michigan. According to RMP’s recently published 2016 Hydrocarbon Production Results January–June, this means Riverside has become the 2nd largest producer of natural gas in Michigan behind Linn Energy practically overnight and Chevron has basically bailed on Michigan and boogied on down the road. California’s Chevron is basically pulling out of Michigan with this recent move to sell their assets to Riverside.

Now for my theory: Chevron has bailed on Michigan because they’re only asset of value in this state, their ASF wells, are going to be devalued by vacuum operations. If you haven’t already, go back and read RMP’s August 2015 MOGM. Just over a year ago, RMP laid bare the reasons why Chevron was fighting against putting ASF wells on a vacuum because Oxygen finds a way and rust happens. I believe Chevron sees the writing on the wall for the Antrim and is cashing out on their asset before the rest of the bag holders figure out later that many ASF well will be devalued by vacuum operations.

Chevron knows that the maneuvering over the past 6 years or so to get ASF vacuum operations approved by the MPSC will be the reason that the ASF could get fouled and go into rapid decline. A flurry of applications for thousands of ASF wells have been received since the MPSC allowed every operator in Michigan to operate on a vacuum with their own self-regulation. All an operator has to do to operate under vacuum is to fill out an application and wait 90 days for de facto approval. Provided there is no contest or contact from the MPSC after filing an application to operate under vacuum, the operator is approved. It’s that easy.

According to RMP’s most current download from the MPSC website (10/26/2016), RMP counts 5,066 ASF wells approved for vacuum operation via this low bar approval process. RMP has marked all of these wells on our special database table to monitor production data so we can truly get a look at the changes in production from before and after the vacuum approval date. RMP has been and will be using our custom software to track this important dataset. RMP’s software lets us track hydrocarbon production data very easily to spot trends and anomalies. At $3.11 per MMBtu, which is the current Henry Hub price, we are talking about $3.11 x .9756 conversion factor x 1,000,000 mcf = $3 million per bcf of natural gas. At current annual production of around 100bcf of natural gas in Michigan, a ten percent drop in production equates to a drop of $30 million in revenues. That’s enough to cause some aggravation if your wells get fouled. The real loser, however, could be the Michigan tax payer. We will keep our eyes following this story.

The analogy of the Antrim’s decline is just like storyboard charted with Freytag’s Pyramid of dramatic structure in classic literature. ASF wells on a vacuum will result in a short term increase in natural gas production upwards toward a climax of higher production. That’s when the plot twists and we find out Oxygen has fouled the processing equipment and methanogenesis of gas production in the Antrim Shale. Then, the we see the falling action of Antrim production toward the denouement with annual production down toward 60 bcf per year and then toward zero.

Other Michigan Oil & Gas Activity in October of 2016

It was another slow month in Michigan oil & gas as far as applications and permits go. It is a safe prediction to say this will be the slowest year ever in Michigan oil & gas. Last year was Michigan’s slowest year ever for permitting in history at 110 permits and so far through 42 weeks in 2016 we have only 37 permits issued by the MDEQ’s OOGM. RMP has been publishing the Michigan Oil & Gas Monthly (MOGM) for two full years come December 31, 2016 and it seems like a logical move to cut this publication down to quarterly. Starting in 2017, I think RMP will start publishing this magazine every 90 days and change its name to the Michigan Oil & Gas Quarterly (MOGQ). There’s just not much going on to write about. It’s time to focus on other issues affecting Michigan’s environmental and energy production landscape.

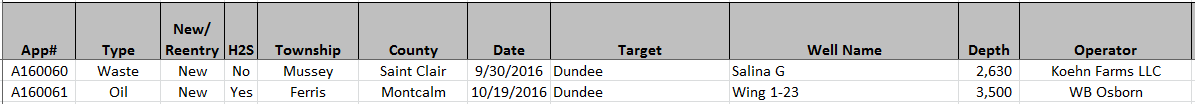

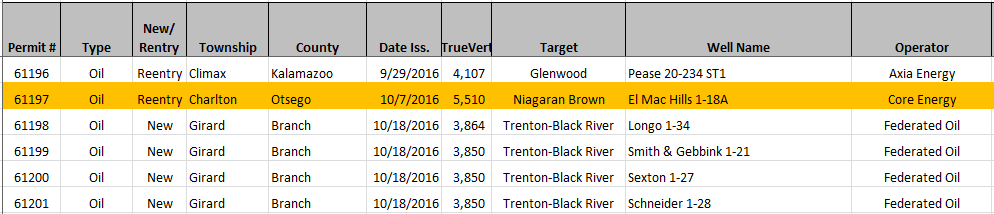

October 2016 – List of New Oil & Gas Well Applications

Michigan received 8 applications in October bringing the total number of applications this year so far up to 40. One new app was for a waste well in St. Clair County and one was for an oil well in Montcalm County.

October 2016 – List of Permits Issued for Oil & Gas Wells

In October of 2016, the MDEQ’s OOGM permitted 6 new oil wells bringing the total number of permits this year up to 37. Most of the action is near Kalamazoo which expands on Axia’s successful well in that area. Federated is going to try the Trenton-Black River formation just south of where Axia had some luck. The other well is a #CCS well which is what RMP has been reporting on and tracking closely.

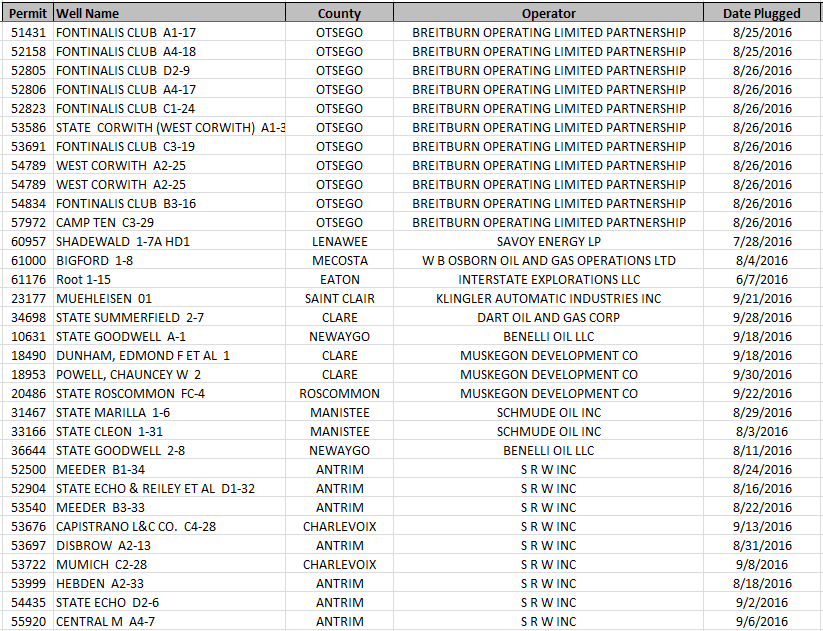

October 2016 – Oil & Gas Wells Published as Plugged

33 wells were reported plugged in October bringing the total wells reported plugged in 2016 up to 127.

October 2016 Apps to Plugs Ratio KPI:

The apps to plugs ratio is self explanatory. By looking at the number of applications to wells plugged KPI we can see wells coming vs wells going. This KPI along with the previous one supports our original 2014 & 2015 outlook post with more numbers and data.

2016 Apps to Plugs Ratio KPI:

40 Applications : 127 Wells Plugged

October 2016 Permits to Plugs Ratio KPI:

The permits to plugs ratio is nearly the same as the apps:plugs ratio but with permits instead of applications.

2016 Permits to Plugs Ratio KPI:

37 Permits Issued : 127 Wells Plugged

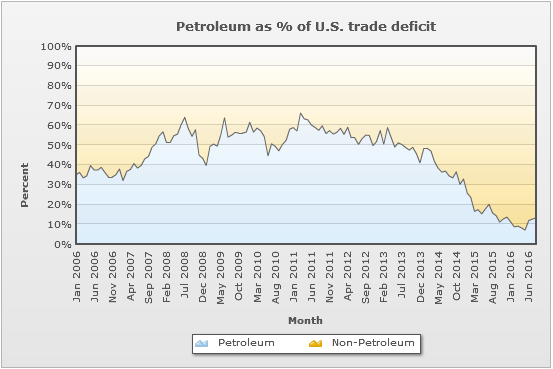

October 2016 – Petroleum As % Of U.S. Trade Deficit KPI:

RMP is tracking this stat since President Obama signed a bill in December of 2015 that lifted an export ban on crude oil that had been in place since 1970. RMP will be monitoring the effect of that federal legislation by monitoring an important economic statistic published by the United States Census Bureau. The data and graph (shown below) come from this website: https://www.census.gov/foreign-trade/statistics/graphs/PetroleumImports.html

This stacked-area line graph shows how much of the monthly US trade deficit can be attributed to the deficit in petroleum products. The vertical axis shows percent of the U.S. Goods and Services Trade Deficit. The horizontal axis shows a monthly time series from January 2006 to present. The bottom area of the graph shows what percent of the deficit comes from petroleum goods. The top area shows the percent of the deficit coming from non-petroleum goods and services. RMP made a prediction the day the bill was signed that this graph would trend toward zero which is a good thing for the US economy.

This month we see the trade deficit tick back upwards a little bit which again is attributable to Saudi actions to preserve market share. Saudi actions have subsided and OPEC is trying to real in over production to improve prices but the glut of oil in the market is persistent. Outlooks on oil pricing in the crystal ball continue to look pretty low for the next year at least.

Final Thoughts For October 2016

2015 was the slowest year for Michigan oil & gas permitting in our State’s history. 2016 is on pace to be 2x slower. RMP got into covering oil & gas in Michigan because of concern over freshwater usage in Michigan’s Collingwood completions. Completions in the Collingwood were some of the largest freshwater consumption wells in all of North America, were unprecedented in Michigan history, and EnCana showed slides to their investors saying they would drill thousands of wells in the Michigan Basin. RMP had a good reason to be concerned and we were. RMP and some very helpful volunteers started doing research about oil & gas exploration to figure out what was really going on and we learned a lot about it. RMP did our homework so we could better protect Michigan’s freshwater natural resources by sharing the information we learned with other concerned citizens.

One of the main things RMP learned was that drilling for gas has very little chance of contaminating fresh water if done properly and to MDEQ standards. RMP research indicated the main concerns were surface spills, well construction/well bore integrity, and large volume water withdrawals. RMP research determined the completion technique (i.e. hydraulic fracturing) is irrespective of whether the well may or may not have problems affecting the environment. The word “fracking” is a red herring plain and simple and RMP does not use that word for that reason.

One of the other things RMP learned on our endeavor to volunteer our time to protect Michigan’s freshwater natural resources is that groups like Ban Michigan Fracking had no desire to learn about oil & gas exploration. They declared “fracking” an ill on society without even knowing what the word “fracking” means and they attacked.

I met Luanne Kozma and Ellis Boal, the founders of Ban Michigan Fracking, in the beginning phases of my oil & gas research in 2012 and I thought I shared a common objective with them: to protect Michigan’s freshwater natural resources. In 2011 & 2012, everyone was still scrambling to learn what HVHF was and what it meant to Michigan because it had never before been done in Michigan.

I quickly learned that I had nothing in common with Luanne Kozma or Ellis Boal and many other groups working with them. They actively ignored science, data, and information that did not support their predetermined narrative. Their group and others demonstrated no desire to understand oil & gas exploration or its history. RMP was leading all environmental groups in Michigan in our understanding of oil & gas exploration and relaying that information back to the other environmental groups. The more we learned and relayed to “anti-fracking” groups the less interested those groups became in learning what we had to say because it did not fit their “witch hunt” narrative. When ignorance was replaced with knowledge it diminished their ability to fear monger emotionally susceptible citizens.

BMF’s philosophy is the exact opposite of RMP’s which is to learn everything we can and never stop trying to learn more. If what RMP learned supported the notion that hydraulic fracturing caused problems for Michigan’s freshwater we would most certainly report that, but that’s not what RMP’s research supported. RMP is not affiliated with Ban Michigan Fracking in any way and I consider their group and similar groups one of the biggest setbacks to freshwater protection and water conservation in Michigan. Groups like BMF set back environmentalism because of their ignorance, fear mongering, and disinterest in applying scientific analysis. I further believe any group that considers themselves an “anti-fracking” group moves environmental science and water conservation backwards because the word “fracking” itself is a red herring. While there are certainly areas of concern with oil & gas development, “fracking” distracts from those issues because it focuses on a completion technique rather than the larger issues of industrialization, sand mining, waste water treatment & disposal, well bore integrity, et Al.

RMP found many people that were interested in learning what does and does not constitute a threat to Michigan’s freshwater and most of them, like me, have determined that “fracking” is a red herring. RMP along with many other volunteers determined it’s time to focus on things that do threaten Michigan freshwater which means moving focus away from “fracking”.

Because RMP is concerned with freshwater protection and conservation, it’s time we started focusing on other things besides oil & gas well drilling in Michigan. With regard to hydrocarbons in Michigan, things like liquid petroleum transmission & storage have a higher instance and risk of groundwater contamination and therefore demand more attention than drilling. Specifically, with regard to Michigan oil , it’s time for RMP to shift focus toward underground storage tanks. RMP will also start focusing on other parts of the country and other things that threaten freshwater too. Oil & gas operations in other states like Pennsylvania have a lot more on their plate with regard to oil & gas exploration than Michigan but even in those states to put the focus on the word “fracking” only distracts from the important issues.

In 2017, the Michigan Oil & Gas Monthly (MOGM) will become the Michigan Oil & Gas Quarterly (MOGQ) as RMP shifts focus and our resources toward other more pressing issues in the Michigan Basin. RMP will continue to publish Michigan’s annual production results in April and the 6 month production results in October. RMP will always be on guard to protect Michigan’s freshwater natural resources, but it’s time to prioritize threats to Michigan’s freshwater and drilling for oil & gas does not seem to be a very high ranking threat after years of continued research.

2 Replies to “Michigan Oil & Gas Monthly – October 2016”