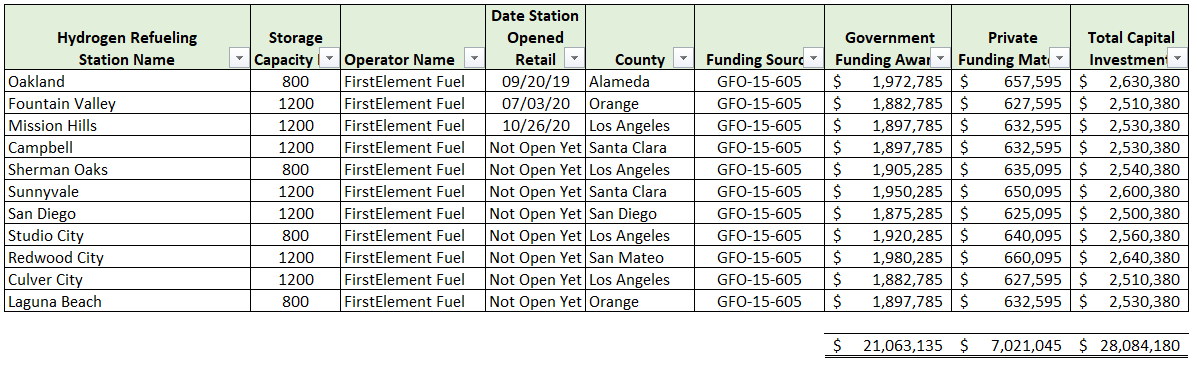

Three new hydrogen refueling stations have come online recently that mark a paradigm change in retail hydrogen refueling infrastructure in the USA:

- Shell Oakland with 800kg capacity Oakland, California 9/20/2019

- TrueZero Fountain Valley with 1,200kg capacity Fountain Valley, California 7/3/2020

- TrueZero Mission Hills with 1,200kg capacity Mission Hills, California 10/26/2020

Sometimes when you want to understand where you are or what just happened, you have to look back to appreciate how you got here. To understand something generationally new, you have to understand its predecessor technology to appreciate the contrast between the way it was and the way it will be going forward. RMP has been writing about some BIG new hydrogen refueling stations that would be coming online soon, and now… they’re here. They’re open now. Now that they’re open & with more BIG stations on the way, it’s starting to set in that we have reached a milestone in retail hydrogen refueling infrastructure. That said, it seems like a good reflection point to look back at retail hydrogen infrastructure development thus far and understand the USA’s history in hydrogen clean energy technology.

People following hydrogen infrastructure development will have many different takes on where we started and how far we’ve come. How far to go back in history is an ambiguous question. RMP will focus on

California in order to write about the genesis & milestones of hydrogen refueling infrastructure from a retail perspective. Cally is really the only game in town.

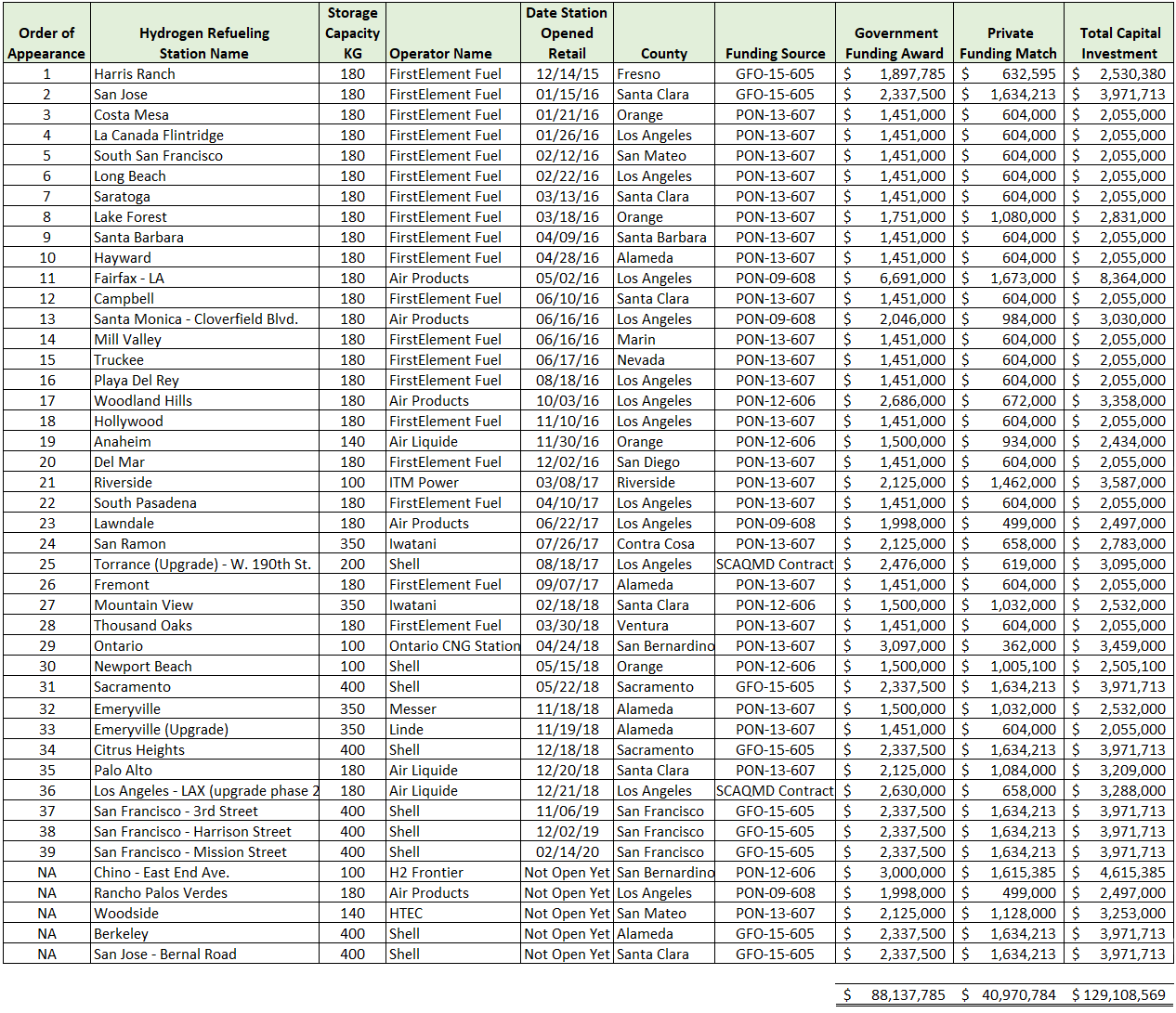

RMP has analyzed the first 60 stations opened or planned in California since ARB 8 was signed by Governor Brown in September 2013 and classified each of them into three distinct categories. By classifying California’s stations this way, it helps to better understand the progression of how stations came online and how far we’ve come. RMP’s three classification categories are listed below:

- Original Pioneer Stations (i.e. UC Irvine & Cal State Univ proof of concept)

- Generation 1 or Gen1 Stations (i.e. the demonstration station phase)

- Generation 2 or Gen2 Stations (i.e. right now, with stations having over 800kg capacity & multiple fueling positions – RMP is calling these stations Gen2 Stations or Generation 2 Stations going forward)

The three big “Gen2” stations open in California today won’t be only three for long as many more Gen2 stations are slated to come online soon: Sherman Oaks (800kg), Sunnyvale (1,200kg), Campbell (1,200kg), San Diego (1,200kg), Redwood City (1,200kg), Studio City (800kg) are all coming online soon. Further, the latest funding round in California will see dozens more Gen2 stations coming online in the next few years of similar size. Collectively, these six new Gen2 stations coming soon & the three just opened, will have more aggregate capacity than the other 38 open stations preceding them. Because of their large capacity size, we are truly watching a paradigm change of scale happen here in 2020 from generation 1 to generation 2 refueling infrastructure. With roughly 7,500 fuel cell electric vehicles registered on the road in California now, RMP expects the number of FCEVs registered to increase significantly in the next five years.

Let’s look back on these three historical phases of hydrogen infrastructure rollout in California.

Original Pioneer Stations

RMP’s version of retail hydrogen infrastructure history in the USA begins at two universities in California: UC Irvine & Cal State LA. The research facilities at these two pioneering institutions provide the genesis of retail hydrogen refueling regardless of which station opened first. The dates of when pioneer stations opened are tricky to keep track of because many stations in the early years were not public stations. The station at UC Irvine, for instance, got started in 2003 but the first official pictures of a grand opening of the station are in February of 2007 and the California Fuel Cell Partnership lists the opening date as November of 2015. So, which opening date is correct? It’s very difficult to pin down any kind of official dates for the earliest of stations because things just don’t work out cut & dried like that in the real world. The genesis of retail hydrogen refueling infrastructure is a medley of stops & starts.

UC Irvine, in RMP’s opinion, is the true genesis of retail hydrogen infrastructure in the USA and that’s why the UC Irvine station was used in this post’s feature image. Cal State has been right there from the beginning also with the first station to officially open to the public for retail on November 12, 2014 but only one picture can be chosen as a featured image. RMP is considering the following five currently open stations as the original pioneering stations that helped demonstrate the hydrogen refueling proof of concept:

- UC Irvine

- Cal State LA

- West Sacramento – S. River Road

- Diamond Bar SCAQMD

- San Juan Capistrano

It should be noted the stations at Newport Beach, Torrance, Santa Monica, Fairfax LA, Lawndale & Harris Ranch might have fallen into RMP’s pioneer station category as first comers but each of those stations is in our next category because many of them were redone or upgraded from their original selves since their historical true opening or planning. The five pioneer stations and the ones in the aforementioned sentence were all funded under CEC 2010 or ARB 8 and are still in operation today. It’s important to understand where the money came from and RMP will recap all of the funding history later in this post.

If those five OG pioneer stations listed above are one group of stations that showed off the hydrogen proof of concept, what would you call the next group of stations? RMP considers the next group of stations an entire batch of stations demonstrating the technology works to a wider audience in order to get more people witnessing how it works just like everyone’s been saying it would: clean, green, & economical. RMP is calling the next 44 stations Gen1 Stations.

Generation 1 or Gen1 Stations

There are various funding sources that allowed the retail hydrogen refueling infrastructure “Gen 1” phase to occur. Literally hundreds of documents & thousands of pages of research were compiled to publish what California calls a NOPA or Noticed Of Proposed Award. The California Energy Commission (CEC) announces a stringent list of criteria that eligible applicants will be scored by in order to win a financial award to help fund construction of a new station.

The CEC will release documentation and notification about how much funding may come available, rules on applicant eligibility, locations carefully selected where the stations must be built, and technical specs such as how fast the station must fill, time between fills, and storage volume. All these things and more thoughtfully determine a scoring system that will determine “who gets the money” by way of “who achieved the highest score”. Following the money is a good way to understand how hydrogen refueling growth occurred and important for other states following in California’s footsteps. States like RMP’s home state of Michigan can benefit from lessons learned in California.

None of the funding for the “demonstration” phase of hydrogen refueling became possible until Governor Brown signed California Assembly Bill No. 8 (hereafter AB8) on September 28, 2013. In general terms, AB8 was a landmark bill to fund $20 million/year until there are 100 stations in California. This was a major milestone in the USA’s retail hydrogen refueling infrastructure history because without money, nothing happens. You gotta pony up if you want to impact meaningful change. The California Energy Commission is the designate in charge of scoring applicants & doling out funding based on legislation passed through California’s congress.

Below is a listing of Generation 1 or Gen1 Stations that opened in California ordered by the date the station opened retail to the public. The listing shows the station name, the station’s storage capacity in kilograms, station operator name, date the station opened, county, funding source, and funding amounts. If you’re reading this on larger screen, you can click to image to have it fill your screen.

RMP is listing Harris Ranch as the princeps Gen1 station in the list of 44 stations above. The Harris Ranch hydrogen fueling station (also called Coalinga) opened December 14, 2015 and was funded under GFO-15-605. The Harris Ranch station was the first station opened by First Element Fuel under the True Zero brand which led the charge in station proliferation across California. Of the 44 stations listed above, First Element Fuel under the True Zero brand represents 19 of the 44 stations opened or 43% of this entire generation of stations.

Only the one station, Harris Ranch, opened in late 2015. It was 2016, however, that was the biggest year yet for station openings in California. Nineteen public retail stations opened in 2016 which is more than any other year. Six stations opened the next year in 2017. Then ten more stations opened the following year in 2018. Note that most of the stations above have a 180kg capacity. Most of the stations above are also compressed gas delivery. RMP is calling these stations Gen1 stations for exactly that reason.

Gen1 stations represent a group of stations, in RMP’s opinion, that demonstrated to a wide range of California’s public citizenry that hydrogen works. This monumental achievement of launching the stations listed above laid the groundwork for the milestone we are just reaching today: Generation 2 stations with liquid hydrogen delivery and a capacity of 800kg or greater.

Generation 2 or Gen2 Stations

If Gen1 stations were to demonstrate to the world that hydrogen works, then Gen2 stations are to demonstrate to the world hydrogen scales. The three newly opened Gen2 stations of Oakland, Fountain Valley, and Mission Hills represent a step change in public retail hydrogen refueling infrastructure. These three new stations and the 8 others that will be opening soon, have some remarkable characteristics. Take a look at the list of these 11 Gen2 stations then let’s talk about the numbers.

The first thing to note regarding the scale change between Gen1 & Gen2 stations is the station capacity. In simplest terms, RMP is using 800kg to differentiate a Gen1 from Gen2 stations. While most Gen1 stations were a capacity of 180kg & gaseous hydrogen delivery, Gen2 stations are mostly liquid hydrogen delivery with a capacity of 800kg or greater. The differences in the numbers when comparing Gen1 & Gen2 stations is stark.

Of the 11 stations listed in the table above, they’re aggregate capacity is 11,600 kg. Of the 44 stations on the Gen1 table, the aggregate capacity is 9,760kg! Think about that! These 11 stations are monsters compared to Gen1 stations. Note the funding too, the 11 Gen 2 stations have an average capital cost of $2.55M whereas the average capital cost of the 44 Gen1 stations is $2.93M! Not only are these stations truly a step change more than 4 times larger than their predecessors, they’re less expensive too!

Hydrogen has a remarkable ability to scale which the world will soon see in the next five years. Because hydrogen is the most abundant element in the universe, its ability to scale is infinite, you can never run out of it. The more we make, the cheaper it gets. Just stepping from Gen1 to Gen2 stations illustrates this point with the numbers RMP has compiled & just reported. When delivered hydrogen reaches $2 GGE (gasoline gallon equivalent), you will see hydrogen adoption increase dramatically across many energy sectors of our economy.

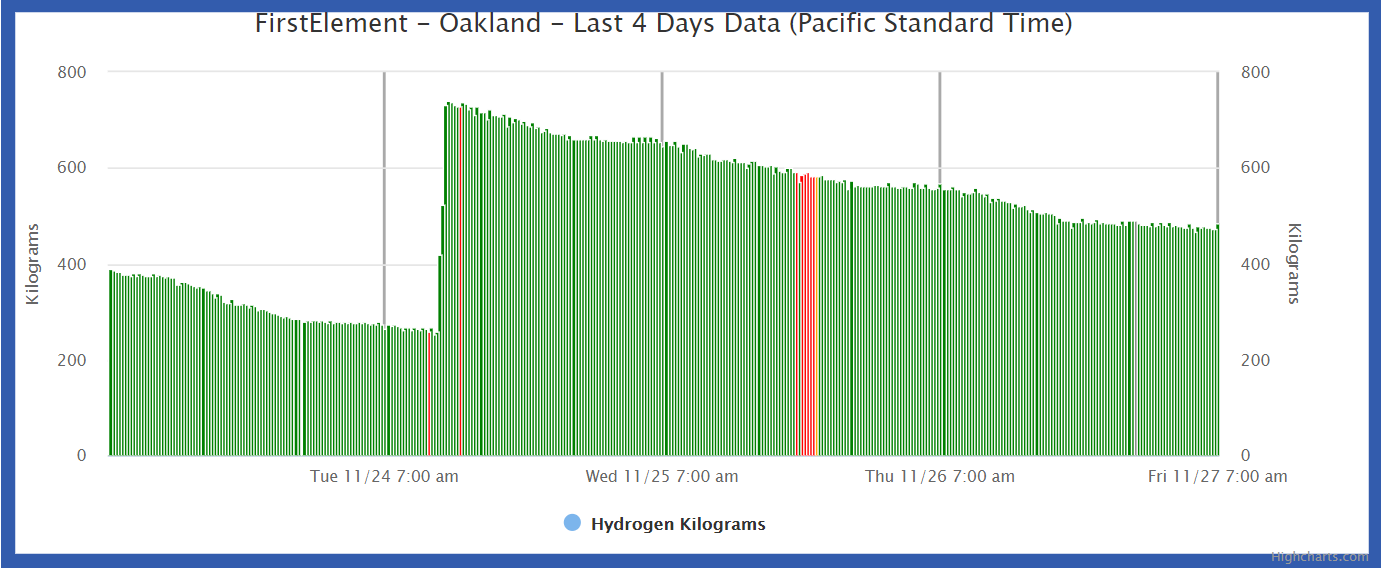

RMP’s New SOSS Tool For Studying Hydrogen Station Data In Real Time

RMP studies the data published by California’s government to generate analysis & bring you information that helps to show you the needle in the haystack. That said, you have to check our RMP’s new SOSS tool that allows you to see retail hydrogen refueling data in real time. This new URL https://www.respectmyplanet.org/public_html/united_states/soss_charts is a good one to bookmark if you’re interested in seeing how all of the hydrogen refueling stations in California operate on a daily & hourly basis in real time. The image below represents a screenshot of the 800kg Gen2 station in Oakland California operated under First Element Fuel’s True Zero brand in RMP’s new SOSS analysis tool. You can click on any station in California to see it’s corresponding 4 day graph.

RMP wrote a little code that takes a snapshot of all California’s hydrogen refueling stations SOSS data every 15 minutes and saves that information to a database. The data accumulates and just like a cartoonist puts one image after the next to show animation, the data from RMP’s database starts to draw an animation of a hydrogen station’s profile in operation.

In the image above, there are 96 bars representing 96 different snapshots 15 minutes apart. These 96 bars represent the station’s activity over the past four days. The small decrements in hydrogen kilograms show how the station slowly depletes its inventory as drivers refuel their vehicles. The spike up in the morning hours of Tuesday November 24, illustrates a replenishing event of the station’s inventory. A liquid hydrogen delivery truck refilled the station’s storage capacity and then the inventory starts to deplete again as drivers refuel. Each bar is colored green, red, yellow, blue, or gray to represent its status as either online, offline, limited, refresh, or unknown respectfully. The color coding and column arrangement illustrates well each station’s “profile” of operation in real time.

The profile of the Oakland station above, a Gen2 station, is different than a Gen1 station in terms of scale. These big Gen2 stations can refuel a larger number of vehicles and replenish their inventory in a similar way to a conventional gasoline station. Bookmark this link if you’re interested in checking out all of California’s hydrogen refueling stations in real-time using RMP’s new SOSS tool.

What’s next after Gen2 stations?

While generation 2 stations in California represent a step change milestone in retail hydrogen distribution, there is much work to do. The next most important objective to demonstrating hydrogen’s scalability is the consistent production & distribution of liquid hydrogen. Currently, Air Products is the major supplier of liquid hydrogen in California. Like you’ve always heard about diversification, it’s true, you need to be well diversified in your supply base to avoid supply disruption. These new Gen2 stations are only as reliable as liquid hydrogen supply. Recently, there has again been disruption in liquid hydrogen supply in California. I just created the new SOSS tool in the last month or so and noticed all three of the new Gen2 stations working very well. It inspired me to write this post because it was so clear to me how different these new stations are and how they behave & I wanted to write about it & develop these new station classifications. Just in the last couple weeks, however, I noticed the inventory status at these new stations was very low. In fact, inventory was down across the board. I posted in the Hydrogen Car Owner forum on facebook about what I was seeing using RMP’s new graphing tool and it was quickly confirmed by drivers in California that there was in fact a supply disruption going on right now in California that I could discern from monitoring the data in Michigan.

This proved two things: One, RMP’s SOSS tool works 😊because I was able to see the numbers in real time and notice a pattern change. Also, two, it goes to show how important it is to diversify California’s liquid hydrogen supply base.

RMP writes a quarterly report on hydrogen infrastructure published on the last day of the quarter recapping the major milestones over the past three months. In RMP’s next quarterly infrastructure report to be published December 31, 2020, the main story is about hydrogen liquefaction production facilities currently planned & under construction to serve the California market.

Ironically, people talk about a chicken/egg scenario about hydrogen refueling stations & hydrogen cars but that’s not correct. The true chicken/egg scenario with hydrogen is about production facilities & retail facilities. The cars & trucks are ready to go. Detroit Michigan based General Motors is ready to mass produce advanced Gen2 fuel cells in a joint venture with Honda Motors right here in Brownstown Michigan. RMP focuses on hydrogen infrastructure in our reporting because as fast as the production & retail infrastructure can be built, the cars & trucks will be produced to make use of it.

Planning & building large scale energy project like hydrogen liquefaction facilities & retail distribution facilities costs millions of dollars but will pay back as economical over the long term. You can see from the numbers RMP compiled that the government of California has awarded $118.8M dollars to date for hydrogen refueling station capital. Private capital has kicked in an additional $50.9M. Together, that’s $169.7M toward building new hydrogen refueling stations. But what about spending on infrastructure for hydrogen production & liquefaction?

Grant Funding Opportunity GFO-17-602 for $12M was awarded in October of 2018 specifically to help fund three new hydrogen production facilities. Private funding has pledged to put up an additional $87.2M for a total of $99M toward new hydrogen production facilities to serve the California market. This is great news and will go a long way toward solving the hydrogen supply issue in California.

Stay tuned for RMP’s next report on 12/31/2020 that will cover all the recent developments in hydrogen production infrastructure that will be coming online soon to serve the California hydrogen FCEV market.

If there’s anyone in Michigan reading this, please reach out to RMP at respectmyplanet @ gmail.com if you want to collaborate to educate Michigan lawmakers about the benefits of hydrogen infrastructure development in Michigan based on California’s AB8 legislation. Right across the Detroit River in Sarnia Canada, there’s a rare North American hydrogen liquefaction plant that could help launch economic refueling of hydrogen vehicles right here in Detroit! Let’s go Michigan. Hit me up with an email and let’s talk about how our non-profit organizations can work together to bring cleaner air & water to Michigan via the hydrogen economy just like California is doing.

Please consider making a tax-deductible donation to RMP to help us continue our public research into clean energy so we can bring more information to the public. CLICK HERE to make a donation. Thanks for reading.

Leave a Reply